Table of Contents

IRS Form 8300 – Report of Cash Payments Over $10,000 Received In a Trade or Business – In today’s business landscape, compliance with IRS regulations is crucial for avoiding penalties and ensuring smooth operations. One key requirement for many trades and businesses is IRS Form 8300, which mandates reporting cash payments exceeding $10,000. This form helps the IRS and the Financial Crimes Enforcement Network (FinCEN) track large cash transactions to prevent money laundering and other illicit activities. Whether you’re a small business owner, retailer, or service provider, understanding Form 8300 filing requirements can save you time and money. In this guide, we’ll cover everything you need to know about IRS Form 8300, including who must file, when to report, how to submit, and recent updates as of 2025.

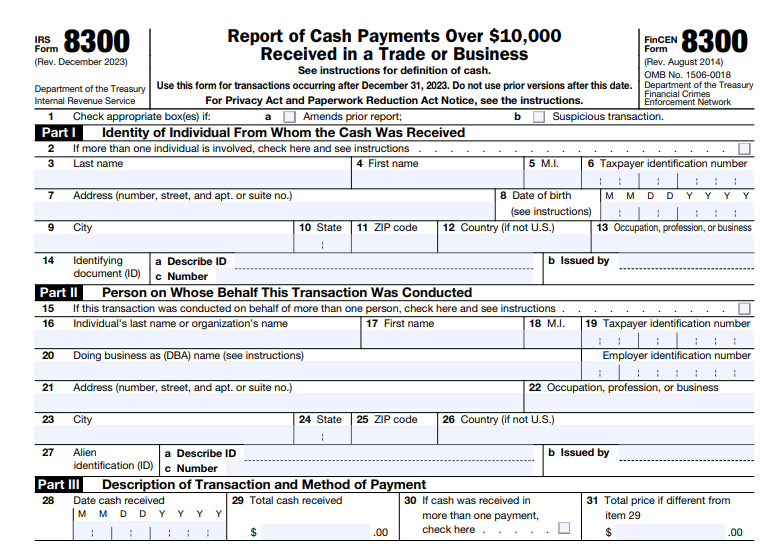

What Is IRS Form 8300?

IRS Form 8300, officially titled “Report of Cash Payments Over $10,000 Received in a Trade or Business,” is a mandatory reporting tool for businesses that receive large cash sums. The form’s primary purpose is to document transactions that could potentially involve tax evasion or illegal activities, as required under Internal Revenue Code Section 6050I and 31 U.S.C. 5331. It’s not a tax form in the traditional sense but an information return that aids government oversight.

Businesses must report cash received in a single transaction or related transactions totaling more than $10,000. This includes payments for goods, services, debt settlements, or other business activities. Voluntary filings are also encouraged for suspicious transactions below the threshold to assist FinCEN and the IRS.

Who Must File Form 8300?

Any person engaged in a trade or business who receives over $10,000 in cash must file Form 8300. This applies to a wide range of entities, including:

- Retailers, service providers, and professionals (e.g., attorneys, plumbers).

- Court clerks receiving bail over $10,000 for specific crimes like money laundering or drug offenses.

- Casinos for non-gaming activities (e.g., hotel or restaurant payments).

- Insurance companies in certain scenarios, though they often have exemptions.

Exceptions include financial institutions filing FinCEN Report 112, casinos for gaming transactions, and transactions outside the U.S. (with nuances for territories like Puerto Rico). If you’re part of a consolidated group, include member details while noting the parent entity’s information.

Sole proprietors and small businesses are not exempt—anyone in a trade or business qualifies. If the cash is received on behalf of another (e.g., an agent), both parties may have reporting obligations.

What Counts as Cash for Form 8300 Reporting Requirements?

Understanding the definition of “cash” is essential for accurate Form 8300 filing. According to IRS guidelines, cash includes:

- U.S. and foreign coins and currency.

- Cashier’s checks, money orders, bank drafts, or traveler’s checks with a face value of $10,000 or less, if received in a “designated reporting transaction” or if used to evade reporting.

