Table of Contents

IRS Form 8846 – Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips – In the hospitality industry, where tips form a cornerstone of employee compensation, employers face unique tax challenges. IRS Form 8846, “Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips,” provides a vital relief valve: a nonrefundable tax credit for the employer’s share of FICA taxes on tips exceeding the federal minimum wage. For the 2025 tax year, with the Social Security wage base rising to $176,100 and no structural changes to the form under the One Big Beautiful Bill Act (OBBBA), this credit—capped at 7.65% of qualified tips—can save qualifying food and beverage establishments thousands in liabilities.

This SEO-optimized guide, informed by the latest IRS draft and official resources, equips restaurant owners, bar managers, and hospitality pros with everything needed to claim the credit on returns due in 2026. From eligibility to step-by-step filing, discover how Form 8846 integrates with Form 3800 to offset payroll costs. Download the draft 2025 Form 8846 from IRS.gov to align with your March 15, 2026, deadline (for calendar-year filers).

What Is IRS Form 8846?

IRS Form 8846 allows eligible employers to calculate and claim a credit for their portion of Social Security (6.2%) and Medicare (1.45%) taxes—totaling 7.65%—paid on employee tips that exceed the amount needed to meet the federal minimum wage ($7.25/hour). Enacted under IRC Section 45B, the credit applies only to “excess tips” in customary tipping businesses like restaurants and bars, where tips are reported via Form 4070 or W-2 Box 7.

Key highlights for 2025:

- Nonrefundable Nature: Reduces tax liability but doesn’t generate refunds; excess carries back one year or forward 20.

- Integration: Flows to Form 3800 (General Business Credit), Part III, line 4f.

- Qualified Tips: Cash, credit card, or shared tips from food/beverage services; excludes non-qualified (e.g., service charges).

- No Cap on Credit: But limited to actual FICA paid on excess tips.

Partnerships/S corps report on Schedule K; others attach to their business return. The draft 2025 form (Rev. Oct. 2025) remains unchanged from 2024, with updated wage base references.

Who Qualifies for the IRS Form 8846 Credit in 2025?

To claim the credit, your business must meet strict criteria under Section 45B:

- Trade or Business: Food or beverage establishments where tipping is customary (e.g., restaurants, bars, hotels with dining services).

- Employee Tips: Tips received by employees in connection with providing food/beverages for on-premises consumption.

- Minimum Wage Test: Credit only for tips exceeding wages needed to reach $7.25/hour (or state minimum if higher, but federal used for computation).

- Reporting Compliance: Employees must report tips to you; you allocate and report on W-2s.

- No High-Wage Exclusion: If any employee’s total wages + tips exceed $176,100 (2025 SS wage base), prorate the credit accordingly.

| Qualification Factor | 2025 Requirement | Notes |

|---|---|---|

| Business Type | Food/beverage with customary tipping | Excludes delivery-only or non-service tips |

| Tip Excess | Tips > minimum wage offset | $7.25/hr federal; compute hours × rate |

| Wage Base | Up to $176,100 per employee | Prorate if exceeded; Medicare unlimited |

| Filer Type | Businesses (not individuals) | Partnerships/S corps: Schedule K |

Exemptions: No credit for unreported tips or non-qualified businesses. Controlled groups aggregate employees. Recent OBBBA guidance confirms no changes to tip reporting on W-2 for 2025.

IRS Form 8846 Download and Printable

Download and Print: IRS Form 8846

How the Credit Works: Calculating Excess Tips for 2025

The credit equals 7.65% of excess tips, where excess = total qualified tips minus the “tip offset” (wages needed to reach minimum wage). For 2025:

- Social Security: 6.2% on tips up to $176,100 (employee + employer total 12.4%).

- Medicare: 1.45% on all tips (no limit; total 2.9%).

- Additional Medicare: 0.9% on wages/tips >$200,000 (employer doesn’t match, so no credit).

Formula:

- Total qualified tips (reported + allocated).

- Subtract offset: Hours worked × $7.25 (or applicable rate).

- Multiply excess by 7.65% (employer share).

Example: An employee works 2,000 hours, earns $5,000 base wages, and receives $10,000 tips. Offset: 2,000 × $7.25 = $14,500. Excess needed: $14,500 – $5,000 = $9,500. But tips $10,000 > $9,500, so excess = $500. Credit: $500 × 7.65% = $38.25.

If wages + tips >$176,100, reduce credit proportionally. Track via payroll software; retain Forms 4070 for audits.

Key Changes to IRS Form 8846 for 2025

The 2025 draft form is stable, with minor updates:

- Wage Base Adjustment: References $176,100 (up from $168,600 in 2024); affects proration on line 4.

