Table of Contents

IRS Form 8843 – Statement for Exempt Individuals and Individuals With a Medical Condition – For nonresident aliens navigating U.S. tax residency rules, maintaining exempt status can mean the difference between filing a simple informational form and facing full U.S. taxation. IRS Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition, is the essential tool to exclude days of physical presence in the United States from the substantial presence test, helping F-1, J-1, M-1, Q-1 visa holders (and their dependents) avoid unintended residency. As the IRS updated the form in January 2025 for tax year 2024 (applicable to 2025 filings), with no major structural changes but clarified instructions on visa extensions and medical exceptions, timely submission remains crucial to preserve nonresident status and potential treaty benefits.

This SEO-optimized guide, based on the official 2025 Form 8843 (Rev. October 2024) and IRS Publication 519 (U.S. Tax Guide for Aliens), covers the form’s purpose, eligibility, step-by-step completion, deadlines, and common pitfalls. Whether you’re an international student on F-1 status wrapping up your degree or a J-1 scholar extending your program, Form 8843 ensures your U.S. days don’t trigger residency—yet only 60% of eligible filers submit it on time, risking audits or visa complications. Download the latest PDF from IRS.gov and file by June 15, 2026, for peace of mind.

What Is IRS Form 8843?

Form 8843 is an informational statement (not a tax return) that nonresident aliens use to document and exclude days of presence in the U.S. from the substantial presence test, which deems you a resident if present 183+ days over three years (weighted formula). It applies to “exempt individuals” like students, teachers, trainees, or those with medical conditions preventing departure, allowing you to maintain nonresident status for tax purposes.

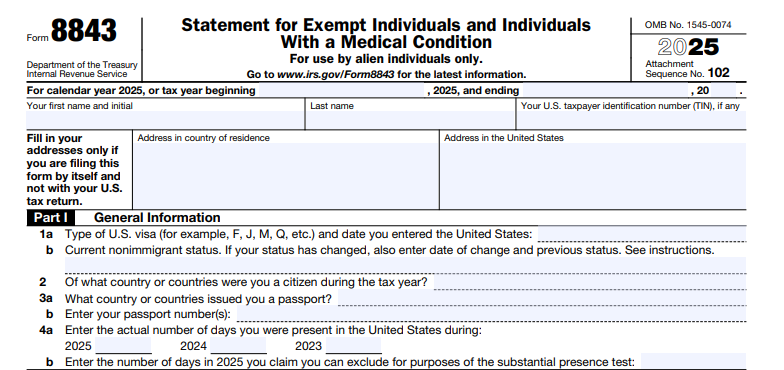

The two-page form includes:

- Part I: General information and visa details.

- Part II: Exempt individual specifics (e.g., student/trainee days).

- Part III: Medical condition exclusions (attach doctor’s statement).

- Part IV: Signature under perjury.

For 2025 filings (covering 2024 presence, but form dated 2025), instructions emphasize attaching Form I-797 for status changes and providing facts for permanent residency intent (line 12). If no U.S. income, file standalone; otherwise, attach to Form 1040-NR. Failure to file may disqualify exclusions, potentially making you a U.S. tax resident liable for worldwide income.

Key Fact: Form 8843 doesn’t report income—it’s purely for presence exclusion; pair with Form 8840 for closer connection if needed.

Who Must File Form 8843?

All nonresident aliens present in the U.S. under F, J, M, or Q visas (and their F-2/J-2/M-2/Q-3 dependents) must file Form 8843 if they seek to exclude any days of presence, regardless of income. This includes:

- Students (F-1/F-2, M-1/M-2, Q-1/Q-2): Exclude up to 5 calendar years (exception for 2 of prior 6 if teacher/trainee).

- Teachers/Trainees (J-1): Up to 2 years (exception for prior student status).

- Professional Athletes: Days competing in charitable events.

- Medical Cases: Days unable to leave due to unforeseen condition (attach physician statement).

Threshold: Any U.S. presence in 2025; file even with zero income.

Exceptions:

- U.S. residents for tax purposes (green card or substantial presence without exclusions).

- No presence in 2025.

- Dependents under 14 who can’t sign: Parent/guardian signs (attach statement).

Mail individually; no e-file for standalone 8843.

Step-by-Step Guide: How to Complete IRS Form 8843 for 2025

The 2025 Form 8843 (Rev. October 2024) is a two-page PDF—download from IRS.gov and complete by hand or digitally (no e-signature for standalone). Use black ink; attach statements as needed.

