Table of Contents

IRS Form 8582 – Passive Activity Loss Limitations – Navigating passive activity losses (PALs) can be a game-changer for real estate investors, limited partners, and rental property owners looking to offset taxable income. IRS Form 8582, “Passive Activity Loss Limitations,” is essential for calculating how much of your PALs you can deduct against nonpassive income in 2025, preventing the misuse of losses from activities like rentals where you don’t materially participate. With no major rule changes from 2024—thanks to the Tax Cuts and Jobs Act (TCJA) extensions through 2025—this form remains a cornerstone for compliance, especially amid rising rental market volatility.

This comprehensive, SEO-optimized guide draws from the latest IRS resources to explain Form 8582’s purpose, eligibility, and step-by-step filing. Whether you’re a landlord claiming the $25,000 special allowance or carrying forward disallowed losses, proper use can unlock significant tax savings. Download the 2025 draft instructions from IRS.gov to align with your April 15, 2026, deadline.

What Is IRS Form 8582?

IRS Form 8582 helps noncorporate taxpayers—individuals, estates, and trusts—figure the allowable portion of passive activity losses for the current year and apply prior-year unallowed losses under IRC Section 469. Passive activities generate income or losses without material participation, such as rental real estate or limited partnerships. The form ensures PALs only offset passive income, with excess carried forward indefinitely until offset or upon full disposition of the activity.

Core elements include:

- Netting Losses: Aggregates income and losses from all passive activities.

- Special $25,000 Allowance: For active participants in rental real estate (phased out above $100,000 modified AGI).

- Carryover Tracking: Disallowed losses roll to future years; full release on sale.

- Coordination Rules: Applies after at-risk (Form 6198) and basis limitations.

For 2025, the form mirrors 2024 with stable thresholds—no inflation adjustments to the $25,000 allowance or AGI phaseout. Use it alongside Schedule E (rentals/partnerships) or Form 4835 (farm rentals). Corporations use Form 8810 instead.

Who Needs to File IRS Form 8582 in 2025?

File Form 8582 if you’re a noncorporate taxpayer with:

- Any passive activity deductions (current or prior unallowed losses) resulting in an overall gain from all passives.

- Rental real estate losses where you actively participate, but only if prior unallowed losses exist, total loss exceeds $25,000, or modified AGI >$100,000.

- Losses from passive trade/business activities (e.g., limited partnerships) or non-rental passives.

Exceptions (no Form 8582 needed):

- Overall loss from all passives with no prior unallowed losses.

- Active rental participants with losses ≤$25,000 and modified AGI ≤$100,000 (report directly on Schedule E).

- Real estate professionals materially participating in rentals (treat as nonpassive).

- Married filing separately and lived with spouse (no special allowance; $0 limit).

Estates/trusts file if qualifying under active participation rules. Attach to Form 1040, 1040-SR, or 1041. If no activity, skip it—but track carryovers for future years.

Key Definitions: Passive vs. Nonpassive Activities on Form 8582

Understanding classifications is crucial to avoid audits. Per IRS Publication 925:

| Category | Description | Examples | Passive? |

|---|---|---|---|

| Passive Activities | Involve no material participation; all rentals unless excepted. | Rental properties, limited partnerships, silent investments. | Yes |

| Trade/Business with Material Participation | >500 hours/year, or primary participant; spouse’s hours count. | Active consulting firm, real estate pro’s developments. | No |

| Rental Activities (Exception) | Average customer use ≤7 days (e.g., hotels) or ≤30 days with services. | Short-term vacation rentals, equipment leasing to business. | No |

| Real Estate Professional | >50% personal services in real estate + >750 hours/year; elect to aggregate. | Full-time property managers qualifying rentals as nonpassive. | No (if elected) |

Material participation tests (7 total): E.g., >500 hours, >100 hours + more than anyone else, or significant prior-year involvement. Track hours via logs. Self-rentals (e.g., business rents from you) are nonpassive.

IRS Form 8582 Download and Printable

Download and Print: IRS Form 8582

How to Complete IRS Form 8582: Step-by-Step Guide for 2025

Gather data from Schedule E, K-1s, and prior Form 8582 (carryover worksheet in instructions). Use positive numbers for income/losses; enter losses as positive in Part II. Tax software simplifies, but manual review ensures accuracy.

Preparation: Worksheets for Prior-Year Carryovers

- Use the Activity Loss Carryover Worksheet (in instructions) to allocate 2024 unallowed losses to 2025 activities.

- Separate rental real estate (with active participation) from other passives.

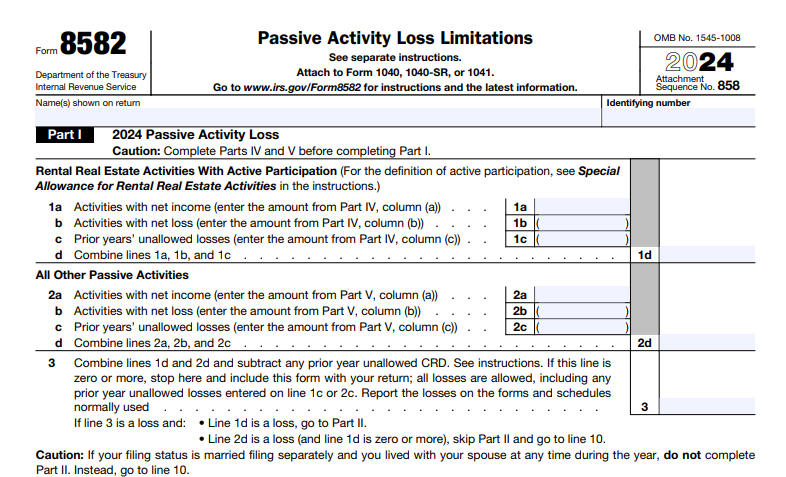

Part I: 2024 Passive Activity Loss

- Lines 1a–1c (Rental Real Estate with Active Participation): From Part IV—current net income (1a), net loss (1b as positive), prior unallowed (1c).

