Table of Contents

IRS Form 8814 – Parents’ Election to Report Child’s Interest and Dividends – As a parent juggling family finances and tax season, discovering your child’s modest investment income from a custodial account can add unexpected complexity. Enter IRS Form 8814, the “Parents’ Election to Report Child’s Interest and Dividends”—a streamlined option that lets you include your dependent’s unearned income on your tax return, sparing them (and you) from filing a separate return. If you’re searching for “Form 8814 instructions 2025,” “kiddie tax thresholds 2025,” or “how to report child’s dividends on parent’s return,” this SEO-optimized guide is your roadmap.

Drawing from the IRS’s draft 2025 instructions and Revenue Procedure 2024-40, we’ll cover eligibility, step-by-step filing, and inflation-adjusted updates like the new $1,350/$2,700 kiddie tax bands. With the April 15, 2026, deadline for 2025 returns looming, electing Form 8814 could simplify compliance while potentially optimizing your tax picture—though it might bump your AGI and phase out credits. Let’s make tax time less taxing.

What Is IRS Form 8814?

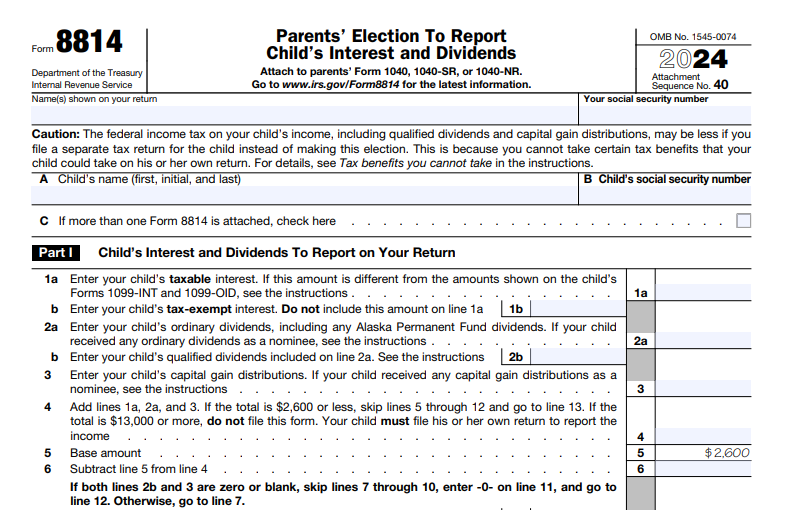

Form 8814 allows eligible parents to elect to report their child’s interest, ordinary dividends, and capital gain distributions directly on their Form 1040, 1040-SR, or 1040-NR. This avoids a separate child return and applies the kiddie tax rules, where unearned income above certain thresholds is taxed at the parent’s rate to prevent income-shifting loopholes.

Key mechanics:

- Unearned Income Focus: Covers only interest (Form 1099-INT), dividends (1099-DIV), and capital gains—no wages or self-employment.

- Kiddie Tax Integration: The first $1,350 (2025) is tax-free; the next $1,350 at the child’s rate; excess at yours (up to 37%).

- Election Per Child: File a separate Form 8814 for each qualifying child; revocable only with IRS consent.

For 2025, the form remains one-page with three parts: income summary, tax computation, and base tax allocation. It’s attached to your return and flows amounts to Schedule 1 (additional income) and Schedule D if needed. While convenient, it can increase your AGI, potentially reducing IRA deductions or child tax credits—run the numbers both ways.

Who Is Eligible to Use IRS Form 8814 in 2025?

Form 8814 is ideal for low unearned income scenarios, but strict criteria apply. You (the parent) must file Form 1040 series, and the child must meet age, income, and filing tests.

Eligible Children

| Criterion | 2025 Details | Notes |

|---|---|---|

| Age | Under 19 (or 24 if full-time student for 5+ months) at year-end | Considered 19/24 by Dec. 31; no election if child turns 19/24 mid-year without student status. |

| Income Type | Only interest/dividends/capital gains; no earned income | Exclude wages, tips, or self-employment. |

| Gross Unearned Income | >$1,350 but ≤$13,500 | Below $1,350: No filing needed; above $13,500: Child files own return. |

| Filing Requirement | Child would otherwise file due to income >$1,350 | No backup withholding or estimated payments in child’s name. |

Parent Qualifications: You must be unmarried or married filing jointly (use higher-income spouse’s return if separate). No election if child claims personal exemption on your return (pre-2018 rules).

Exclusions: Children with foreign trust distributions (file Schedule B, Part III) or backup withholding must file separately.

