Table of Contents

IRS Form 8840 – Closer Connection Exception Statement for Aliens – Navigating U.S. tax residency as a non-U.S. citizen can be complex, especially if you’re spending significant time in the United States. If you’re an alien individual who meets the substantial presence test but wants to maintain nonresident status, IRS Form 8840—the Closer Connection Exception Statement for Aliens—is your key tool. This form allows you to claim an exception by proving a stronger tie to a foreign country (or two) than to the U.S., potentially avoiding U.S. tax on worldwide income.

In this SEO-optimized 2025 guide, we’ll cover everything from Form 8840 eligibility and substantial presence test basics to step-by-step filing instructions, deadlines, and common pitfalls. Whether you’re searching for “IRS Form 8840 instructions 2025,” “closer connection exception requirements,” or “how to file Form 8840,” this article draws directly from official IRS resources to help you stay compliant and minimize your tax burden.

What Is IRS Form 8840?

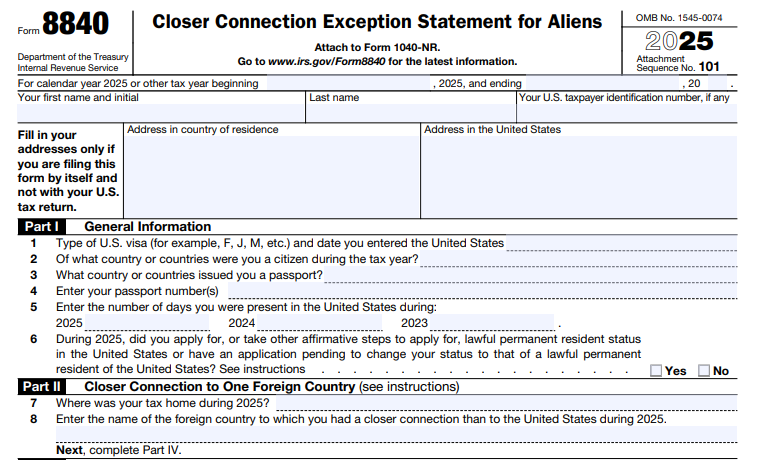

Form 8840 is a one-page IRS statement that alien individuals use to claim the closer connection exception to the substantial presence test under Internal Revenue Code (IRC) Section 7701(b). This exception treats you as a nonresident alien for U.S. tax purposes, even if your U.S. presence might otherwise classify you as a resident.

The form requires you to provide general information about your U.S. presence, tax home, and significant personal/economic contacts with foreign countries. It’s not a tax return but an attachment or standalone filing that supports your nonresident claim. For 2025, the form was revised on April 28, 2025, with updates mainly to the header for the tax year.

Key benefit: Claiming this exception means you’re taxed only on U.S.-source income, not your global earnings, and you may qualify for treaty benefits.

Understanding the Substantial Presence Test

Before diving into Form 8840, grasp the substantial presence test, which determines U.S. tax residency based on days spent in the country:

- You meet the test if present in the U.S. for at least 31 days in the current year (2025) and 183 days over a 3-year weighted period:

- All days in 2025.

- 1/3 of days in 2024.

- 1/6 of days in 2023.

Certain days don’t count, like transit days (<24 hours), medical condition days, or time as an exempt individual (e.g., student, teacher). If exempt, file Form 8843 instead.

If you pass this test but have a closer foreign connection, Form 8840 lets you opt out of resident status.

Who Must File IRS Form 8840 in 2025?

You must file Form 8840 if you’re an alien individual who:

- Meets the substantial presence test for 2025.

- Was present in the U.S. for fewer than 183 days during 2025 (a prerequisite for the exception).

- Had a tax home in a foreign country for the entire year (your main place of business, employment, or residence if no business).

- Has a closer connection to one foreign country (or two under specific rules) than to the U.S.

- Did not apply for, take steps toward, or have a pending application for U.S. lawful permanent resident (green card) status.

Each eligible individual files a separate form—no joint filings.

Closer Connection to One Foreign Country

To qualify:

- Tax home in one foreign country all year.

- More significant contacts with that country than the U.S. (detailed in Part IV of the form).

Closer Connection to Two Foreign Countries

Stricter rules apply:

- Tax home in Country A on January 1, 2025.

- Switched to Country B during 2025, maintaining it for the rest of the year.

- Closer connection to each country during its respective period.

- Taxed as a resident in at least one country for the full year (or both for their periods).

