Table of Contents

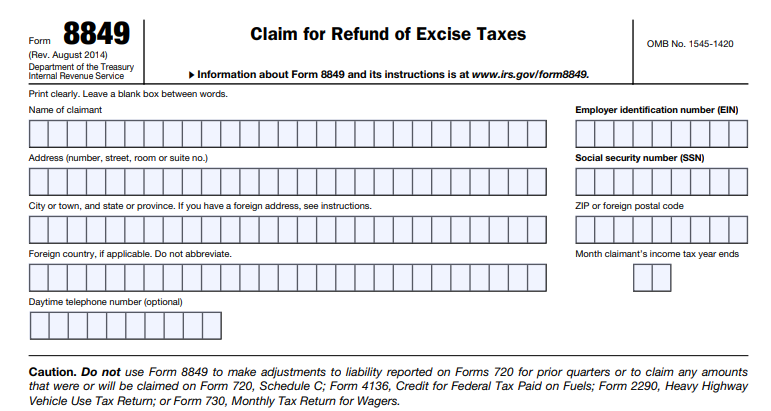

IRS Form 8849 – Claim for Refund of Excise Taxes – is an essential IRS form that allows eligible taxpayers to request refunds for certain federal excise taxes paid, primarily related to fuels but also extending to other excise categories. This form helps businesses, vendors, purchasers, and other entities recover overpaid or refundable excise taxes on items like gasoline, diesel, kerosene, alternative fuels, and more, often for nontaxable uses, exemptions, or duplicate payments.

The form is particularly relevant for those in transportation, farming, aviation, government, nonprofit sectors, or fuel-related industries where excise taxes apply but specific uses qualify for relief.

Who Can File Form 8849?

Form 8849 is available to various parties who have paid excise taxes and meet IRS criteria for a refund. Common filers include:

- Ultimate purchasers of fuels (e.g., businesses or individuals using gasoline, diesel, kerosene, aviation fuel, or liquefied petroleum gas (LPG) for nontaxable purposes).

- Registered ultimate vendors selling undyed diesel fuel, undyed kerosene, aviation kerosene, gasoline, or aviation gasoline to exempt buyers.

- Producers, sellers, or users of biodiesel mixtures, renewable diesel mixtures, or alternative fuels claiming credits.

- Persons paying a duplicate section 4081 tax on taxable fuel (where a prior tax was also paid and reported).

- Registered credit card issuers for certain sales to state/local governments or nonprofit educational organizations.

- Other taxpayers claiming refunds for excise taxes reported on forms like Form 720 (Quarterly Federal Excise Tax Return), Form 2290 (Heavy Highway Vehicle Use Tax), Form 730 (Monthly Tax Return for Wagers), or Form 11-C.

Nonprofit organizations (e.g., schools, colleges, or government entities) may qualify for refunds on fuels used for exempt purposes. Note: Form 8849 is not for adjusting prior excise tax liabilities (use Form 720-X instead) or claiming credits already reported on other forms like Form 4136 or Form 2290.

Key Schedules on Form 8849

Form 8849 itself serves as the main claim document, but you attach one or more specific schedules depending on your claim type. Only attach schedules for which you’re claiming a refund—multiple schedules may require separate Forms 8849 in some cases (e.g., Schedules 2, 3, 5, and 8 cannot be combined with others).

- Schedule 1 (Nontaxable Use of Fuels): For ultimate purchasers claiming refunds on gasoline, gasohol, aviation gasoline, diesel fuel, kerosene, aviation fuel (non-gasoline), and LPG used in nontaxable ways (e.g., off-highway, farming, export).

- Schedule 2 (Sales by Registered Ultimate Vendors): For registered vendors claiming refunds on sales of undyed diesel/kerosene, aviation kerosene, gasoline, or aviation gasoline to exempt users.

- Schedule 3 (Certain Fuel Mixtures and the Alternative Fuel Credit): For claims related to biodiesel/renewable diesel mixtures and alternative fuel credits/sales/uses. (Use the January 2023 revision for any allowable 2024 claims through April 11, 2025; check IRS for 2025 updates.)

- Schedule 5 (Section 4081(e) Claims): For refunds of a second (duplicate) section 4081 tax paid on the same taxable fuel.

- Schedule 6 (Other Claims): Catch-all for refunds not covered by other schedules, including overpayments or refunds from Forms 720, 2290, 730, or 11-C (e.g., vehicle destroyed, stolen, sold, or low-mileage scenarios for heavy highway vehicle tax).

- Schedule 8 (Registered Credit Card Issuers): For registered credit card issuers claiming refunds on certain taxable fuel sales to governments or nonprofits.

Each schedule requires details like the claim period, gallons involved, tax rate, type of use (from a table on the form), and refund amount.

How to File Form 8849

- Gather Information: Provide your name, EIN (or SSN if applicable), address, income tax year-end month, and daytime phone (optional). Sign under penalties of perjury, confirming no duplicate claims.

- Complete Schedules: Attach only relevant ones with supporting details. Use separate Forms 8849 for incompatible schedules.

- Filing Methods:

- Paper: Mail to IRS addresses based on schedules (e.g., Cincinnati, OH for Schedules 1/6; Covington, KY for others). Use U.S. Postal Service for P.O. boxes.

- Electronic: Optional e-filing available through IRS-approved Modernized e-File (MeF) providers for Schedules 1, 2, 3, 5, 6, and 8. Check with providers for availability and fees.

- Deadlines: Generally, file within 3 years from the taxable year for certain claims (e.g., annual claims by governments or exempt organizations). Specific fuel claims often follow the statute of limitations under IRC section 6511. Consult Pub. 510 for details.

- Include Refund in Income: If you deducted the excise tax earlier, report the refund as gross income (cash method: year received; accrual method: year of fuel use/sale).

Important Tips and Considerations

- Do not use Form 8849 for credits claimed elsewhere (e.g., on Form 4136 for income tax) or liability adjustments.

- Processing delays occur if information is incomplete, EIN/SSN is wrong, or procedures aren’t followed.

- For nontaxable fuel uses, reference the form’s Type of Use Table (codes 1–16, e.g., farm use, export).

- Always verify eligibility and amounts using IRS Publication 510, Excise Taxes (latest revision March 2025), which covers fuel taxes, credits, refunds, nontaxable uses, and reporting in detail.

- Check the official IRS page for updates: https://www.irs.gov/forms-pubs/about-form-8849. Download the current Form 8849 and schedules from irs.gov (note: the base form is Rev. August 2014, with schedule-specific revisions; e.g., Schedule 6 instructions Rev. October 2025).

Filing Form 8849 correctly can provide significant tax relief for qualifying excise tax overpayments or exemptions. For complex situations, consult a tax professional or the IRS Business & Specialty Tax Line at 1-800-829-4933. Always rely on official IRS sources for the most accurate, up-to-date guidance.

IRS Form 8849 Download and Prinable

Download and Print: IRS Form 8849