Recent Changes to IRS Form 8814 for Tax Year 2025

The IRS released the 2025 draft Form 8814 and instructions in late 2024, with inflation adjustments per Rev. Proc. 2024-40. No structural redesign, but key tweaks reflect rising thresholds and ongoing kiddie tax refinements:

- Inflation-Adjusted Thresholds: Standard deduction for unearned income rises to $1,350 (from $1,300 in 2024); kiddie tax threshold to $2,700 (from $2,600); election ceiling to $13,500 (10x base, from $13,000).

- Qualified Dividends Handling: Enhanced Line 2b instructions for box 1b on 1099-DIV; eligible for lower capital gains rates on parent’s return.

- AGI Impact Warning: Draft emphasizes potential reductions in IRA deductions, child credits, or estimated tax penalties due to added income.

- Underpayment Penalty Alert: If electing for 2025, increase withholding/estimates to cover added tax; up to $130 more liability possible vs. separate filing.

- No Major Legislative Shifts: Post-SECURE Act rules hold; trusts/estates rates reverted to parents’ in 2020.

Fiscal-year filers prorate; e-file preferred.

IRS Form 8814 Download and Printable

Download and print: IRS Form 8814

Step-by-Step Guide: How to Complete IRS Form 8814 for 2025

Use the 2025 draft form; attach one per child to your return. Gather 1099-INT/DIV/OID and verify no withholding. Based on draft instructions:

Part I: Child’s Interest and Dividends (Lines 1-4)

- Line 1a: Interest (1099-INT/OID box 1).

- Line 2a: Ordinary dividends (1099-DIV box 1a).

- Line 2b: Qualified dividends (box 1b).

- Line 3: Capital gain distributions (box 2a).

- Line 4: Total (≤$13,500; >$2,700? Skip to Line 13 if under threshold).

Example: Child has $800 interest + $600 dividends ($100 qualified) + $200 cap gains = $1,600 total (Line 4).

Part II: Tax Computation (Lines 5-12)

- Line 5: Subtract $1,350 (2025 standard deduction) from Line 4.

- Line 6: Taxable portion at child’s rate (≤$1,350; use 2025 tables, 10% for low income).

- Line 7: Multiply Line 6 by 10% (or child’s rate).

- Line 8: Remaining after child’s band ($2,700 total threshold).

- Line 9: Tax on Line 8 at parent’s rate (use Qualified Dividends Worksheet if applicable).

- Line 10: Add Lines 7 and 9.

- Line 11: Base tax allocation (pro-rata if multiple 8814s).

- Line 12: Subtract Line 11 from Line 10 (net tax).

Part III: Base Amount Tax (Line 13-15)

- Line 13: If Line 4 >$2,700, compute tax on $1,350 at child’s rate.

- Line 14: Tax on full Line 4 minus Line 13.

- Line 15: Include on Form 1040, Line 16 (check box 1); add to Schedule 1, Line 8z (“Form 8814”).

Capital Gains Note: Report Line 3 on Schedule D, Line 13 (dotted line: “Form 8814”).

Filing Tips

- Attach: To Form 1040; e-file via software.

- Deadlines: April 15, 2026; extend to October 15 (Form 4868, pay estimates).

- Records: Keep 1099s 3+ years.

Common Mistakes to Avoid When Filing Form 8814

Election errors can trigger audits or penalties—here’s a safeguard table:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Exceeding $13,500 Limit | Overlooking gross income cap | Verify total unearned ≤$13,500; child files if over. |

| Ignoring AGI Effects | Forgetting phaseouts | Recalculate IRA/child credits; consider separate filing. |

| Wrong Thresholds | Using 2024 numbers | Apply 2025: $1,350/$2,700/$13,500. |

| Withholding Oversight | Child had backup withholding | Child must file separately. |

| No Estimated Tax Adjustment | Added income triggers penalty | Increase withholding; see Pub. 505. |

Why Use Form 8814? Real-World Impact for 2025 Families

For a child with $2,000 in dividends, electing Form 8814 adds ~$65 tax (10% on $650 after $1,350 deduction) to your return—simpler than a child filing, but if your rate is 24%, it costs $130 more than separate. With 2025 thresholds up ~4%, more families qualify, per IRS estimates, saving time amid rising filings.

Final Thoughts: Simplify 2025 Taxes with Form 8814

IRS Form 8814 eases reporting for qualifying children’s unearned income, but weigh simplicity against AGI hikes. With 2025’s adjusted $1,350/$2,700 bands, verify eligibility early.

Download the draft from IRS.gov and consult a tax advisor for multi-child scenarios. Explore Pub. 929 for kiddie tax details. Questions on “child investment income 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your situation.