Table of Contents

IRS Form 8853 – Archer MSAs and Long-Term Care Insurance Contracts – Navigating tax-advantaged health savings and insurance can save you thousands, but IRS rules are strict. IRS Form 8853 is your key tool for reporting contributions to Archer Medical Savings Accounts (MSAs), distributions from Archer or Medicare Advantage MSAs, and taxable benefits from long-term care (LTC) insurance. For tax year 2024 (filed in 2025), this form ensures compliance while maximizing deductions—especially with new clarifications on qualifying medical expenses like condoms.

Whether you’re self-employed with an Archer MSA or receiving LTC per diem benefits, this SEO-optimized guide breaks down Form 8853 filing requirements for 2025, eligibility, limits, step-by-step instructions, and updates. Download the official 2024 form at IRS.gov/Form8853.

What Is IRS Form 8853?

Form 8853, “Archer MSAs and Long-Term Care Insurance Contracts,” attaches to Form 1040, 1040-SR, or 1040-NR. It serves three main purposes:

- Archer MSA Reporting (Sections A & B): Tracks contributions (deductible on Schedule 1, line 13), distributions (taxable on Schedule 1, line 8e), and penalties (e.g., 20% on non-qualified withdrawals).

- LTC Insurance (Section C): Calculates taxable per diem or reimbursement benefits exceeding limits, reported on Schedule 1, line 8z.

Archer MSAs—pilot-program accounts from the 1990s paired with high-deductible health plans (HDHPs)—are rare today, mostly for pre-2007 participants. Medicare Advantage MSAs offer similar benefits for Medicare enrollees. LTC reporting prevents double-dipping on tax-free benefits.

File even if you have no taxable income—just distributions trigger it.

Who Must File Form 8853 in 2025?

You (or your spouse, if joint) must file if any apply for 2024:

- Made/employer made Archer MSA contributions.

- Acquired an Archer/Medicare Advantage MSA from a decedent.

- Received Archer/Medicare Advantage MSA distributions (use Form 1099-SA).

- Received LTC per diem/accelerated death benefits (Form 1099-LTC).

No filing if only employer contributions (W-2 code R) without personal activity, but track for deductions. Self-employed? Deduct 100% of premiums (up to limits) on Schedule 1, line 17.

2025 Deadlines for Form 8853

Attach to your 2024 return: April 15, 2025 (or October 15 with extension via Form 4868). Archer contributions for 2024 can be made until April 15, 2025. LTC benefits are reported in the year received.

| Tax Year Event | Deadline |

|---|---|

| 2024 Contributions (Archer MSA) | April 15, 2025 |

| Form 1040/8853 Filing | April 15, 2025 |

| Extension (Form 4868) | October 15, 2025 |

Archer MSA Contribution and Deduction Limits for 2025

Archer MSAs require an HDHP: $2,800–$4,150 deductible (self-only) or $5,550–$8,300 (family) for 2024 (filed 2025). Contributions are 65% (self) or 75% (family) of deductible, capped by earned income from the HDHP employer.

No new Archer MSAs since 2007; existing ones roll over tax-free. Medicare Advantage MSAs: Up to 1/2 HDHP deductible, max $3,900 (2024).

2024 HDHP Limits Table (Filed in 2025)

| Coverage Type | Minimum Deductible | Maximum Deductible |

|---|---|---|

| Self-Only | $2,800 | $4,150 |

| Family | $5,550 | $8,300 |

Long-Term Care Insurance Limits for 2025

Qualified LTC premiums count as medical expenses (Schedule A) if >7.5% AGI. Deduct up to age-based caps; per diem benefits tax-free up to $420/day (2025) or actual costs (whichever greater). Excess is taxable.

Self-employed deduct 100% (up to limit) above-the-line. State credits (e.g., 20% in some) add value.

2025 LTC Premium Deduction Limits Table

| Age (End of 2024) | Maximum Deductible Premium |

|---|---|

| 40 or under | $480 |

| 41–50 | $900 |

| 51–60 | $1,800 |

| 61–70 | $4,810 |

| 71+ | $6,020 |

*Per couple: Double if both qualify. Source: Rev. Proc. 2024-40.

