Table of Contents

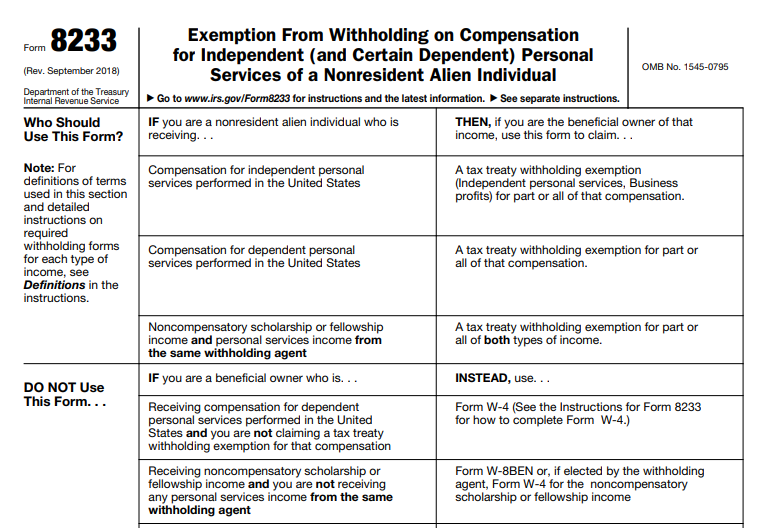

IRS Form 8233 – Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual – IRS Form 8233 allows nonresident alien individuals to claim exemption from withholding on compensation for personal services performed in the United States, primarily through income tax treaty benefits. As of December 2025, the latest instructions are revised December 2025, reflecting current IRS guidelines for avoiding 30% withholding on eligible income.

Nonresident aliens earning income from independent or dependent personal services in the U.S. often face automatic 30% federal tax withholding under IRC Section 1441. However, many U.S. tax treaties reduce or eliminate this withholding for qualifying individuals, such as professors, researchers, students, or independent contractors.

What Is IRS Form 8233?

Form 8233, titled “Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual,” is an IRS document that nonresident aliens use to assert tax treaty benefits. It certifies eligibility for reduced or zero withholding on:

- Independent personal services (e.g., fees for consulting, professional services, or self-employment).

- Certain dependent personal services (e.g., wages as an employee, including compensatory scholarships).

The form does not apply to non-personal services income (use Form W-8BEN instead) or to public entertainers/athletes in most cases, as treaties often limit or exclude their exemptions.

Who Must File Form 8233?

Nonresident alien individuals qualify if:

- They are not U.S. citizens or resident aliens (no green card or substantial presence test met).

- They perform personal services in the U.S.

- Their country of residence has a tax treaty with the U.S. providing exemption or reduced rates (see IRS Publication 901 for treaty tables).

- Common beneficiaries include foreign professors/teachers, researchers, students/trainees on F/J/M/Q visas, and independent contractors.

Note: Form 8233 is required annually and for each withholding agent (e.g., separate forms for different employers or income types).

IRS Form 8233 Download and Printable

Download and Print: IRS Form 8233

How to Complete and Submit Form 8233

Step-by-Step Process

- Download the Form — Obtain the current Form 8233 (Rev. September 2018) and Instructions (Rev. December 2025) from IRS.gov/Form8233.

- Fill Out the Form — Provide personal details, U.S. TIN (SSN or ITIN—apply via Form W-7 if needed), visa information, treaty country, and specific article citation.

- Attach required statements for students/teachers/researchers (see Appendices in Publication 519).

- Submit to Withholding Agent — Give the completed form to your employer or payer.

- Withholding Agent Review — The agent verifies eligibility, signs Part IV, and forwards a copy to the IRS within 5 days (mail or fax to specified address/number).

- Validity — Effective for the calendar year specified; renew annually.

If the IRS rejects the form, withholding resumes at 30% (or graduated rates for dependent services).

Key Differences: Independent vs. Dependent Services

- Independent: Typically 30% flat withholding; treaties often fully exempt if no U.S. fixed base.

- Dependent: Graduated withholding like U.S. employees; treaties may exempt wages for teachers/researchers/students.

For non-treaty-exempt portions, use Form W-4 (with Notice 1392 adjustments for nonresidents).

Common Examples of Tax Treaty Benefits

- A foreign professor from a treaty country (e.g., Germany) may exempt teaching income for up to 2–3 years.

- International students/trainees often exempt compensation during training periods.

- Independent consultants avoid withholding if the treaty’s independent services article applies.

Check specific treaty limits (e.g., time/dollar thresholds) in Publication 901.

Important Notes and Deadlines

- Submit before payments begin to avoid initial withholding (overwithheld amounts can be refunded via tax return).

- No personal exemption amount claims allowed on personal services compensation.

- Penalties apply for false claims.

- For entertainers/athletes exceeding treaty thresholds, consider a Central Withholding Agreement.

For the most accurate application, consult IRS Publication 519 (U.S. Tax Guide for Aliens) and your specific tax treaty.

By properly using Form 8233, eligible nonresident aliens can significantly reduce U.S. tax burdens on personal services income in 2025 and beyond. Always refer to official IRS sources for personalized advice.