Table of Contents

IRS Form 8038 – Information Return for Tax-Exempt Private Activity Bond Issues – Are you issuing tax-exempt private activity bonds to finance essential infrastructure like affordable housing or renewable energy projects? Filing IRS Form 8038, the Information Return for Tax-Exempt Private Activity Bond Issues, is a critical compliance step to maintain the bonds’ tax-exempt status. Revised in September 2025, this form helps issuers report bond details to the IRS, ensuring adherence to Internal Revenue Code (IRC) sections 141–150. In this comprehensive guide, we’ll explore the purpose of Form 8038, who must file, step-by-step instructions, and 2025 updates—so you can avoid penalties and support public-benefit initiatives effectively.

Whether you’re a state or local government official or a bond counsel navigating private activity bonds, understanding IRS Form 8038 streamlines reporting and promotes transparency. Let’s get started.

What Is IRS Form 8038?

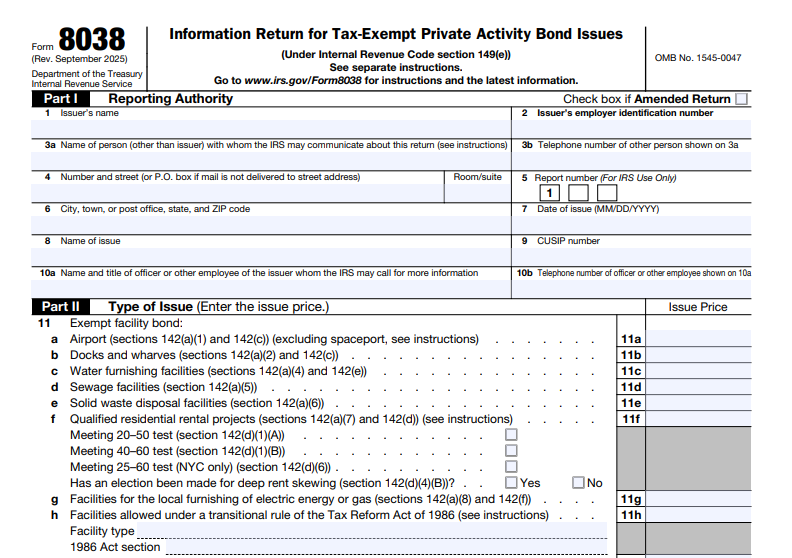

IRS Form 8038 is an information return used by issuers of tax-exempt private activity bonds to disclose key details about the bond issue to the IRS. Under IRC section 149(e), it provides data on issuance, proceeds use, and compliance with private activity bond rules (sections 141–150). The September 2025 revision (Catalog No. 49973K) includes updates for emerging projects like qualified broadband and carbon dioxide capture facilities, reflecting legislative changes from the Infrastructure Investment and Jobs Act.

Private activity bonds finance projects with private involvement but public benefits, such as airports, hospitals, or high-speed rail. Unlike governmental bonds (reported on Form 8038-G), these require volume cap allocations and stricter scrutiny to preserve tax-exempt interest. The form’s OMB No. 1545-0047 estimates a 10-hour burden, but most issuers complete it in under 5 hours with proper preparation.

Who Needs to File IRS Form 8038?

State or local governmental units—including agencies, authorities, or instrumentalities—must file Form 8038 for each issue of tax-exempt private activity bonds issued after 1986. This applies to:

- Qualified 501(c)(3) bonds for nonprofit facilities (e.g., hospitals, schools).

- Exempt facility bonds for airports, docks, or environmental enhancements.

- Mortgage revenue bonds for affordable housing or veterans’ loans.

Separate forms are required per issue; pooled financings or amendments need their own filings. Non-private activity bonds use Form 8038-G. Issuers electing direct payments for certain tax credit bonds file Form 8038-CP instead. Always consult IRC section 141 for definitions—transitional bonds under Tax Reform Act sections 1312/1313 are exempt from this reporting.

Purpose and Benefits of IRS Form 8038

The core purpose of Form 8038 is to enable IRS monitoring of private activity bonds, verifying tax-exempt eligibility and preventing misuse of proceeds. It reports issuance facts, volume cap usage, and project purposes, supporting IRS oversight of over $400 billion in annual tax-exempt issuances.

Benefits include:

- Compliance Assurance: Certifies adherence to volume caps (IRC section 146) and use restrictions, avoiding bond defeasance.

- Transparency: Tracks public-benefit projects, aiding IRS audits and statistical analysis (e.g., SOI Tax Stats).