IRS Form 8853 Download and Printable

Download and Print: IRS Form 8853

How to Complete IRS Form 8853: Step-by-Step (2024 Form)

Use 2024 form for 2025 filings. Joint filers: Separate sections per spouse if needed; combine on “controlling” form. Gather Forms 1099-SA (distributions), 5498-SA (contributions), 1099-LTC (benefits).

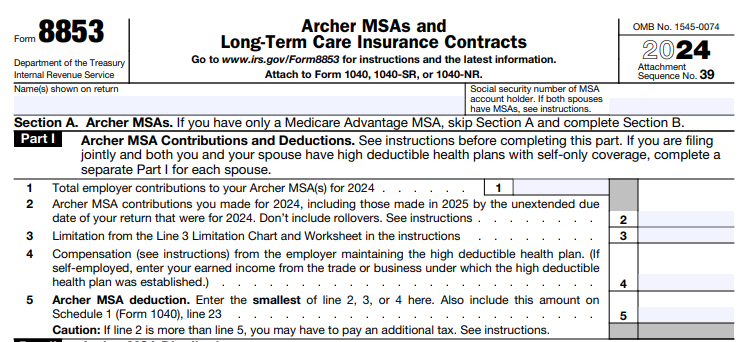

Section A: Archer MSA Contributions & Deductions

- Line 1: Employer contributions (W-2, box 12, code R).

- Line 2: Your contributions (Jan 1–Apr 15, 2025, for 2024).

- Line 3: Limitation—65%/75% of HDHP deductible (use monthly worksheet if partial year).

- Line 4: Compensation from HDHP employer.

- Line 5: Deduction = smallest of lines 1–4 (to Schedule 1, line 13).

Section A: Archer MSA Distributions

6a–6c: Total distributions (1099-SA, box 1); code (box 2); spouse total. 7: Unreimbursed qualified expenses (Pub. 502; keep receipts). 8: Taxable amount (6c – 7); to Schedule 1, line 8e. 9: 20% penalty on non-qualified (line 8 × 0.20, exceptions for death/disability); to Schedule 2, line 8.

Section B: Medicare Advantage MSA Distributions

10–13b: Similar to Archer; 50% penalty on non-qualified (line 13a × 0.50, to Schedule 2, line 17f).

Section C: LTC Insurance Contracts

14–26: Policyholder info; per diem/reimbursement amounts (1099-LTC); subtract actual costs or $420/day limit; excess taxable on line 26 (Schedule 1, line 8z).

Pro Tip: Use accrual method for expenses; rollovers (1099-SA code 2) aren’t taxable.

Recent Changes to Form 8853 for 2025 Filings

- Medical Expense Expansion: Condoms qualify as reimbursable (Notice 2024-71).

- LTC Per Diem: $420/day (up from $410).

- Premium Caps: Increased across ages (e.g., 71+: $6,020 vs. $5,880).

- No Archer Changes: Limits tied to HDHP; no new accounts.

Check IRS.gov for post-draft updates.

Penalties for Errors on Form 8853

- Excess Contributions: 6% excise tax (Form 5329).

- Non-Qualified Distributions: 20% (Archer) or 50% (Medicare) additional tax.

- LTC Excess: Taxable as ordinary income.

- Late Filing: 5% monthly on unpaid tax (up to 25%).

Reasonable cause waives; amend with Form 1040-X.

Best Practices for Form 8853 in 2025

- Track Monthly: Verify HDHP coverage for Archer limits.

- Retain Records: 1099s, receipts (3+ years); actual LTC costs beat per diem caps.

- Software Help: TurboTax/H&R Block auto-populates from W-2/1099s.

- Self-Employed Tip: Deduct LTC premiums fully (up to limit) without itemizing.

- Consult Pros: For decedents or complex LTC, see a CPA.

Maximize via Pub. 502 for expenses.

Conclusion: Optimize Your Health Tax Breaks with Form 8853 in 2025

IRS Form 8853 unlocks deductions for rare Archer MSAs and essential LTC coverage, potentially saving $1,000+ via limits like $6,020 premiums (71+). With April 15, 2025, looming, gather docs now—especially post-2024 expansions.

Download at IRS.gov/Form8853; call 800-829-1040 for help. File accurately: Health savings today, bigger refunds tomorrow.

Last updated: December 2025. Verify IRS sources for advice.