You cannot claim the exception if your tax home was ever in the U.S. or if you pursued permanent residency (e.g., filed Form I-485).

Even if ineligible for this exception, you might claim nonresident status via a tax treaty—file Form 8833 with Form 1040-NR.

Establishing a Closer Connection: Significant Contacts

The IRS evaluates your closer connection based on facts and circumstances, focusing on where you maintain more ties. Part IV of Form 8840 lists 17 factors, such as:

- Location of your permanent home (available year-round).

- Where your family lives.

- Personal belongings (cars, furniture, jewelry).

- Bank accounts, business activities, driver’s license, voting registration.

- Country of residence on official forms (e.g., W-8BEN vs. W-9).

- Source of income and investments.

- Health insurance provider.

List U.S. contacts honestly, but emphasize foreign ones to show the balance tips abroad.

When Is Form 8840 Due for Tax Year 2025?

Timely filing is critical—late submissions disqualify the exception unless you prove reasonable cause with clear evidence.

- If Filing a U.S. Tax Return: Attach Form 8840 to your Form 1040-NR (U.S. Nonresident Alien Income Tax Return). Due June 17, 2026 (for non-wage earners; April 15 for wage earners), including extensions up to October 15, 2026.

- If No Tax Return Required: Mail standalone Form 8840 by the same Form 1040-NR due date (June 17, 2026, or extended).

Penalties for non-filing: Loss of the exception, potentially making you a U.S. resident subject to worldwide taxation.

IRS Form 8840 Download and Printable

Download and Print: IRS Form 8840

How to Complete and File Form 8840: Step-by-Step Guide

The IRS estimates 2 hours to complete Form 8840. Download the 2025 PDF from IRS.gov. Use black ink for paper; e-filing isn’t available—it’s paper-only.

Step 1: Gather Documents

- Passport, visa details, days-count logs.

- Proof of foreign ties (e.g., foreign tax returns, bank statements).

Step 2: Fill Out the Form

- Header: Name, SSN/ITIN (if any), addresses.

- Part I: General Information

- Line 1: Visa type/date entered (or VWP details).

- Lines 2–4: Citizenship, passport countries/numbers.

- Line 5: U.S. presence days (2023–2025).

- Line 6: Confirm no green card pursuit (ineligible if yes).

- Part II: One Foreign Country

- Line 7: Tax home location.

- Line 8: Country of closer connection.

- Part III: Two Foreign Countries (complete instead of Part II if applicable)

- Lines 9–10: Tax home locations and switch date.

- Lines 11–13: Confirm closer connections and foreign tax residency; attach proofs/explanations.

- Part IV: Significant Contacts

- Lines 14–30: Detail foreign vs. U.S. ties (e.g., home address, family location, income sources). Attach extra sheets if needed.

- Signature: Only if filing standalone; declare under perjury.

Step 3: Submit

- With return: Attach to Form 1040-NR and mail per its instructions.

- Standalone: Send to Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215.

Pro Tip: Keep copies and proofs—IRS may request verification.

Common Mistakes and Penalties for Form 8840

Avoid these pitfalls:

- Forgetting to count weighted days correctly.

- Claiming without <183 U.S. days in 2025.

- Incomplete Part IV (must show foreign ties outweigh U.S. ones).

No direct monetary penalties, but failure to file timely revokes the exception, leading to resident status and back taxes/interest.

Recent Updates to IRS Form 8840 for 2025

The 2025 form (Rev. April 2025) includes no major changes from 2024, but clarifies tax home definitions and two-country rules. It aligns with ongoing IRS emphasis on international compliance. Check IRS.gov for any post-release notices.

Frequently Asked Questions (FAQs) About IRS Form 8840

1. Do I need Form 8840 if I’m under a tax treaty?

No—for treaty-based nonresidency, use Form 8833. Form 8840 is for the substantial presence exception only.

2. What if I have no ITIN?

You can file without one, but get an ITIN if needed for refunds or future filings via Form W-7.

3. Can spouses file together?

No—separate forms required.

4. How do I count U.S. presence days?

Use the 3-year formula; exclude transit, medical, or exempt days.

5. Where do I download the 2025 Form 8840?

From IRS.gov/pub/irs-pdf/f8840.pdf.

For tailored advice, consult a tax professional. Proper filing keeps your nonresident status intact—don’t miss out!

Last updated: December 2025. Sources: IRS.gov official publications.