Table of Contents

IRS Form 8822 – Change of Address – Moving to a new home is exciting, but it comes with administrative tasks—including updating your address with the Internal Revenue Service (IRS). Failing to notify the IRS of a change can lead to delayed refunds, missed correspondence, or even penalties if important notices are sent to your old address. Enter IRS Form 8822, Change of Address: the official way to update your home mailing address for tax purposes.

In this comprehensive guide, we’ll cover everything you need to know about Form 8822, including who needs it, how to file it step-by-step, and tips for 2025 filers. Whether you’re relocating due to a job change, marriage, or divorce, this article will help you stay compliant and avoid common pitfalls. Let’s dive in.

What Is IRS Form 8822?

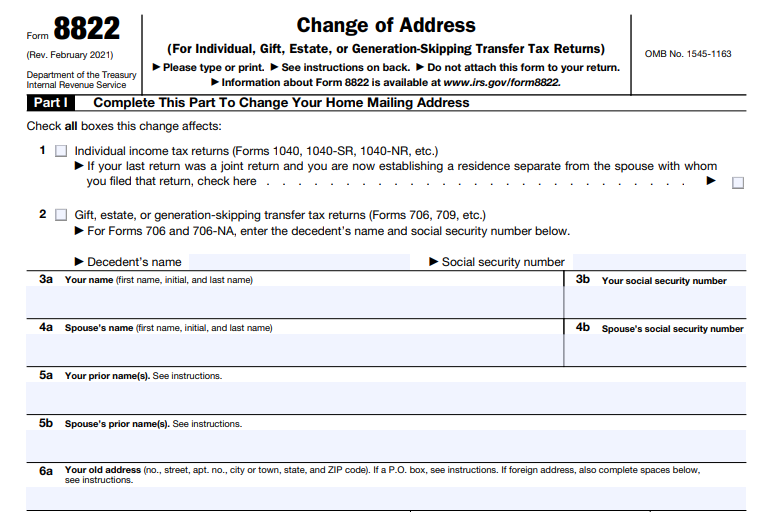

IRS Form 8822 is a simple one-page document used to notify the IRS of a change in your home mailing address. It’s specifically for individuals filing personal income tax returns (like Forms 1040 or 1040-NR), as well as those involved in gift, estate, or generation-skipping transfer tax returns (such as Forms 706 or 709).

The form ensures the IRS sends all future correspondence—refunds, notices, or audit letters—to your correct address. Note that Form 8822 is for personal (home) addresses only; businesses should use Form 8822-B for mailing or responsible party changes. The current version of Form 8822 was revised in February 2021, with no major updates reported for 2025.

Processing typically takes 4-6 weeks, so file promptly after your move.

Who Needs to File IRS Form 8822?

Not everyone who moves needs to file this form—especially if you’re updating your address directly on your next tax return. However, Form 8822 is essential in these scenarios:

- Individuals changing their home address: Anyone filing Forms 1040, 1040-SR, or 1040-NR.

- Spouses separating after a joint return: If you’re establishing a separate residence, check the box on Line 1 to indicate this.

- Filers of gift, estate, or generation-skipping transfers: Includes donors (Form 709) or executors (Form 706).

- Parents with dependent children: File a separate Form 8822 for each child’s address change if it affects their returns.

- Name changes due to marriage or divorce: Include prior names on Lines 5a or 5b to link records.

You don’t need to file if your address change is temporary (e.g., a short vacation) or if you’re only updating state/local tax authorities. Always notify the U.S. Postal Service (USPS) separately via their online forwarding service to avoid mail disruptions.

When Should You File Form 8822?

Timing is key to keeping your tax records current. File IRS Form 8822 as soon as possible after your move—ideally within 60 days—to minimize risks. Key triggers include:

- Post-move urgency: Submit immediately to ensure refunds or notices reach you.

- Before filing your next return: If you’ve already moved, use the form; otherwise, update on your return.

- Life events: Marriage, divorce, or death in the family often prompt address or name changes.

- No deadline, but proactive is best: Unlike tax returns, there’s no strict due date, but delays can cause issues during tax season.

For 2025, with tax filing deadlines approaching (e.g., April 15 for most individuals), early filing prevents bottlenecks.

