Table of Contents

IRS Form 8810 – Corporate Passive Activity Loss and Credit Limitations – In the complex world of corporate taxation, passive activities—like rental real estate or limited partnerships—often generate losses that corporations can’t fully deduct against active income, thanks to the passive activity loss (PAL) rules under Internal Revenue Code Section 469. IRS Form 8810, Corporate Passive Activity Loss and Credit Limitations, is the essential tool for personal service corporations (PSCs) and closely held corporations (CHCs) to compute allowable PALs and credits, ensuring compliance while unlocking deductions up to the corporation’s net active income. As the IRS released the 2025 instructions in late 2024 with no structural changes from 2024, but emphasizing updated worksheets for prior-year unallowed losses and special rules for cooperatives, timely filing remains critical to avoid penalties up to $340 per form for late submissions after December 31, 2025.

This SEO-optimized guide, based on the official 2025 Instructions for Form 8810 and IRS Publication 925 (Passive Activity and At-Risk Rules), covers the form’s purpose, eligibility, step-by-step completion, deadlines, and strategies for maximization. Whether you’re a PSC professional firm or a CHC with rental investments, Form 8810 can offset up to 100% of net active income against PALs—potentially saving thousands in corporate taxes. Download the 2025 PDF from IRS.gov and attach to your Form 1120 by March 15, 2026, to stay compliant and strategic.

What Is IRS Form 8810?

Form 8810 is a specialized worksheet for PSCs and CHCs to figure allowable passive activity losses (PALs) and credits from passive activities in the current year, as well as the amount of prior-year unallowed losses and credits deductible on the corporation’s return. Passive activities include rentals or trades/businesses without material participation, limiting losses to passive income or net active income for CHCs.

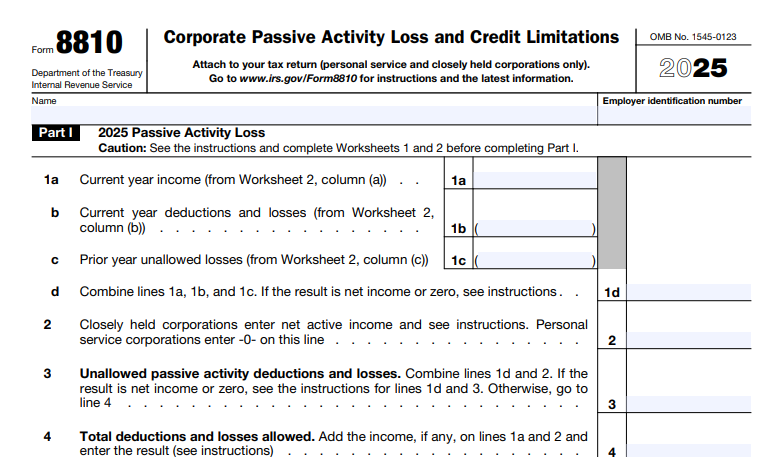

The form’s key parts:

- Part I: Current-year PALs (trade/business and rental).

- Part II: Prior-year unallowed losses.

- Part III: Allowable losses and credits.

- Worksheets: For grouping elections, PTPs, and cooperatives.

For 2025, instructions clarify treatment of former passive activities (e.g., full disposition allows suspended losses) and special rules for cooperatives converting qualified expenditures to credits via Form 3800. Attach to Form 1120 (or 1120-S for S-corps, though S-corps use Form 8582); e-file supported. Unallowed amounts carry forward indefinitely.

Key Fact: CHCs can offset up to 100% of net active income with PALs, while PSCs are limited to 40%—making Form 8810 a must for real estate-heavy corps.

Who Must File Form 8810?

Personal service corporations (PSCs) and closely held corporations (CHCs) must file Form 8810 if they have passive activities generating losses or credits in 2025. Definitions:

- PSC: >95% services in health, law, engineering, architecture, accounting, actuarial, or consulting; ≥75% owned by employee-owners.

- CHC: >50% stock (by value) owned by ≤5 individuals (or entities treated as individuals).

When Required:

- Any PAL or credit from passive activities (rentals, non-material participation businesses).

- Prior-year unallowed amounts to carry forward.

- Election to increase basis on credit property disposition (Part III).

Exceptions:

- C-corps not PSCs/CHCs: No PAL limitations (use Schedule M-1 adjustments).

- S-corps: Shareholders use Form 8582.

- Grouping elections: Attach statement if combining activities.

