Table of Contents

IRS Form 8829 – Expenses for Business Use of Your Home – In today’s remote work revolution, where over 40% of U.S. workers now operate from home at least part-time, turning your living space into a tax-deductible office is a game-changer. IRS Form 8829, Expenses for Business Use of Your Home, empowers self-employed individuals, freelancers, and small business owners to claim a portion of rent, utilities, insurance, and depreciation—potentially saving thousands annually. For the 2025 tax year, the form remains unchanged in structure from 2024, but with the SALT deduction cap rising to $40,000 ($20,000 if married filing separately) and inflation adjustments influencing phaseouts, it’s prime time to optimize your home office setup.

This SEO-optimized guide, based on the official 2025 Instructions for Form 8829 (Rev. December 2024) and IRS Publication 587 (Business Use of Your Home), breaks down eligibility, methods, step-by-step completion, deadlines, and pitfalls. Whether you’re a gig economy creator in a spare bedroom or a consultant deducting mortgage interest, Form 8829 could unlock deductions up to your business’s gross income—without the simplified method’s $1,500 cap. Download the 2025 PDF from IRS.gov and transform your home into a profit center before the April 15, 2026, deadline.

What Is IRS Form 8829?

Form 8829 is a detailed worksheet for calculating the allowable business use of home deduction on Schedule C (Form 1040), Schedule F (Form 1040), or Schedule E (Form 1040), allocating indirect expenses like utilities and direct costs like repairs to your office space. It separates operating expenses from depreciation and casualty losses, ensuring compliance with the exclusive and regular use rules while carrying forward unallowed amounts indefinitely.

The multi-part form includes:

- Part I: Simplified method election (optional $5/sq ft up to 300 sq ft, max $1,500).

- Part II: Direct/indirect expenses calculation.

- Part III: Depreciation and basis.

- Part IV: Carryover of unallowed expenses.

- Part V: Total allowable deduction.

For 2025, instructions highlight the SALT cap increase to $40,000 (from $10,000), allowing fuller real estate tax deductions on Schedule A while using Form 8829 for business portions. Attach to Schedule C, line 30; no separate filing. The deduction is limited to your business’s gross income (minus non-home expenses), with excess carried forward.

Key Fact: Unlike employees (ineligible since 2018 TCJA), self-employed can deduct via Form 8829 or the simplified method—no recapture on sale if using actual expenses.

Who Must File Form 8829?

File Form 8829 if you’re self-employed and using the actual expense method for a qualifying home office—mandatory for detailed tracking, though the simplified method skips it entirely. Eligible filers include:

- Sole Proprietors/Schedule C: Freelancers, consultants with exclusive/regular home office use.

- Farmers/Schedule F: Those with a home-based ag business (worksheet in Pub. 587).

- Partners/Schedule E: Rental property managers using home for admin.

- Qualified Daycare Providers: Time-based allocation if not exclusive use.

Qualifying Use: Space used regularly/exclusively for business (principal place, client meetings, or inventory storage); or daycare with time proration.

Exceptions:

- Employees: No deduction (TCJA 2018–2025).

- Simplified Method Users: Enter directly on Schedule C, line 30 (up to $1,500).

- No Profit: Deduction limited to gross income; carryover allowed.

Choose methods yearly—actual for higher deductions if expenses exceed $1,500.

Actual vs. Simplified Method: Which Home Office Deduction Fits Your 2025 Setup?

Form 8829 is for actual expenses, but the simplified method offers ease—compare to decide. Here’s a breakdown:

| Feature | Actual Expense Method (Form 8829) | Simplified Method |

|---|---|---|

| Calculation | % of home (sq ft or rooms) × actual costs (mortgage, utilities, etc.) | $5 per sq ft (up to 300 sq ft = $1,500 max) |

| Eligible Expenses | Direct (repairs) + indirect (prorated rent, insurance, depreciation) | Flat rate; no depreciation or itemization |

| Recordkeeping | Receipts, measurements, basis for depreciation | Minimal; just sq ft and business % |

| Depreciation | Allowed; recapture on home sale | None; no recapture |

| Limit | Gross business income (carryover excess) | $1,500 absolute cap |

| Best For | High expenses/homeowners with equity | Low costs/renters or beginners |

| SALT Interaction | Business % of taxes deductible on Schedule A (up to $40,000 cap) | Full SALT on Schedule A unchanged |

Switch methods yearly; simplified avoids audits over depreciation.

