Table of Contents

IRS Form 8288 – U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons – When foreign individuals or entities sell or dispose of U.S. real property, they often encounter specific tax obligations under the Foreign Investment in Real Property Tax Act (FIRPTA). At the heart of this process is IRS Form 8288, which ensures that the U.S. government collects withholding tax on these transactions. This article breaks down everything you need to know about Form 8288, including its purpose, filing requirements, withholding rates, and recent updates as of late 2025. Whether you’re a foreign seller, buyer, or real estate professional, understanding this form can help you navigate compliance and avoid penalties.

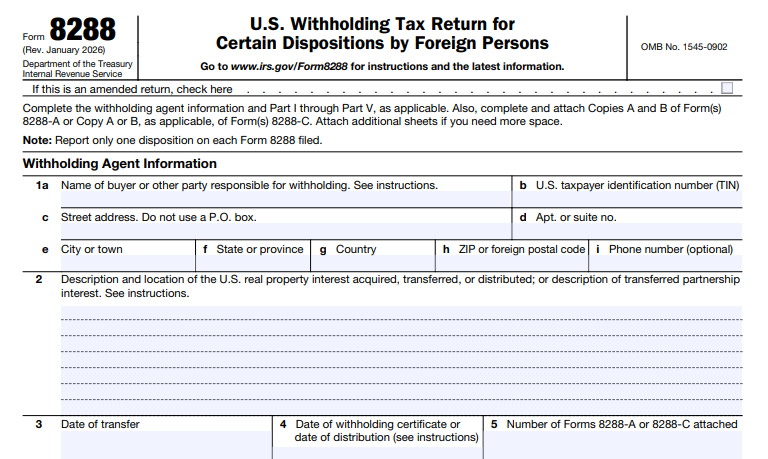

What Is IRS Form 8288?

IRS Form 8288, titled “U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons,” is used to report and remit withholding tax on the sale or other disposition of U.S. real property interests (USRPIs) by foreign persons. Under FIRPTA, which is codified in Section 1445 of the Internal Revenue Code, buyers (or transferees) are typically responsible for withholding a portion of the proceeds to cover potential capital gains taxes owed by the foreign seller. This form also applies to certain distributions and transfers under Sections 1445(e), 1446(f)(1), and 1446(f)(4), such as those involving partnerships or qualified investment entities (QIEs).

USRPIs include land, buildings, mines, wells, and even interests in U.S. corporations that hold significant real property. The form ensures that foreign sellers pay taxes on gains from these assets, treating them as effectively connected with a U.S. trade or business. Without proper withholding, the buyer could become liable for the tax.

Who Must File Form 8288?

The primary filer of Form 8288 is the withholding agent, which is usually the buyer or transferee in the transaction. This includes:

- Buyers purchasing U.S. real property from foreign persons (under Section 1445(a)).

- Corporations, QIEs, trusts, or estates making distributions attributable to USRPI gains (under Section 1445(e)).

- Transferees in partnership interest transfers where the partnership has effectively connected gain (under Section 1446(f)(1)).

- Partnerships distributing property to transferees who failed to withhold (under Section 1446(f)(4)).

Foreign persons themselves do not file Form 8288; instead, they report their actual tax liability on their U.S. tax return (e.g., Form 1040-NR or 1120-F). However, if excess withholding occurs, the transferee may claim a refund using Part V of the form.

Exceptions to filing include cases where no withholding is required, such as:

- The property is acquired for use as a residence and the sales price is $300,000 or less.

- The transferor provides a non-foreign affidavit (Form W-9).

- The transaction qualifies for nonrecognition treatment, or the property is not a USRPI (e.g., publicly traded stock in certain corporations).

Withholding Rates Under FIRPTA

Withholding rates vary based on the type of transaction:

- Section 1445(a) Dispositions: Generally 15% of the amount realized (sales price, including cash, fair market value of other property, and liabilities assumed). Reduced to 10% for residential properties where the price is between $300,001 and $1,000,000, and the buyer intends to use it as a residence.

- Section 1445(e) Distributions: 21% (or 35% for pre-2018 transactions) on gains from USRPIs by corporations, QIEs, trusts, or estates; 15% for certain redemptions or liquidations.

- Section 1446(f)(1) Partnership Transfers: 10% of the amount realized, unless adjusted by a withholding certificate.