File with Form 1120 by the due date (March 15 for calendar year; extendable).

Step-by-Step Guide: How to Complete IRS Form 8810 for 2025

The 2025 Form 8810 is a 2-page PDF—download from IRS.gov and use tax software for worksheets. Start with activity groupings (Pub. 925).

1. Gather Data

- Passive income/losses from Schedules K-1 or activity worksheets.

- Net active income (total income minus portfolio/rental).

- Prior-year unallowed from 2024 Form 8810, line 11.

2. Part I: Current Year PALs (Lines 1–6)

- Line 1: Trade/business PALs (Worksheet 1).

- Line 2: Rental PALs (Worksheet 2; special CHC rules).

- Line 3: Total current PALs.

- Line 4: Net active income (if CHC).

- Line 5: Allowable (smaller of 3 or 4; PSC limited to 40%).

- Line 6: Carryforward (line 3 – 5).

3. Part II: Prior Year Unallowed (Lines 7–11)

- Line 7: Prior trade/business unallowed.

- Line 8: Prior rental unallowed.

- Line 9: Total prior.

- Line 10: Allowable (per Part I rules).

- Line 11: Carryforward (9 – 10).

4. Part III: Credits and Elections (Lines 12–15)

- Line 12: Current passive credits (Form 3800).

- Line 13: Allowable credits (limited by active income).

- Line 14: Prior unallowed credits.

- Line 15: Election to increase basis on disposition (attach statement).

Pro Tip: Use Worksheet 5 for cooperatives; group rentals if significant participation.

Deadlines and How to File Form 8810 for 2025

Attach to Form 1120 (or 1120-F/C) by the due date (March 15, 2026, for calendar year; extendable to September 15 via Form 7004, but pay by original due). E-file (mandatory for large corps) or paper mail to IRS center.

- Grouping Elections: Attach statement by due date; irrevocable without consent.

- Amended: Use Form 1120X within 3 years for missed losses.

- Carryforwards: Track line 6/11 annually; no expiration.

Refunds/credits via e-file in 6–8 weeks; retain worksheets 3+ years.

Common Mistakes to Avoid When Filing Form 8810

PAL errors trigger 15% of corporate audits—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Misclassifying Activities (Part I) | Treating rentals as active. | Use Pub. 925; material participation tests. | Disallowed losses; $5,000 penalty. |

| Wrong CHC/PSC Status | Overlooking ownership. | Confirm >50% 5-person control (CHC). | Full disallowance. |

| Ignoring Prior Carryforwards (Part II) | Lost 2024 line 11. | Track annually; add to current. | Permanent loss. |

| PTP Errors | No special worksheet. | Use Instructions Worksheet 3 for publicly traded. | Suspended losses untouchable. |

| No Grouping Election | Separate rentals. | Attach statement for significant participation. | Fragmented losses. |

| Late Filing | Missing March 15. | Extend with 7004; pay estimate. | 5%/month penalty + interest. |

Amend with 1120X; audit-proof with participation logs.

IRS Form 8810 Download and Printable

Download and Print: IRS Form 8810

2025 Updates and Special Considerations for Form 8810

The 2025 instructions (Rev. Dec. 2024) confirm no form changes:

- Net Active Income: Total minus portfolio/rental (line 4).

- PSC Limit: 40% of net active (line 5).

- CHC Allowance: 100% offset.

- Cooperatives: Worksheet 5 for credit conversions (Form 3800).

- PTPs: Special rules; losses suspended until disposition.

- Grouping: Elect via statement; irrevocable.

- Carryforwards: Indefinite for unallowed PALs/credits.

For S-corps, shareholders compute personally; monitor TCJA sunset post-2025.

Final Thoughts: Navigate PALs with Form 8810 in 2025

IRS Form 8810 is indispensable for PSCs and CHCs, unlocking PALs against active income to optimize corporate taxes. For 2025, group wisely, track carryforwards, and file by March 15, 2026—potentially deducting $100K+ in suspended losses. With no updates, leverage prior-year data for accuracy.

Consult Pub. 925 or a CPA for groupings. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 8810

What corporations file Form 8810 in 2025?

PSCs (>95% services, 75% employee-owned) and CHCs (>50% 5-person ownership).

What is the PSC PAL limitation on Form 8810?

40% of net active income.

When is Form 8810 due for 2025?

With Form 1120 by March 15, 2026 (extendable).

Can S-corps use Form 8810?

No—shareholders use Form 8582.