Table of Contents

IRS Form 8804-W – Installment Payments of Section 1446 Tax for Partnerships – For partnerships with foreign partners, managing U.S. tax withholding on effectively connected taxable income (ECTI) is a critical compliance obligation under Section 1446 of the Internal Revenue Code. Enter IRS Form 8804-W, the Installment Payments of Section 1446 Tax for Partnerships worksheet—a vital tool for calculating and planning quarterly estimated tax payments. As we approach the end of 2025, partnerships preparing 2024 filings (due March 17, 2025, for calendar-year entities) need accurate guidance to avoid underpayment penalties.

This SEO-optimized guide draws from the latest IRS resources, including the 2024 Form 8804-W instructions released in late 2024, to explain the form’s purpose, eligibility, step-by-step completion, deadlines, and strategies for compliance. Whether you’re a tiered partnership or handling preferential rate income, mastering Form 8804-W ensures smooth estimated payments and minimizes IRS scrutiny. Let’s break it down.

What Is IRS Form 8804-W?

Form 8804-W is a non-filing worksheet designed exclusively for partnerships to estimate and compute installment payments of Section 1446 withholding tax. This tax applies to ECTI allocated to foreign partners, ensuring the U.S. collects taxes on income effectively connected with a U.S. trade or business before the income reaches the partners.

Unlike the annual Form 8804 (which reports total liability and transmits Forms 8805 to partners), Form 8804-W helps determine quarterly payments via Form 8813 vouchers or electronic methods. It’s not submitted to the IRS but retained for records and used to calculate potential penalties on Schedule A (Form 8804) if underpayments occur. For 2024, the form incorporates updated tax rates and safe harbor rules, with no major structural changes from 2023, though instructions emphasize netting rules for losses and preferential rates.

Key Fact: Partnerships owe Section 1446 tax at rates up to 37% on ECTI for corporate foreign partners and 10%–37% (based on individual brackets) for non-corporate ones, including a 4% Medicare portion for non-corporate partners.

Who Must Use Form 8804-W?

Form 8804-W is required for any U.S. or foreign partnership (domestic or tiered) that allocates ECTI to foreign partners and expects aggregate Section 1446 tax of $500 or more for the tax year. This includes:

- Domestic Partnerships: Those engaged in a U.S. trade or business with foreign partners receiving ECTI.

- Foreign Partnerships: Subject to withholding if they have U.S.-sourced ECTI allocable to foreign partners.

- Tiered Partnerships: Upper-tier entities credit lower-tier withholdings on Form 8804, line 6f/g.

Exceptions:

- Publicly traded partnerships use Section 1446(f) rules for transfers, not standard installments.

- If total tax is under $500, no installments are required, but annual reporting via Form 8804 still applies.

Partnerships must notify foreign partners of their allocable share within 10 days of each payment. Failure to withhold properly can lead to full partnership liability, plus interest and penalties.

Step-by-Step Guide: How to Complete IRS Form 8804-W for 2024

Complete a separate Form 8804-W for each installment based on year-to-date data. Use the 2024 version from IRS.gov; estimates are acceptable for prior-year safe harbors if Form 8804 isn’t filed yet. Payroll or tax software can automate calculations, but manual filers should net losses per section 1(h) rules before entering positives.

1. Gather Data

- Review partnership agreements for ECTI allocations.

- Collect year-to-date ECTI by category: ordinary, net short-term capital gain/loss, 28%-rate gain/loss, unrecaptured section 1250 gain, and adjusted net capital gain.

- Note reductions: State/local taxes (Reg. §1.1446-6(c)(1)(iii)) and certified items via Form 8804-C.

- For preferential rates: Use 0%, 15%, or 20% for qualifying capital gains on lines 1i, 1m, 1q.

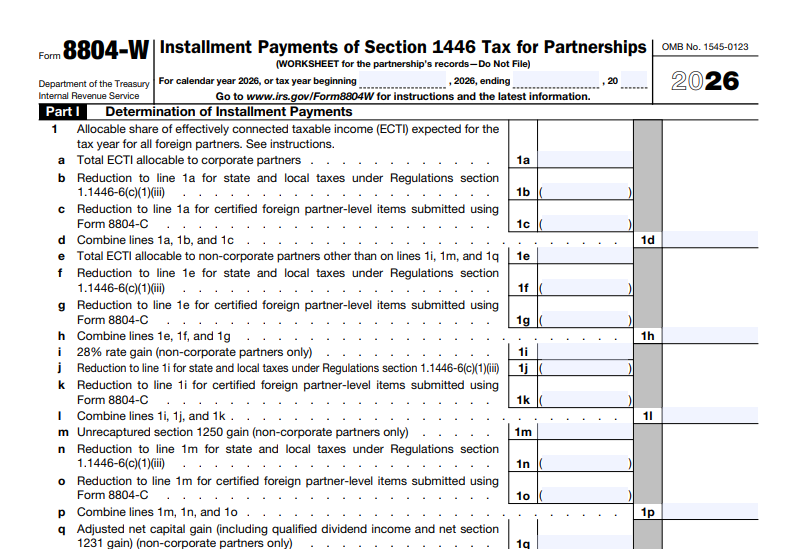

2. Part I: Determination of Installment Payments

- Lines 1a–1s (ECTI Allocable to Foreign Partners): Break down ECTI by type. Subtract state/local reductions (lines 1b, 1f, etc.) and Form 8804-C items (lines 1c, 1g, etc.). Combine for net amounts (no negatives).