A designated reporting transaction involves retail sales of consumer durables (e.g., cars or appliances expected to last over a year with a price >$10,000), collectibles (e.g., art, gems, coins), or travel/entertainment activities exceeding $10,000.

Exclusions: Personal checks drawn on the payer’s account, bank loan proceeds, or installment payments don’t count as reportable cash. Related transactions—those connected within 24 hours or over a longer period if evasion is suspected—must be aggregated.

When to File Form 8300: Deadlines and Triggers

File Form 8300 within 15 days after receiving the cash that pushes the total over $10,000. If the 15th day falls on a weekend or holiday, file by the next business day.

Triggers include:

- A single lump-sum payment over $10,000.

- Multiple related payments within 24 hours totaling over $10,000.

- Installments over 12 months that cumulatively exceed $10,000.

Additionally, provide a written or electronic statement to the payer by January 31 of the following year, including your business details and the aggregate amount reported. Retain records for five years.

How to File Form 8300: Step-by-Step Guide

Filing IRS Form 8300 is straightforward but requires attention to detail. Here’s a quick guide:

- Gather Information: Collect the payer’s name, address, TIN (SSN, ITIN, or EIN), date of birth, occupation, and ID verification details. For transactions on behalf of others, include up to three additional persons.

- Complete the Form:

- Part I: Payer’s identity.

- Part II: If applicable, person on whose behalf the transaction occurred.

- Part III: Transaction details, including date, amount, and type (e.g., personal investment, escrow).

- Part IV: Your business details, including EIN and nature of business.

- Comments: Add clarifications, such as “suspicious transaction” or “related party.”

- Submit Electronically or by Mail: As of January 1, 2024, e-filing is mandatory via the FinCEN BSA E-Filing System if you file 10 or more other information returns (e.g., Forms 1099 or W-2) annually. Otherwise, paper filing is allowed without a waiver. Mail paper forms to the IRS Detroit Federal Building.

- Amend if Needed: File a full amended form if corrections are required, checking the amendment box.

For detailed instructions, refer to the official IRS Form 8300 reference guide.

Penalties for Not Filing Form 8300

Non-compliance can be costly. Penalties include:

- Up to $330 per incomplete or late form (adjusted for inflation).

- Minimum $25,000 for intentional disregard.

- Criminal penalties: Up to five years in prison and fines up to $250,000 for individuals or $500,000 for corporations.

Reasonable cause may waive penalties if you demonstrate due diligence. Always consult a tax professional to avoid issues.

IRS Form 8300 Download and Printable

Download and print: IRS Form 8300

Recent Updates to IRS Form 8300 in 2025

As of December 2025, the key change remains the 2024 e-filing mandate for businesses required to e-file other returns. No significant 2025-specific updates have been announced, but the IRS continues to emphasize electronic submission for efficiency. Proposed regulations from earlier years expanding the “cash” definition (e.g., to include certain digital assets) have not been finalized. Check IRS.gov for any late-year announcements, as thresholds and rules can adjust annually.

Frequently Asked Questions About IRS Form 8300

Do personal transactions require Form 8300?

No, only those in a trade or business qualify.

What if I receive cash in installments?

Report when the total exceeds $10,000 within 12 months.

Can I file Form 8300 voluntarily for suspicious activity?

Yes, even if under $10,000.

How do I get a waiver for e-filing?

Submit Form 8508 for undue hardship.

For more FAQs, visit the IRS Form 8300 reference guide.

Conclusion: Stay Compliant with IRS Form 8300

Mastering IRS Form 8300 reporting requirements ensures your business remains compliant and avoids hefty penalties. By understanding what transactions to report, deadlines, and filing methods, you can streamline the process. Always use trusted sources like IRS.gov for the latest info, and consider consulting a CPA for personalized advice. If you’re dealing with large cash payments over $10,000, proactive reporting is key to maintaining good standing with the IRS.