Table of Contents

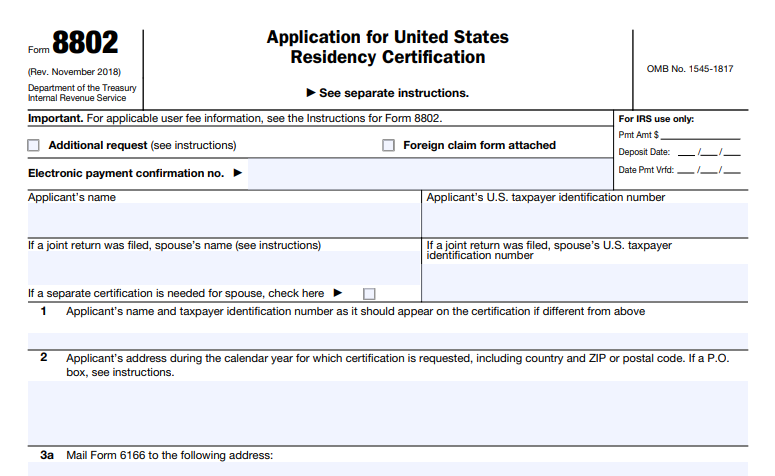

IRS Form 8802 – Application for United States Residency Certification – In an increasingly global economy, U.S. residents and entities often need to prove their tax residency status to claim benefits under international tax treaties or exemptions from value-added tax (VAT) in foreign countries. IRS Form 8802, officially known as the Application for United States Residency Certification, serves this exact purpose by allowing applicants to request Form 6166, a letter certifying U.S. residency for tax purposes. This certification can help reduce withholding taxes on income from foreign sources or avoid double taxation. If you’re a U.S. citizen, green card holder, business owner, or entity dealing with international transactions, understanding Form 8802 is crucial. In this comprehensive guide, we’ll cover everything you need to know about IRS Form 8802, including eligibility, application steps, fees, and recent updates as of 2025.

What is IRS Form 8802 and Why Do You Need It?

IRS Form 8802 is the application used to request a certificate of U.S. residency, Form 6166, which verifies that the applicant is a U.S. resident for tax purposes. This certification is primarily used to claim benefits under U.S. income tax treaties with other countries or to obtain VAT exemptions/refunds abroad. For instance, if you’re earning royalties, dividends, or interest from a foreign entity, Form 6166 can help you apply for reduced tax rates as outlined in the relevant tax treaty.

Without this certification, foreign payers might withhold taxes at higher rates, leading to potential cash flow issues or the need for later refunds. It’s not intended for claiming foreign tax credits on U.S. returns but rather for interactions with foreign tax authorities. Common scenarios include:

- U.S. businesses expanding internationally.

- Individuals receiving pensions or investments from abroad.

- Entities seeking VAT refunds on foreign purchases.

As of 2025, the form remains essential for anyone navigating cross-border tax compliance, with no major structural changes noted beyond procedural refinements.

Who Needs to File IRS Form 8802?

Form 8802 is for U.S. residents or entities that require official proof of residency for tax treaty claims or VAT purposes. Eligible applicants include:

- Individuals: U.S. citizens, lawful permanent residents (green card holders), sole proprietors, or other U.S. resident aliens under section 7701(b)(1)(A).

- Corporations: Generally those incorporated in the U.S., including S corporations, or certain foreign corporations qualifying under specific IRC sections (e.g., 269B, 953(d), 1504(d)).

- Partnerships and Disregarded Entities (DREs): These aren’t residents themselves but can apply on behalf of U.S. partners or owners.

- Trusts and Estates: Including grantor trusts, simple trusts, complex trusts, IRAs, and estates.

- Employee Benefit Plans/Trusts: Such as pension plans, provided they meet filing requirements.

- Exempt Organizations: U.S.-organized nonprofits with determination letters.

- Nominees: Acting on behalf of others, with proper authorizations.

You may not be eligible if you haven’t filed a U.S. tax return (unless you provide documentation explaining why), filed as a nonresident, or are a dual resident claiming non-U.S. residency under a treaty tie-breaker rule. Special considerations apply for dual-status aliens, U.S. territory residents, or those living abroad.

Eligibility Requirements for U.S. Residency Certification

To qualify, applicants must demonstrate U.S. residency for the requested year(s) and have complied with U.S. tax filing obligations. Key requirements include:

- A valid Taxpayer Identification Number (TIN), such as a Social Security Number (SSN) or Employer Identification Number (EIN).

- Proof of residency, like Form I-551 for green card holders or I-94 for substantial presence test qualifiers.