1. Part I: General Information (Lines 1–5)

- Line 1a: Name (full legal).

- Line 1b: U.S. address (if any; foreign OK).

- Line 1c: Identifying number (SSN/ITIN; none required if no income).

- Line 2: Foreign address.

- Line 3: Country of citizenship.

- Line 4: Days present in 2025 (total U.S. days).

2. Line 5: Visa Type

- Enter F, J, M, or Q; check if exempt (student/teacher/trainee/professional athlete/medical).

3. Part II: Exempt Individual (Lines 6–15)

- Students (Lines 6a–6c): Academic institution name/address/phone; visa type/dates; exclude up to 5 years.

- Teachers/Trainees (Lines 8a–8c): Institution/program director details; up to 2 years.

- Professional Athletes (Line 9): Charitable event name/dates.

- Line 10: Total excluded days (sum above).

4. Part III: Medical Condition (Lines 16–18)

- Line 16a: Describe condition/problem.

- Line 16b: Date unable to leave.

- Line 17: Physician name/address/signature certifying unforeseen complication.

- Line 18: Excluded days (attach statement).

5. Part IV: Signature (Lines 19–21)

- Sign/date under perjury; preparer info if applicable.

Pro Tip: For extensions (e.g., OPT), attach I-797; if changing status, explain on attached statement.

Deadlines and How to File Form 8843 for 2025

File by June 15, 2026, for standalone (no income); otherwise, with your 1040-NR by April 15, 2026 (extendable to June 15 abroad). Mail to Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215—no e-file for standalone.

- With Return: Attach to 1040-NR; e-file if possible.

- No Income: Standalone by June 15; certified mail for proof.

- Prior Years: File late if missed; no penalty but preserves status.

Retain copies 3 years; no IRS confirmation—track mailing.

Common Mistakes to Avoid When Filing Form 8843

Non-filing risks residency deeming—here’s a table of errors:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Missing Days (Line 4) | Underreporting presence. | Count all U.S. days; include transit. | Residency trigger; worldwide tax. |

| Wrong Visa (Line 5) | Confusing F/J. | Verify I-94; explain changes. | Exclusion denial. |

| No Physician Statement (Part III) | Medical without attach. | Get signed note; describe unforeseen. | Days not excluded. |

| Group Filing | Mailing multiples together. | Separate envelopes per person. | Processing failure. |

| Late Standalone | Missing June 15. | Mail by deadline; certified proof. | Status complications; visa issues. |

| Intent Statement (Line 12) | No facts for “No” permanent residency. | Attach home ties (job/family abroad). | Residency presumption. |

File late for prior years; no penalty but retroactive status risk.

IRS Form 8843 Download and Printable

Download and Print: IRS Form 8843

2025 Updates and Special Considerations for Form 8843

The 2025 Form 8843 (Rev. October 2024) is unchanged structurally:

- OMB No.: 1545-0074; Cat. No. 17227H.

- Visa Extensions: Attach I-797 for OPT/AT changes.

- Medical Exception: Unforeseen complications only; physician certifies no pre-existing.

- Student Limit: 5 years (exception if prior teacher/trainee).

- Teacher/Trainee: 2 years; no overlap with student.

- Dependents: Separate forms; parent signs for minors.

- No SSN/ITIN Needed: If no income; otherwise, include.

For dual-status, attach to 1040-NR; states may not follow federal exclusions.

Final Thoughts: Secure Your Nonresident Status with Form 8843 in 2025

IRS Form 8843 is a low-effort safeguard for exempt nonresidents, excluding U.S. presence days to avoid residency traps. For 2025, file by June 15, 2026 (standalone), attach to 1040-NR if income, and mail separately per person—preserving treaty benefits and visa paths. With no income requirement, it’s a must for F/J/M/Q holders.

Consult Pub. 519 or a tax advisor for status changes. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 8843

Who must file Form 8843 in 2025?

Nonresident aliens on F, J, M, or Q visas (and dependents) present any day in 2025, to exclude presence.

What is the deadline for standalone Form 8843 in 2025?

June 15, 2026; with 1040-NR by April 15, 2026.

Do I need an SSN/ITIN for Form 8843?

No, if no income; yes if filing a return.

Can dependents file Form 8843?

Yes—separate form; parent signs for under 14.