- Line 5 (Total Net ECTI): Sum lines 1d, 1h, 1l, 1p, 1t, 1x.

- Line 6 (Current-Year Safe Harbor): Apply 2024 rates (e.g., 37% corporate, 10% base + 37% top for non-corporate) to line 5; add 4% Medicare for non-corporate ECTI.

- Line 7: 25% of line 6 (annualized estimate).

- Line 8 (Prior-Year Safe Harbor): Total 2023 Section 1446 tax (from prior Form 8804, line 5f, ignoring reductions). Qualifies if prior year ≥50% of current ECTI estimate and timely filed. Caution: Using line 7 over line 8 forfeits prior-year protection for penalties.

- Line 9: Smaller of lines 7 or 8.

- Line 11: 25% of line 9 per installment (or from Part IV if using alternative methods).

- Line 12: Credits (e.g., prior overpayments, tiered withholdings) allocated to installments.

3. Parts II–IV: Alternative Methods (Optional)

- Use Annualized Income Installment (Part III) or Adjusted Seasonal Installment (Part II) for variable ECTI (e.g., seasonal businesses). Qualify if ≥70% ECTI in a 6-month base period over 3 prior years.

- Line 43 (Part IV): Smallest required installment from safe harbors or alternatives. Exclude extraordinary items (> $1M or §481(a) adjustments) unless de minimis.

4. Refigure if Needed

- If estimates change (e.g., new Form 8804-C), recalculate and make catch-up payments to minimize penalties.

Pro Tip: Retain worksheets for 3 years; they support Schedule A penalty calculations.

Due Dates and How to File Form 8804-W Payments for 2024

For calendar-year partnerships, 2024 installments were due April 15, June 17 (adjusted), September 16, and December 16 (next business day if weekend/holiday). Fiscal-year entities align to their tax year months.

- Payment Methods: Use Form 8813 with check/money order or EFTPS (mandatory for >$2,500 annual deposits). EFTPS doesn’t replace filing Forms 8804/8805.

- Annual Reconciliation: Balance due with Form 8804 by March 15, 2025 (extendable via Form 7004, but pay estimate to avoid interest).

Notify partners via statements mirroring Form 8805 within 10 days.

Common Mistakes to Avoid with IRS Form 8804-W

Underestimating installments is the top error, per IRS data, leading to penalties up to 5% annualized on underpayments. Here’s a quick reference:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Ignoring Netting Rules | Failing to offset losses against gains per §1(h). | Net within categories before entry; no negatives on lines 1d–1x. | Overstated tax; unnecessary payments. |

| Misapplying Safe Harbors | Using prior-year when ECTI <50% current. | Verify 50% threshold; switch methods with catch-up if needed. | Full-year penalty exposure. |

| Overlooking Reductions | Not claiming state/local or Form 8804-C items. | Document certifications; apply netting to reductions. | Inflated installments; cash flow issues. |

| Missing Tiered Credits | Forgetting lower-tier withholdings on line 12. | Allocate to installments; report on Form 8804, lines 6f/g. | Double taxation risks. |

| Late Notifications | Delaying partner statements >10 days. | Automate via software; track due dates. | Partner credit denials on their returns. |

| Extraordinary Items Error | Annualizing non-de minimis events. | Defer >$1M items to year-end; disclose if switching methods. | Penalty recalculation on Schedule A. |

Corrections? Amend via adjusted Form 8813 payments; refile Form 8804 if needed.

IRS Form 8804-W Download and Printable

Download and Print: IRS Form 8804-W

2024 Updates and Special Considerations for Form 8804-W

The 2024 instructions (Rev. 2024) align with post-TCJA rates, emphasizing:

- Preferential Rates: Expanded guidance for capital gains (0%/15%/20%) on lines 1i–1q; tiered partnerships must trace allocations.

- EFTPS Mandate: Required for larger payers; no changes to thresholds.

- Base Period for Seasonal Method: Updated to include 2021–2023 data for 2024 qualification (≥70% ECTI in 6 months).

- Penalty Relief: No broad waivers, but de minimis extraordinary items (<$1M) can be annualized.

For tiered structures, credit §1446(f)(1) withholdings on dispositions. Consult Pub. 519 for alien partners.

Final Thoughts: Master Section 1446 Compliance with Form 8804-W

IRS Form 8804-W is your roadmap to timely, accurate Section 1446 installment payments, shielding partnerships from penalties while supporting foreign partners’ tax credits. With 2024 filings looming, download the latest worksheet and instructions from IRS.gov today—early planning pays dividends.

For complex allocations, partner with a tax advisor. This guide is informational; always verify with official IRS sources for your situation.

Not tax advice. Consult a professional for personalized guidance.