- For entities, lists of partners, shareholders, owners, or beneficiaries, along with authorizations (e.g., Form 8821 or 2848).

- If no U.S. return was filed, attach explanations or supporting documents like income statements, Form W-2, or 1099.

- For fiscally transparent entities, confirm that U.S. partners/owners filed as residents.

Ineligibility can stem from unposted tax returns, fiscal transparency without U.S. ties, or being an exempt organization not organized in the U.S. Dual residents must include statements affirming U.S. residency or treaty tie-breaker details.

Step-by-Step Guide: How to Apply for IRS Form 8802

Applying for Form 8802 involves completing the form, gathering documents, paying fees, and submitting via mail or fax. Here’s the process:

- Download the Form and Instructions: Get the latest version (Rev. November 2018, with October 2024 instructions) from IRS.gov.

- Complete the Form:

- Enter your name, TIN, and address (no P.O. boxes for the certification address).

- Select applicant type and provide details (e.g., partner lists for partnerships).

- Specify the certification year(s) and tax period.

- Indicate the purpose (tax treaty or VAT with NAICS code).

- Sign under penalties of perjury, using the appropriate statement from Table 2 in the instructions.

- For multiple certifications, detail the number per country/year.

- Gather Required Documents:

- Copies of recent tax returns (write “COPY – do not process” if including to expedite).

- Authorizations like Form 2848 for third parties.

- Proof if no return filed.

- Foreign claim forms (optional).

- Pay the User Fee: See the fees section below.

- Submit the Application:

- Mail to: Internal Revenue Service, US Residency Certification, Philadelphia, PA 19255-0625 (or private delivery address).

- For electronic payment via Pay.gov, upload a PDF of Form 8802 (≤15MB) for validation, then mail or fax the full application.

- Fax options: Up to 10 forms (100 pages) to 877-824-9110 (U.S.) or 304-707-9792 (international), with a cover sheet.

Submit at least 45 days before you need Form 6166. For current-year certifications, applications postmarked before December 1 of the prior year will be returned.

IRS Form 8802 Download and Printable

Download and Print: IRS Form 8802

Fees for IRS Form 8802

A user fee is required for each Form 8802 submitted. As of 2025:

- Individuals: $85 per application.

- Non-individuals (e.g., corporations, trusts): $185 per application (increased effective December 1, 2018, per Revenue Procedure 2018-50).

Fees apply per Form 8802, even for multiple certifications within one application. Pay by check/money order or electronically via Pay.gov (search “IRS Certs”). No refunds for denied applications.

For additional requests (within 12 months of an approved application with no changes), use a separate Form 8802, check the “Additional Request” box, and pay the standard fee.

Processing Time for Form 8802

The IRS typically processes Form 8802 within 4-6 weeks, but allow at least 45 days to account for mailing and potential delays. If your tax return hasn’t posted, including a signed copy can speed things up. The IRS will contact you if there’s a delay beyond 30 days. For status inquiries, call 267-941-1000 and select the U.S. residency option.

Common Mistakes to Avoid When Filing Form 8802

To prevent rejections or delays:

- Using a P.O. box as the certification address.

- Submitting too early for current-year certifications.

- Omitting perjury statements or authorizations.

- Providing incorrect TIN or mismatched names.

- Forgetting to include fees or uploading oversized PDFs on Pay.gov.

- Not attaching required proofs for no-return filers or dual residents.

False information can lead to penalties under IRC sections 6702 and 6703, including denial of certification.

Recent Changes and Updates to Form 8802 in 2025

The IRS made the new submission process permanent after a 2-year pilot starting April 4, 2022. Key updates include:

- When the IRS requests a signed tax return (if not posted), submit only the main pages (e.g., pages 1-6 of Form 1120) without schedules.

- Optional inclusion of a signed return copy marked “COPY – do not process” to expedite if posting status is uncertain.

- Pay.gov upload requirement for electronic payments (effective September 29, 2024) for validation, not full processing.

No specific 2025 form revisions are noted, but check IRS.gov for the latest. A 3-year procedure is available for estates, employee plans, and exempt organizations, allowing simplified renewals in years 2-3 if no changes occur.

Conclusion: Secure Your U.S. Residency Certification Today

IRS Form 8802 is a vital tool for U.S. taxpayers engaging in international activities, ensuring you can claim deserved tax benefits efficiently. By following this guide, you can navigate the application process with confidence. Always consult a tax professional for personalized advice, as tax laws can be complex. For the most current information, visit the official IRS website or contact their helpline.

This article is for informational purposes only and not tax advice. Stay compliant and optimize your global tax strategy with Form 8802 in 2025.