Table of Contents

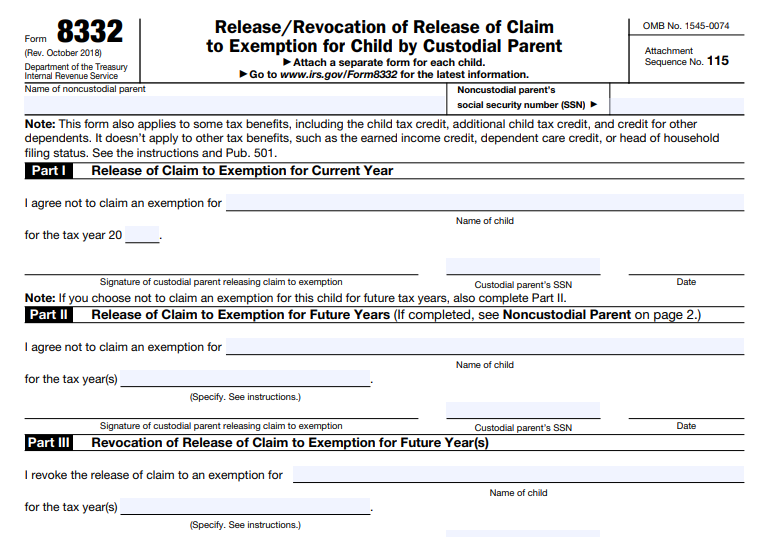

IRS Form 8332 – Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent – Navigating tax rules after divorce or separation can be complex, especially when it involves claiming a child as a dependent. IRS Form 8332, officially titled Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent, plays a key role for divorced or separated parents. This form allows the custodial parent to release their claim to certain child-related tax benefits, enabling the noncustodial parent to claim them instead.

Even though personal exemption deductions are suspended through 2025 under the Tax Cuts and Jobs Act, Form 8332 remains essential for accessing benefits like the Child Tax Credit (CTC) and Credit for Other Dependents (ODC). Understanding Form 8332 can help avoid IRS disputes and optimize tax savings for your family.

What Is IRS Form 8332 and Why Is It Important in 2025?

Form 8332 is used exclusively by the custodial parent—the parent with whom the child lived for the greater number of nights during the tax year (or the parent with higher adjusted gross income if nights are equal)—to:

- Release the claim to treat the child as a dependent for the current tax year (Part I).

- Release the claim for future tax years (Part II).

- Revoke a previous release for future tax years (Part III).

By signing this form, the custodial parent allows the noncustodial parent to claim the child as a qualifying child for specific tax benefits, including:

- Child Tax Credit (up to $2,000 per child in recent years, subject to phaseouts).

- Credit for Other Dependents ($500 per dependent).

However, Form 8332 does not transfer benefits tied to residency, such as:

- Head of Household filing status.

- Earned Income Tax Credit (EITC).

- Dependent Care Credit.

These generally remain with the custodial parent.

The noncustodial parent must attach the signed Form 8332 (or a compliant substitute) to their tax return each year they claim the benefits. For e-filed returns, it may require Form 8453.

Who Is the Custodial vs. Noncustodial Parent?

The IRS defines the custodial parent as the one with whom the child resided for more than half the year. Tiebreakers (equal nights) go to the parent with higher AGI. This determination is independent of legal custody labels in divorce decrees.

Key Rules for Divorce Decrees and Form 8332

A common misconception is that a divorce decree alone allows the noncustodial parent to claim the child. IRS rules are strict:

- For decrees executed after December 31, 2008, a divorce or separation agreement cannot substitute for Form 8332. The custodial parent must sign and provide Form 8332.

- Older decrees (post-1984 but pre-2009) may allow attaching specific pages if they unconditionally release the claim and conform to Form 8332’s substance.

Without proper documentation, the IRS will disallow the noncustodial parent’s claim, even if the decree states otherwise.

IRS Form 8332 Download and Prinable

Download and Print: IRS Form 8332

How to Complete and File Form 8332

- Download the Form: Get the latest version (Rev. December 2025 draft available) from IRS.gov.

- Fill Out Details:

- Child’s name and SSN.

- Custodial parent’s name, SSN, and signature.

- Specify years (current, specific future, or “all future years”).

- Separate Form per Child: Required for each qualifying child.

- Provide to Noncustodial Parent: The custodial parent gives the signed original or copy.

- Noncustodial Parent’s Responsibility: Attach to Form 1040 (paper) or follow e-file instructions.

- Revocation: Complete Part III to revoke prior releases. Effective the following tax year (e.g., revoke in 2025 → effective 2026). Notify the noncustodial parent in writing.

Common Mistakes to Avoid with Form 8332

- Assuming a court order is sufficient post-2008.

- Forgetting to attach the form annually (even for multi-year releases).

- Releasing benefits without considering overall family tax impact.

- Revoking too late (no retroactive effect).

Frequently Asked Questions About Form 8332

Does Form 8332 affect child support or alimony?

No, it only impacts federal tax benefits.

Can I use it if parents were never married?

Yes, as long as parents lived apart for the last 6 months of the year.

What if the custodial parent won’t sign?

The noncustodial parent generally cannot claim the benefits without it.

Is Form 8332 still relevant in 2025?

Absolutely—while personal exemptions are $0 through 2025, it unlocks CTC and ODC.

For the most accurate guidance, consult IRS Publication 501 (Dependents, Standard Deduction, and Filing Information) and Publication 504 (Divorced or Separated Individuals), or a tax professional. Download Form 8332 and related publications directly from IRS.gov.

Proper use of Form 8332 ensures compliance and maximizes tax advantages for both parents. Always verify the latest rules on the official IRS website, as tax laws can change.