- Section 1446(f)(4) Partnership Distributions: Up to 100% of the distribution until the required 10% withholding plus interest is covered.

These rates can be reduced or eliminated with an IRS-issued withholding certificate (Form 8288-B), which requires proof that the actual tax liability is less than the standard withholding amount.

How to Complete Form 8288

Form 8288 is divided into parts based on the applicable section:

- Part I: For Section 1445(a) withholding. Enter the withholding agent’s details, property description, transfer date, amount realized, and withheld tax.

- Part II: For Section 1445(e) distributions. Report the amount subject to withholding and applicable rates.

- Part III: For Section 1446(f)(1) transfers. Calculate 10% of the amount realized.

- Part IV: For Section 1446(f)(4) distributions by partnerships.

- Part V: For refund claims on excess withholding.

Attach related forms like 8288-A (Statement of Withholding) for each foreign transferor or 8288-C for certain partnership withholdings. If the Taxpayer Identification Number (TIN) is missing, file anyway—the IRS will request it later.

Due Dates and Filing Requirements

Form 8288 must be filed by the 20th day after the date of transfer or distribution. Mail it to the Ogden Service Center, P.O. Box 409101, Ogden, UT 84409, along with the withheld funds.

A significant update requires electronic payments via the Electronic Federal Tax Payment System (EFTPS) for all FIRPTA withholdings, following an executive order issued on March 25, 2025. As of October 17, 2024, paper checks are no longer accepted, and payments must be made electronically to comply. This change aims to streamline federal payments and reduce processing delays.

For installment sales, withhold the full amount on the first payment if possible; otherwise, obtain a withholding certificate.

IRS Form 8288 Download and Printable

Download and Print: IRS Form 8288

Recent Changes to IRS Form 8288 in 2025

In 2025, the IRS introduced several updates to enhance compliance:

- Electronic Payment Mandate: All FIRPTA payments must now be submitted via EFTPS, effective following the March 2025 executive order. This eliminates mailed checks and applies to transactions closing after September 30, 2025.

- Draft 2026 Form Revisions: Released on August 28, 2025, the draft includes changes to address compliance gaps, such as clearer reporting for partnership transfers and updated instructions for withholding agents.

- Tax Year Adjustments: The IRS may adjust the tax year on Form 8288 based on the transfer date, ensuring accurate reporting.

These changes reflect ongoing efforts to modernize FIRPTA administration and close loopholes in international tax compliance.

Related Forms to IRS Form 8288

- Form 8288-A: Statement of Withholding on Dispositions by Foreign Persons. Attached to Form 8288 for each foreign transferor; the IRS stamps and returns Copy B to the transferor for credit on their tax return.

- Form 8288-B: Application for Withholding Certificate. Used to request reduced or zero withholding based on actual tax liability.

- Form 8288-C: Statement of Withholding Under Section 1446(f)(4). For partnerships withholding on distributions.

Penalties for Non-Compliance

Failing to withhold or file Form 8288 can result in severe penalties:

- Late filing or payment: Up to 25% of the tax due under Section 6651.

- Failure to withhold: The agent is liable for the full tax plus interest.

- Willful violations: Fines up to $10,000 or criminal penalties under Section 7202.

- Personal liability for responsible parties under Section 6672.

Agents must also notify the IRS if they suspect false certifications, or they risk liability.

Frequently Asked Questions About IRS Form 8288

What if the sales price is under $300,000?

No withholding is required if the buyer acquires the property as a residence.

Can withholding be reduced?

Yes, by obtaining a withholding certificate from the IRS via Form 8288-B, typically processed within 90 days.

How does FIRPTA apply to partnerships?

For transfers of partnership interests, withholding is 10% if the partnership has USRPIs generating effectively connected income.

What if I overwithheld?

File Part V of Form 8288 to request a refund, attaching supporting documents.

Conclusion

Navigating IRS Form 8288 and FIRPTA withholding is crucial for anyone involved in U.S. real estate transactions with foreign parties. By understanding the form’s requirements and staying updated on changes like the 2025 electronic payment mandate, you can ensure compliance and minimize risks. Always consult a tax professional for personalized advice, as tax laws can be complex and subject to change. For the latest official guidance, visit the IRS website.