Table of Contents

IRS Form 8308 – Report of a Sale or Exchange of Certain Partnership Interests – When a partner sells or exchanges their interest in a partnership, certain tax rules come into play—especially if the partnership holds “hot assets” like unrealized receivables or inventory items. IRS Form 8308, titled Report of a Sale or Exchange of Certain Partnership Interests, ensures proper reporting of these transactions under Internal Revenue Code (IRC) Section 751(a). This form helps the IRS track ordinary income portions of gains that might otherwise be treated as capital gains.

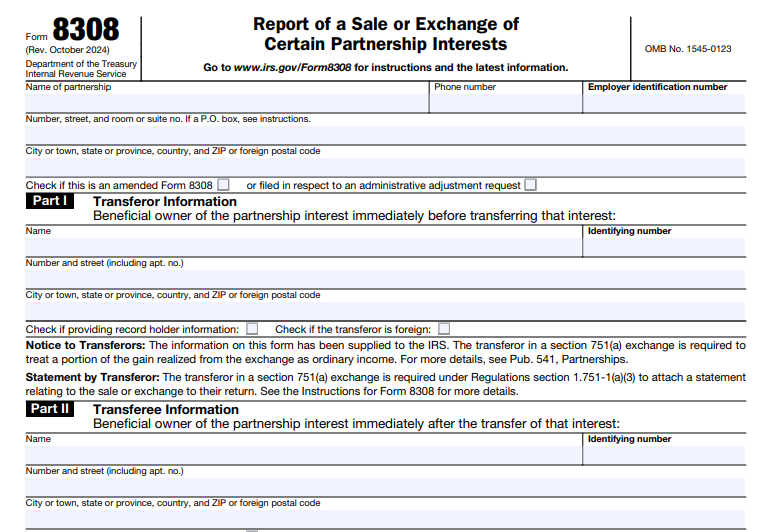

As of December 2025, the latest version of Form 8308 (Revised October 2024 or November 2025 instructions) reflects updates for accuracy in reporting Section 751(a) exchanges. Partnerships must file this form to avoid penalties and comply with federal tax laws.

What Is IRS Form 8308 and Why Is It Required?

Partnerships file Form 8308 to report the sale or exchange of a partnership interest where any portion of the consideration is attributable to unrealized receivables or inventory items—known as a Section 751(a) exchange. Under IRC Section 751(a), the transferor (selling partner) must treat the portion of gain or loss related to these “hot assets” as ordinary income or loss, rather than capital gain or loss.

- Unrealized receivables include rights to payment for goods or services not yet reported as income.

- Inventory items encompass stock in trade, property held for sale, or other assets that would generate ordinary income if sold by the partnership.

The form alerts the IRS and provides necessary information to both the transferor and transferee. No filing is required if a Form 1099-B (from a broker) covers the transaction.

Who Must File Form 8308?

The partnership bears responsibility for filing a separate Form 8308 for each Section 751(a) exchange. The partnership has “notice” of the exchange when:

- It receives written notification from the transferor (including names, addresses, TINs, and date).

- Or it knows of the transfer and holds any unrealized receivables or inventory at that time.

The transferor partner must notify the partnership of the exchange (unless a broker files Form 1099-B).

When and How to File Form 8308

- Filing with IRS — Attach Form 8308 to the partnership’s Form 1065 (U.S. Return of Partnership Income) and file by the partnership return due date (including extensions, typically March 15 for calendar-year partnerships, or later with extension).

- Furnishing to partners — Provide copies (or equivalent statements) to the transferor and transferee by the later of:

- January 31 of the year following the exchange.

- 30 days after the partnership receives notice.

Recent changes (proposed regulations from August 2025, effective for exchanges on or after January 1, 2025) clarify that only Parts I, II, and III need furnishing by the January 31 deadline. Part IV (detailed gain/loss computations) can wait until the Form 1065 due date.

For 2024 exchanges, transitional penalty relief applied if Parts I-III were timely furnished.

IRS Form 8308 Download and Printable

Download and Print: IRS Form 8308

Key Sections of the Latest Form 8308

The current Form 8308 includes:

- Part I and II: Information about the transferor and transferee (record holder and beneficial owner), including a checkbox for foreign partners.

- Part III: Details on the type of interest transferred (e.g., capital or profits interest).

- Part IV: Computation of Section 751(a) gain/loss, including partnership-level deemed sale gain, partner’s allocable share, collectibles gain, and unrecaptured Section 1250 gain. This information also appears on the transferor’s Schedule K-1 (Box 20, with specific codes).

Transferors must attach a statement to their personal tax return detailing the ordinary and capital portions of the gain/loss.

Penalties for Non-Compliance

Failure to file a correct Form 8308 or furnish statements timely can trigger penalties under IRC Sections 6721 (failure to file) and 6722 (failure to furnish). Penalties may be waived for reasonable cause.

The IRS has provided relief in recent years for incomplete Part IV furnishings, but full compliance remains essential.

Recent Updates to Form 8308 (2024-2025)

- Revisions in 2023-2024 expanded reporting in Parts III and IV for better tracking of hot asset gains.

- Proposed regulations (REG-108822-25, August 2025) ease the January 31 burden for Part IV, allowing partnerships more time.

- Partnerships can rely on these proposed rules for 2025 exchanges onward.

For the most current form and instructions, visit the official IRS page: About Form 8308.

Final Tips for Compliance

- Notify your partnership promptly of any sale/exchange involving potential hot assets.

- Consult a tax professional to determine if Section 751(a) applies and to compute gains accurately.

- Retain records, as tiered partnerships and special allocations can complicate reporting.

Proper handling of Form 8308 ensures correct tax treatment and avoids IRS scrutiny. Stay updated with IRS guidance, as partnership tax rules evolve.