Table of Contents

IRS Form 8822-B – Change of Address or Responsible Party – Business – Businesses must keep the IRS informed of key changes to ensure smooth tax compliance. IRS Form 8822-B, titled Change of Address or Responsible Party — Business, allows entities with an Employer Identification Number (EIN) to report updates to their mailing address, business location, or responsible party.

Failing to update this information can lead to missed notices, delayed refunds, or compliance issues. This 2025 guide explains the form’s purpose, filing requirements, and step-by-step instructions based on official IRS guidelines.

What Is IRS Form 8822-B?

IRS Form 8822-B notifies the IRS of changes affecting business tax correspondence and accountability. Use it to report:

- A new business mailing address

- A new business location (physical address)

- A change in the identity of the “responsible party” (the individual who controls or manages the entity)

The form applies to any entity with an EIN, including corporations, partnerships, LLCs, nonprofits, estates, and trusts—whether actively operating or not.

Note: Do not confuse this with Form 8822, which is for individual or personal address changes. Businesses must use Form 8822-B specifically.

The current version is Revision December 2019, with no updates reported as of December 2025.

When Do You Need to File Form 8822-B?

File Form 8822-B whenever:

- Your business moves to a new mailing address or physical location

- The responsible party changes (e.g., new owner, principal officer, or fiduciary)

You must report responsible party changes within 60 days of the effective date.

While no strict deadline applies to address changes, update promptly to avoid disruptions in IRS communications. Processing typically takes 4-6 weeks.

Who Is the Responsible Party?

The responsible party is the individual who ultimately owns, controls, or exercises effective control over the entity and its assets. This must be a real person (with an SSN or ITIN), not another entity (except for government entities).

Examples include:

- President, CEO, or principal officer for corporations and tax-exempt organizations

- General partner for partnerships

- Grantor, owner, or trustor for trusts

- Fiduciary for estates

Nominees (temporary stand-ins with limited authority) should not be listed—correct any prior nominee listings using Form 8822-B.

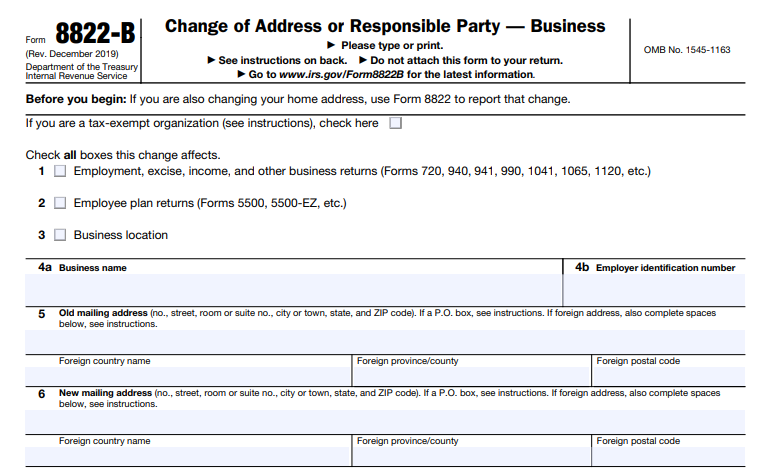

IRS Form 8822-B Download and Printable

Download and Print: IRS Form 8822-B

How to Fill Out IRS Form 8822-B: Step-by-Step

Download the latest Form 8822-B from the IRS website (irs.gov/pub/irs-pdf/f8822b.pdf).

- Check applicable boxes (top section): Indicate what the change affects (e.g., business returns, employee plan returns, business location).

- Lines 1-4: Enter your business name, EIN, old mailing address, and any prior name or EIN changes if applicable.

- Line 5: Old mailing address.

- Line 6: New mailing address (include foreign details if applicable).

- Line 7: New business location (if different from mailing address).

- Lines 8-9: New responsible party’s full name and SSN/ITIN (or EIN in limited cases—refer to Form SS-4 instructions).

- Line 10: Signature of an authorized person (officer, owner, partner, fiduciary) with title, date, and optional daytime phone number. Attach power of attorney (Form 2848) if signing as a representative.

The form must be signed under penalties of perjury. Unsigned forms will not be processed.

Where to Mail Form 8822-B

Mail the completed form based on your old business address location:

- Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, West Virginia, Wisconsin:Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999 - Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Tennessee, Texas, Utah, Washington, Wyoming, or outside the U.S.:Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

No electronic filing option exists—mail only.

Common Mistakes to Avoid When Filing Form 8822-B

- Using Form 8822 instead of 8822-B for business changes

- Forgetting to sign or date the form

- Reporting a nominee as the responsible party

- Mailing to the wrong IRS center

- Missing the 60-day deadline for responsible party updates

Keep a copy of the filed form and note the mailing date for your records.

Frequently Asked Questions About Form 8822-B

Is there a penalty for not filing Form 8822-B?

No direct penalty exists, but outdated information can cause missed notices, delayed processing, or compliance problems.

Can I file Form 8822-B online?

No, the IRS requires mailing the paper form.

Do I need to file if I’m also changing my personal address?

Use Form 8822 for personal changes in addition to 8822-B for business.

How do I know if the IRS processed my form?

The IRS does not send confirmation, but allow 4-6 weeks. If concerned, follow up by phone.

For the most current details, visit the official IRS page: irs.gov/forms-pubs/about-form-8822-b.

Keeping your IRS records accurate with Form 8822-B helps avoid unnecessary complications and ensures your business stays in good standing. File promptly when changes occur!