Table of Contents

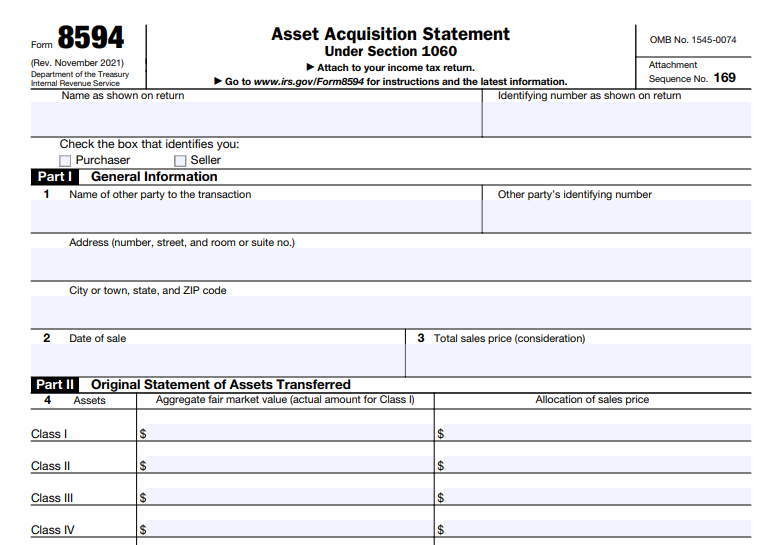

IRS Form 8594 – Asset Acquisition Statement Under Section 1060 – When buying or selling a business, properly allocating the purchase price among acquired assets is crucial for tax compliance. IRS Form 8594, known as the Asset Acquisition Statement Under Section 1060, plays a key role in this process. This form ensures that both buyers and sellers report the transaction consistently, helping to determine tax implications like depreciation, amortization, and capital gains. In this guide, we’ll break down everything you need to know about Form 8594, including its purpose, filing requirements, asset classes, and allocation methods. Whether you’re a business owner, accountant, or tax professional, understanding this form can help you navigate asset acquisitions smoothly and avoid costly penalties.

What Is IRS Form 8594 and Why Is It Important?

IRS Form 8594 is required for reporting the sale or purchase of a group of assets that constitute a trade or business, particularly when goodwill or going concern value is involved. Under Internal Revenue Code (IRC) Section 1060, the form details how the total purchase price is allocated across different asset categories. This allocation affects the buyer’s basis in the assets for depreciation and amortization purposes, while influencing the seller’s gain or loss calculations.

The importance of Form 8594 lies in its role in preventing discrepancies between buyer and seller reports, which could trigger IRS audits. For instance, buyers often prefer allocating more to depreciable assets like equipment for faster tax deductions, while sellers may want more allocated to capital assets to minimize ordinary income taxes. Both parties must generally agree on the allocation and file identical forms to ensure compliance.

As of December 2025, there are no major updates to Form 8594 or Section 1060, with the last significant revisions dating back to 2021 instructions. However, always check the IRS website for any late-year developments, especially if your transaction involves complex elements like earnouts or contingencies.

Who Needs to File Form 8594?

Both the purchaser and the seller must file Form 8594 if the transaction qualifies as an “applicable asset acquisition.” This applies when:

- A group of assets forms a trade or business.

- Goodwill or going concern value attaches (or could attach) to the assets.

- The buyer’s basis in the assets is determined solely by the amount paid.

Exceptions include like-kind exchanges under Section 1031 (unless partially taxable) and certain partnership interest transfers not treated as asset sales. For controlled foreign corporations, U.S. shareholders may need to attach it to Form 5471.

If you’re amending due to changes in consideration (e.g., price adjustments), a supplemental Form 8594 is required. Individuals file with Form 1040, estates with 1041, partnerships with 1065, and corporations with 1120.

When and How to File Form 8594

File Form 8594 by attaching it to your income tax return for the year the sale occurs, due on the return’s deadline (including extensions). For supplemental filings due to consideration changes, submit in the year the change is accounted for.

To complete the form:

- Part I: Provide general information, including the other party’s name, address, TIN, sale date, and aggregate consideration.

- Part II: Report the original asset allocation, including fair market values (FMV) and allocated amounts for each class.

- Part III: Use for supplemental statements, explaining reallocations.

Retain detailed records, as the IRS estimates about 11 hours for recordkeeping per filing.

The Seven Asset Classes Explained

Assets are divided into seven classes for allocation, with lower classes prioritized. If an asset fits multiple classes, assign it to the lowest-numbered one. Here’s a breakdown:

- Class I: Cash and general deposit accounts (excluding CDs).

- Class II: Actively traded personal property, CDs, and foreign currency.

- Class III: Assets marked to market annually, debt instruments, and accounts receivable.

- Class IV: Inventory and stock in trade.

- Class V: All other tangible assets (e.g., buildings, land, equipment).

- Class VI: Section 197 intangibles (e.g., patents, copyrights, covenants not to compete), excluding goodwill.

- Class VII: Goodwill and going concern value.

Classes VI and VII are combined for reporting on the form.

How to Allocate the Purchase Price

Use the residual allocation method under Treasury Regulations Section 1.1060-1. Start by reducing the total consideration by Class I assets’ FMV, then allocate the remainder sequentially to Classes II through VI based on FMV (not exceeding FMV), with any leftover going to Class VII.

For increases in consideration post-sale, allocate first to Class I, then proportionally to higher classes. Decreases reduce Class VII first, then lower classes proportionally. If contingencies exist, estimate maximum consideration on Line 6.

IRS Form 8594 Download and Printable

Download and Print: IRS Form 8594

Handling Supplemental Forms and Changes

If the purchase price changes after filing (e.g., due to earnouts or disputes), both parties must file a supplemental Form 8594. This ensures updated allocations reflect the new reality, and changes are treated as occurring on the purchase date if in the same year.

Penalties for Non-Compliance

Failure to file accurately or on time can result in penalties under IRC Sections 6721-6724, unless reasonable cause is shown. These can range from $50 to $290 per form, escalating for intentional disregard.

Final Thoughts on Form 8594

Mastering IRS Form 8594 is essential for any business asset transaction under Section 1060. By properly classifying assets and allocating the purchase price, you can optimize tax outcomes and stay compliant. Consult a tax advisor for complex deals, and always reference the latest IRS instructions. For more details, visit the official IRS page or related publications like Forms 1040, 1065, or 1120. If you’re preparing for a 2025 filing, confirm no new changes have emerged by checking IRS.gov.