IRS Form 8822 Download and Printable

Download and Print: IRS Form 8822

How to Complete IRS Form 8822: Step-by-Step Instructions

Filling out Form 8822 takes about 16 minutes and requires basic personal info. Download the PDF from IRS.gov and type or print clearly. Do not attach it to your tax return—mail it separately. Here’s a line-by-line breakdown:

Part I: Change of Home Mailing Address

- Check the boxes (Lines 1-2): Mark Line 1 for individual income taxes. For gift/estate taxes, mark Line 2 and enter the decedent’s name and SSN if applicable.

- Enter names and SSNs (Lines 3a-4b): Provide your full name, SSN, and spouse’s details if filing jointly.

- Prior names (Lines 5a-5b): List any previous names (e.g., maiden names) to avoid processing delays.

- Old address (Lines 6a-6b): Detail your previous address, including apt./suite numbers, city, state, ZIP. For P.O. boxes, use “C/O” if mail goes to a third party. Include foreign country, province, and postal code if outside the U.S.

- New address (Line 7): Same format as Line 6—be precise to prevent errors.

Part II: Signature

- Optional contact info: Add a daytime phone number.

- Sign and date: You (or executor/representative) must sign. Spouses sign if the last return was joint. Representatives need a power of attorney (e.g., Form 2848) and title.

Double-check for accuracy—errors can delay processing. If signing for someone else, attach proof of authority.

Where to Mail Your Completed Form 8822?

Mailing addresses vary by your old address and form type. Use the chart below for quick reference (based on 2025 guidelines):

| Old Address Location | Mailing Address |

|---|---|

| AL, AR, DE, GA, IL, IN, IA, KY, ME, MA, MN, MO, NH, NJ, NY, NC, OK, SC, TN, VT, VA, WI | Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0023 |

| FL, LA, MS, TX | Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0023 |

| AK, AZ, CA, CO, CT, DC, HI, ID, KS, MD, MI, MT, NE, NV, NM, ND, OH, OR, PA, RI, SD, UT, WA, WV, WY | Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0023 |

| Foreign countries, American Samoa, Puerto Rico (excluding income under IRC 933), APO/FPO, Forms 2555/2555-EZ/4563 filers, dual-status aliens, non-bona fide Guam/VI residents | Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0023 |

| Guam (bona fide residents) | Department of Revenue and Taxation, Government of Guam, P.O. Box 23607 GMF, GU 96921 |

| Virgin Islands (bona fide residents) | V.I. Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802 |

| Gift/Estate Returns (Line 2 checked) | Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999-0023 |

Send via certified mail for tracking.

Alternatives to Filing IRS Form 8822

While Form 8822 is the dedicated method, you have options:

- On your tax return: Enter the new address when e-filing or mailing your next return—it’s automatically updated.

- USPS notification: Handles mail forwarding but doesn’t update IRS records.

- Online tools: No direct e-file for Form 8822, but check IRS.gov for future digital options (none as of 2025).

- For businesses/responsible parties: Use Form 8822-B within 60 days of changes.

If you’re unsure, consult a tax professional.

Common Mistakes to Avoid When Filing Form 8822

- Attaching to returns: Always mail separately.

- Incomplete addresses: Omit apt. numbers or foreign details, causing returns.

- Forgetting spouses/children: File separate forms as needed.

- Name mismatches: Update prior names to link SSNs correctly.

- Ignoring USPS: Combine with forwarding to cover all bases.

Retain a copy for your records.

FAQs About IRS Form 8822

Does filing Form 8822 update my state tax address?

No—notify your state revenue department separately.

Can I e-file Form 8822?

Not yet; mail is required, but updates via returns are electronic.

What if I moved abroad?

Use the foreign address fields and mail to the Austin, TX center.

How long until the change takes effect?

4-6 weeks; continue checking old mail during this time.

Is there a fee to file Form 8822?

No—it’s free.

Final Thoughts: Stay Ahead of Your Tax Changes in 2025

Updating your address with IRS Form 8822 is a quick step that safeguards your financial health. With no major changes for 2025, the process remains straightforward, but accuracy is crucial. Download the form today from IRS.gov, complete it diligently, and mail it off. For personalized advice, visit a local IRS office or consult a CPA.

Ready to file? Head to IRS.gov/Form8822 for the latest resources. Your future self (and wallet) will thank you!