Table of Contents

IRS Form 8379 – Injured Spouse Allocation – If you’re married and filing a joint tax return, you might expect a refund based on your combined income and withholdings. However, if your spouse has past-due debts—such as child support, federal student loans, state taxes, or other obligations—the IRS may offset the entire joint refund to pay those debts, even if you aren’t responsible for them. This is where IRS Form 8379, Injured Spouse Allocation, comes in. Filing this form allows the “injured spouse” (the one not liable for the debt) to reclaim their portion of the refund.

As of 2025, the latest instructions for Form 8379 are revised November 2024, applicable for tax years beginning in 2024 and later. This guide explains what injured spouse allocation is, who qualifies, how to file, and key differences from similar relief options, based on official IRS guidelines.

What Is IRS Form 8379: Injured Spouse Allocation?

Form 8379 is used when a joint tax overpayment (refund) is applied to a past-due obligation owed solely by one spouse. The injured spouse files it to allocate the joint refund and recover their share.

Common debts that trigger offsets include:

- Past-due child or spousal support

- Federal nontax debts (e.g., student loans)

- State income tax obligations

- Certain unemployment compensation debts

The IRS administers this through the Treasury Offset Program (TOP). Without Form 8379, the full refund can be seized, leaving the non-liable spouse without their entitled portion.

Note: This relief protects your refund share—it does not forgive or remove the underlying debt owed by your spouse.

Who Qualifies as an Injured Spouse?

You may qualify if:

- You filed a joint return (Form 1040 or 1040-SR).

- Your share of the joint refund was (or will be) offset to pay your spouse’s separate past-due debt.

- You are not legally required to pay that debt.

- You reported income, withholdings, or refundable credits (e.g., Earned Income Credit) contributing to the overpayment.

Special rules apply in community property states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin). The IRS allocates the refund according to state laws, which often treat income and overpayments as equally shared.

If both spouses owe separate debts, you may still file, but allocation is more complex.

IRS Form 8379 Download and Printable

Download and Print: IRS Form 8379

Injured Spouse vs. Innocent Spouse Relief: Key Differences

People often confuse “injured spouse” with “innocent spouse” relief, but they address different issues:

| Aspect | Injured Spouse (Form 8379) | Innocent Spouse (Form 8857) |

|---|---|---|

| Purpose | Recover your share of a joint refund offset to spouse’s debt | Relieve you from joint tax liability due to spouse’s errors/underreporting |

| When It Applies | Refund seized for spouse’s pre-existing debt (e.g., child support) | Understated tax on joint return (e.g., omitted income) |

| Liability Relief | Only affects refund allocation | Relieves you from paying additional taxes, interest, penalties |

| Filing Deadline | Generally 3 years from return filing or 2 years from payment | Usually 2 years from IRS collection notice |

Do not file Form 8379 if seeking innocent spouse relief—use Form 8857 instead.

How to File Form 8379 in 2025

You can file Form 8379 in three ways:

- With your original joint return (recommended to prevent offset): Attach it and write “Injured Spouse” in the upper left corner of Form 1040.

- With an amended return (Form 1040-X).

- Separately (after offset notice or if you learn of potential offset later).

Steps to Complete:

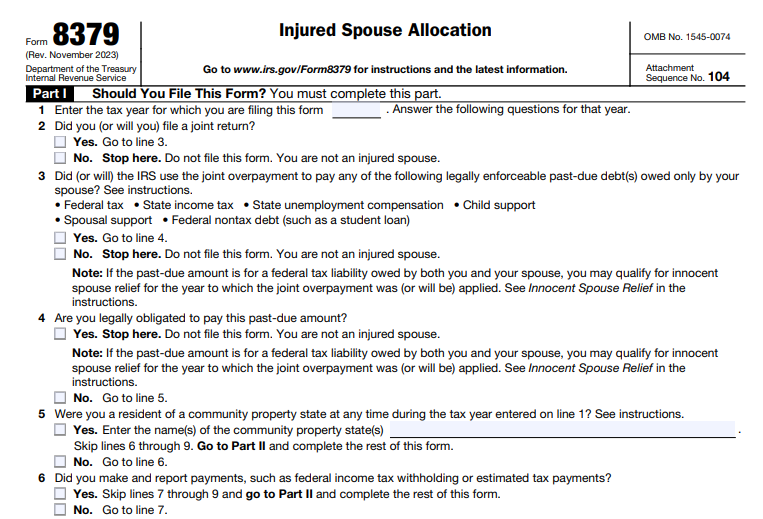

- Part I: Confirm eligibility.

- Part II/III: Allocate income, credits, deductions, and withholdings between spouses (as if filing separately).

- Attach copies of W-2s, 1099s showing withholding (for both spouses).

- Sign (injured spouse only if filing separately).

Electronic Filing: Yes, you can e-file Form 8379 with your joint return.

Where to Mail (if separate): Send to the IRS Service Center where your original return was filed.

Processing Time (as of 2025):

- E-filed with joint return: ~11 weeks

- Paper-filed with joint return: ~14 weeks

- Filed separately: ~8 weeks

Tips for Successful Filing

- File early (with your return) to avoid offset delays.

- Include all required supporting documents to prevent processing delays.

- In community property states, check the box on the form—IRS will apply state rules.

- Track status via IRS “Where’s My Refund?” tool or call 800-829-1040.

For the latest form and instructions, visit IRS.gov/Form8379 or IRS.gov/InjuredSpouse.

Frequently Asked Questions

Can I file if we’re divorced?

Yes, if the joint return was for a year when married and the debt is your ex-spouse’s.

What if no offset has occurred yet?

File proactively with your return.

Is there a deadline?

Generally within 3 years of filing the return or 2 years of payment (see IRC Section 6511 for details).

Filing Form 8379 can protect your hard-earned refund. Always consult a tax professional for your specific situation, as rules can vary by state and circumstances.

Sources: IRS.gov (About Form 8379, Instructions for Form 8379 Rev. Nov 2024, Injured Spouse Relief page, last reviewed/updated 2025).