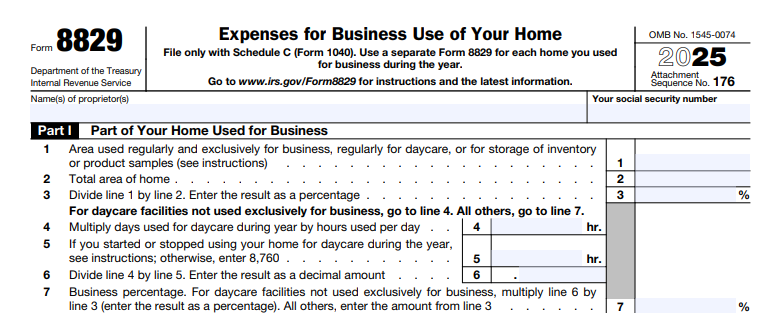

Step-by-Step Guide: How to Complete IRS Form 8829 for 2025

Use the 2025 Form 8829 (Rev. December 2024)—a 4-page PDF from IRS.gov; software like TurboTax auto-populates from inputs. Measure office sq ft; track expenses.

1. Part I: Simplified Method (Lines 1–5) – Optional

- Line 1: Sq ft used (≤300).

- Line 2: $5 × line 1 (≤$1,500).

- Line 3: Business % (if partial year).

- Line 4: Multiply lines 2–3.

- Line 5: Enter on Schedule C, line 30 if electing; skip to Part II otherwise.

2. Part II: Direct/Indirect Expenses (Lines 6–18)

- Line 6: Direct expenses (100% deductible, e.g., office repairs).

- Lines 7–18: Indirect (prorated): Mortgage interest, taxes (business % of total), utilities, insurance, etc.

- Business %: Sq ft office/total home or # rooms (fair comparison).

3. Part III: Depreciation (Lines 19–41)

- Line 19: Home basis (purchase + improvements – land value).

- Line 20–36: Adjusted basis for business use.

- Line 37–41: Depreciation % from tables (e.g., 2.461% for 39-year property placed in 2025); multiply for allowable.

4. Part IV: Carryover (Lines 42–43)

- Line 42: Prior unallowed from 2024 Form 8829, line 43.

- Line 43: Current unallowed (total expenses – income limit).

5. Part V: Total Deduction (Lines 44–35)

- Sum allowable; enter on Schedule C, line 30 (limited to business income).

Pro Tip: Use Pub. 587 worksheet for daycare time allocation; track sq ft annually.

Deadlines and How to File Form 8829 for 2025

Attach to Schedule C/F/E with your 2025 Form 1040—due April 15, 2026 (extendable to October 15 via Form 4868). E-file (90%+ returns) or paper mail to IRS center.

- Simplified Method: No form—direct to Schedule C.

- Amended: Use 1040-X within 3 years for missed deductions.

- Depreciation Deadline: Placed-in-service by December 31, 2025.

Refunds in 21 days e-file; retain records (receipts, measurements) 3+ years.

Common Mistakes to Avoid When Filing Form 8829

Audit triggers often stem from poor records—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Non-Qualifying Space | Mixed personal/business use. | Ensure exclusive/regular; photo/document. | Full disallowance; $5,000 penalty. |

| Wrong Business % | Inaccurate sq ft/rooms. | Measure precisely; use fair room method. | Under/over deduction; audit. |

| Depreciation Errors (Part III) | Wrong basis/table. | Exclude land; use MACRS 39-year. | Recapture on sale; interest. |

| Income Limit Ignore | Deducting >gross income. | Cap at income; carryover excess. | IRS adjustment; negligence penalty. |

| SALT Double-Dip | Full taxes on Schedule A. | Prorate business % to Form 8829. | Over-deduction; repayment. |

| No Carryover (Part IV) | Forgetting prior unallowed. | Track line 43 annually. | Lost deductions. |

Amend with 1040-X; audit-proof with logs.

IRS Form 8829 Download and Printable

Download and Print: IRS Form 8829

2025 Updates and Special Considerations for Form 8829

The 2025 instructions (Rev. Dec. 2024) reflect TCJA extensions:

- SALT Cap: $40,000 ($20,000 MFS; phaseout >$500K MAGI)—prorate business taxes.

- Simplified Max: $1,500 (300 sq ft × $5); no depreciation.

- Depreciation: MACRS 39-year residential; Pub. 946 tables.

- Carryover: Indefinite for unallowed operating/depreciation.

- Daycare: Time % if non-exclusive; Pub. 587 worksheet.

- Renters: Full prorated rent; no basis issues.

Post-2025 TCJA sunset may reinstate employee deductions—monitor.

Final Thoughts: Deduct Smarter with Form 8829 in 2025

IRS Form 8829 unlocks the full power of home office deductions for self-employed pros, prorating costs to fuel your business without the simplified method’s limits. For 2025, measure accurately, track expenses, and file by April 15, 2026—potentially deducting $5,000+ while carrying over more. With SALT cap relief to $40,000, itemize boldly.

Consult Pub. 587 or a CPA for daycare/depreciation. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS resources.

FAQs About IRS Form 8829

What is the simplified method limit for Form 8829 in 2025?

$1,500 max ($5/sq ft up to 300 sq ft); skips the form.

Can renters use Form 8829 for home office?

Yes—prorate rent as indirect expense.

What is the business income limit for Form 8829 deductions?

Capped at gross income from business; excess carries forward.

Does Form 8829 require depreciation?

Only for actual method; simplified avoids it.