- Penalty Avoidance: Timely filing prevents $10,000+ fines; late filings can be excused with explanation.

- Program Support: Facilitates funding for infrastructure like spaceports (new in 2025 instructions), boosting economic development.

In 2025, with added lines for broadband (11k) and CO2 facilities (11o), the form aligns with green initiatives, enhancing issuer credibility.

Step-by-Step Guide: How to Fill Out IRS Form 8038

Download the fillable PDF from IRS.gov/Form8038. Use black ink or type; attach schedules as needed. Base all info on the issue date—file post-issue only.

- Prepare Essentials: Gather EIN, issue date, volume cap certification, and bond documents.

- Header (Lines 1–3): Enter issuer name, address, EIN, and issue month/year.

- Issue Details (Lines 4–9): Describe bond type, CUSIP, issue price, and if federally guaranteed.

- Use of Proceeds (Lines 10–20): Allocate net proceeds (e.g., construction, reserves); note reissuances.

- Purpose (Lines 11a–11q): Check boxes for qualified purposes (e.g., 11a for 501(c)(3) bonds); attach NAICS codes.

- Volume Cap (Lines 49–51): Report allocated cap; attach state certification.

- Other (Lines 21–52): Cover maturity, arbitrage elections, reimbursements, and TEFRA info.

- Sign and Date: Authorized official signs under perjury penalties.

- Review and File: Attach explanations for late/amended returns; mail to Ogden, UT.

Tip: For 2025 updates, use new Line 11q for high-speed rail or spaceports.

IRS Form 8038 Download and Printable

Download and Print: IRS Form 8038

Key Sections of IRS Form 8038 Explained

Form 8038 spans multiple pages with targeted sections:

Issuer and Issue Identification (Lines 1–9)

- Basic info: Name, EIN, date, price. Line 8: Check if deep discount (<95% of principal).

Proceeds Allocation (Lines 10–20)

- Net proceeds breakdown: Capital expenditures, reserves, refunds. Line 20c: Issue price for reissuances.

Bond Purpose and Facilities (Lines 11–18)

- Checkboxes for types: 11b (mortgage), 11k (broadband), 11o (CO2 capture). Describe facilities, owners, NAICS.

Maturity and Refunding (Lines 36–45)

- Weighted average maturity; refunding dates and amounts.

Volume Cap and Elections (Lines 49–52)

- Allocated cap (49a); carryforwards (49b). TEFRA public approval (52).

Compliance Certifications

- Arbitrage monitoring procedures; reimbursement intent dates.

Privacy: Data protected under IRC 6109; used for bond oversight only.

Submission Process for Form 8038

Mail the original to: Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201. Use designated private delivery services for timely filing. E-filing isn’t available—paper only. File by the 15th day of the 2nd month after the quarter of issuance (e.g., Q4 2025: Feb. 15, 2026).

Amended returns: Mark “Amended” and explain changes. Late filings: Attach a letter detailing reasons and exam status—no penalty if reasonable cause shown. Track via certified mail; retain copies for 3+ years.

Privacy, Security, and Important Notes

Submissions comply with Privacy Act (5 U.S.C. 552a); info shared only for enforcement. 2025 Notes:

- New purposes: Spaceports, rail enhancements—update Line 11 selections.

- No land acquisition >25% (IRC 147(c)); exceptions for environmental/farmer use.

- Pair with Form 8038-T for arbitrage rebates.

Penalties: $10,000+ for late/incomplete filing; 1.5% on unmet construction spending.

Frequently Asked Questions (FAQs) About IRS Form 8038

What’s the deadline for Q1 2025 private activity bonds?

May 15, 2025—15th day of the 2nd month post-quarter.

Do governmental bonds use Form 8038?

No—use Form 8038-G; 8038 is private activity only.

How do I report broadband projects?

Check Line 11k; attach NAICS and state certification.

What if I file late?

Attach explanatory letter; penalty waivable for cause.

Where’s the 2025 revision?

IRS.gov/pub/irs-pdf/f8038.pdf (Rev. 9-2025).

Conclusion: Master Form 8038 for Compliant Private Activity Bond Issuance

IRS Form 8038 is indispensable for safeguarding the tax-exempt status of private activity bonds, enabling vital projects from housing to clean energy. With the September 2025 updates, issuers can now report innovative infrastructure seamlessly. Download the form and instructions from IRS.gov today to ensure timely compliance and maximize public impact.

For more resources, visit the IRS Tax-Exempt Bonds page. Bond issuers: Consult counsel for tailored advice.

This article is informational only and not official IRS guidance. Always refer to IRS.gov for authoritative details.