- Lines 2a–2c (All Other Passive Activities): From Part V—similar for non-rentals.

- Line 3: Prior unallowed commercial revitalization deductions (CRD) from rentals (enter as negative).

- Lines 1d/2d: Net (income – losses – prior unallowed); if zero or gain, all losses allowed—stop here.

- Line 3: Combine 1d + 2d + CRD; if gain, proceed to allowed losses.

Example: $10,000 rental income, $30,000 rental loss, $5,000 prior unallowed = $25,000 net loss (line 1d). No other passives: Proceed to Part II.

Part II: Special Allowance for Rental Real Estate with Active Participation

For those making management decisions (e.g., approving repairs/tenants); limited partners ineligible.

- Line 4: Smaller of line 1d loss or line 3 loss (positive).

- Line 5: $150,000 ($75,000 if married filing separately, lived apart).

- Line 6: Modified AGI (AGI + add-backs like IRA deductions, student loan interest, passive losses).

- Line 7: Phaseout: If AGI >$100,000, 50% of excess over $100,000 ($50,000 separate); else $0.

- Line 8: Smaller of $25,000 ($12,500 separate) or line 7.

- Line 9: Smaller of line 4 or line 8; add CRD allowance via worksheet if applicable (e.g., up to $12,500 extra for qualified revitalization).

Tip: Active participation requires less involvement than material (no hour test), but document decisions.

Part III: Total Losses Allowed

- Line 10: Passive income (line 3 if gain) + special allowance (line 9).

- Line 11: From Parts VI–IX; deduct on Schedule E/Form 4835.

Parts IV–V: Detailed Activity Breakdown

- Part IV (Rentals): List each activity—name, current income/loss, prior unallowed (only if active both years), overall gain/loss.

- Part V (Other Passives): Same for partnerships, S corps, etc.; note CRD.

Part VI: Allocate Special Allowance

- For rental losses (Part IV column e): Prorate line 9 across activities (ratios sum to 1.00); unallocated to Part VII.

Part VII: Allocate Remaining Unallowed Losses

- Prorate total unallowed (line 3 positive – line 9) across all overall losses.

Parts VIII–IX: Allowed/Unallowed per Form/Schedule

- Part VIII: Single activity—net loss + prior minus unallowed = allowed.

- Part IX: Multiple (e.g., 28% rate gains)—net per form, prorate unallowed, report on Schedule D/Form 8949 with “PAL” notation.

Carry unallowed to next year’s Part IV/V. For dispositions, release all prior losses as nonpassive.

Key Changes and Stable Rules for IRS Form 8582 in 2025

No structural updates to Form 8582 for 2025—the $25,000 allowance, $100,000 AGI threshold, and phaseout remain unchanged. TCJA’s excess business loss limit ($305,000/$610,000 for 2025, inflation-adjusted) applies before PAL rules via Form 461, but doesn’t alter PAL itself. Real estate professionals still bypass limits if qualifying (>750 hours, >50% services in realty). CRD handling persists for prior years. Always verify IRS.gov for late-2025 notices.

Common Mistakes to Avoid When Filing Form 8582

- Misclassifying Activities: Treating short-term rentals as passive—check 7/30-day rules.

- Forgetting Carryovers: Use the IRS worksheet; errors compound over years.

- Overlooking Modified AGI Add-Backs: Include passive losses in AGI calculation.

- No Documentation: Keep participation logs; audits target high-income filers.

- Ignoring Coordination: Apply at-risk/basis limits first.

Per Publication 925, prorate deductions if partially disallowed.

Tips for Maximizing Deductions with IRS Form 8582 in 2025

- Qualify as Real Estate Pro: Log >750 hours to reclassify rentals as nonpassive—unlimited offsets.

- Leverage the $25,000 Allowance: Time expenses to keep AGI <$100,000; spouses can double up if filing jointly.

- Aggregate Activities: Elect on return to treat all rentals as one for participation tests.

- Plan Dispositions: Sell to release suspended losses fully.

- Use Software: TurboTax or H&R Block automates prorations and carryovers.

- Consult Experts: CPAs spot PTP or self-rental nuances.

Strategic timing can turn suspended losses into immediate savings.

Final Thoughts: Optimize Your 2025 Taxes with Smart PAL Management

IRS Form 8582 enforces fair play on passive losses but offers pathways like the special allowance and pro status to ease burdens for active investors. By accurately completing it and leveraging carryforwards, you’ll minimize 2025 liabilities while staying audit-ready.

For the official 2025 Form 8582 and Publication 925, head to IRS.gov/Form8582. Facing complex rentals or partnerships? A tax advisor can tailor strategies. Begin reviewing your activities now—your future tax bill will thank you.