- OBBBA Impact: No changes to tip credits or W-2 reporting; focuses on employee deductions for tips/overtime (Notice 2025-69), but employer credit unchanged.

- Filing Enhancements: E-file integration with Form 3800; no new lines.

Per IRS Rev. Proc. 2024-40, inflation drives the wage base hike, potentially increasing credit for high-tip employees below the cap. No phaseouts or rate shifts.

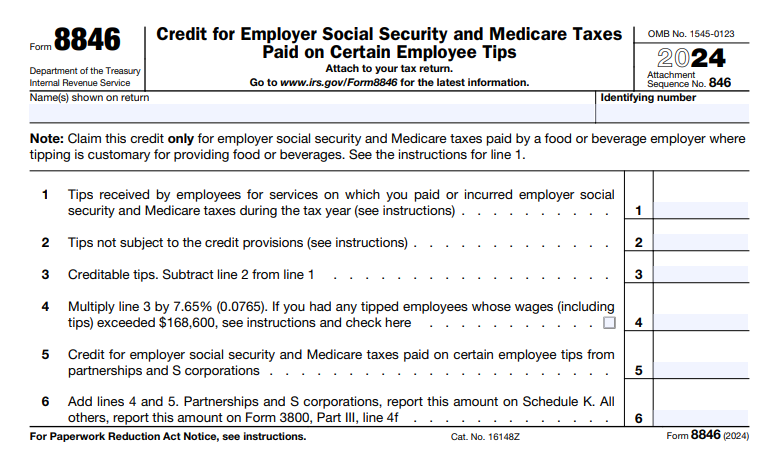

How to Complete IRS Form 8846: Step-by-Step Guide for 2025

Gather W-2 data, tip reports, and payroll records. Use the draft form; tax software like QuickBooks automates.

Part I: Current Year Credit (Lines 1–6)

- Line 1: Total tips received by employees (from W-2 Box 7 or Forms 4070).

- Line 2: Multiply line 1 by 0.0765 (7.65%).

- Line 3: Offset tips (total hours × $7.25; attach worksheet).

- Line 4: Excess tips (line 1 – 3, or 0 if negative). Check box if any employee exceeded $176,100—prorate.

- Line 5: Credit from partnerships/S corps (Schedule K-1).

- Line 6: Total credit (lines 4 × 0.0765 + 5); report on Form 3800.

Part II: Carryforward (If Applicable)

- Line 7: Prior-year unused credit.

- Line 8: Carryback to prior year (Form 3800 instructions).

Attach to your return (e.g., Form 1120, Schedule C). File by your business return due date; amend via Form 8846 with original.

Tip: Use IRS Worksheet in instructions for multi-employee allocation.

Common Mistakes to Avoid When Filing Form 8846

- Understating Excess Tips: Forgetting to subtract only the minimum wage offset—overclaims trigger audits.

- Wage Base Oversight: Not prorating for employees >$176,100; IRS cross-checks W-2s.

- Unreported Tips: Credit only for reported/allocated tips; cash tips must be documented.

- Wrong Rate: Using employee share (7.65% is employer only).

- Missing Attachments: No worksheet for line 3—penalties up to 20% for substantial understatements.

Review Pub. 531 for tip rules; retain records 3+ years.

Tips for Maximizing Your 2025 Tip Credit with IRS Form 8846

- Track Tips Diligently: Implement digital tip jars or apps for accurate reporting; train staff on Form 4070.

- Leverage Software: Integrate with payroll systems for auto-calculation; TurboTax Business handles Form 3800 flow-through.

- Combine Credits: Pair with FICA tip credit on state returns; explore OBBBA overtime deductions for employees.

- Audit-Proof Documentation: Maintain hour logs, tip sheets; allocate shared tips fairly.

- Consult a Pro: CPAs spot controlled group issues; ideal for chains.

- Plan for Growth: Credit shrinks if tips push wages over $176,100—monitor high earners.

Averaging $500–$2,000 per location, this credit boosts retention in tip-heavy industries.

Final Thoughts: Unlock Tax Savings for Your Tipped Workforce with IRS Form 8846 in 2025

IRS Form 8846 isn’t just compliance—it’s a strategic tool for hospitality employers to recoup FICA costs on tips, easing the burden of minimum wage compliance amid 2025’s wage base hike. By accurately calculating excess tips and filing with Form 3800, you can enhance profitability while supporting tipped staff.

For the official draft 2025 Form 8846 and instructions, visit IRS.gov/Form8846. High-volume tip operations? A tax advisor can optimize claims. Start reviewing your 2025 tip data today for a stronger 2026 return.