Table of Contents

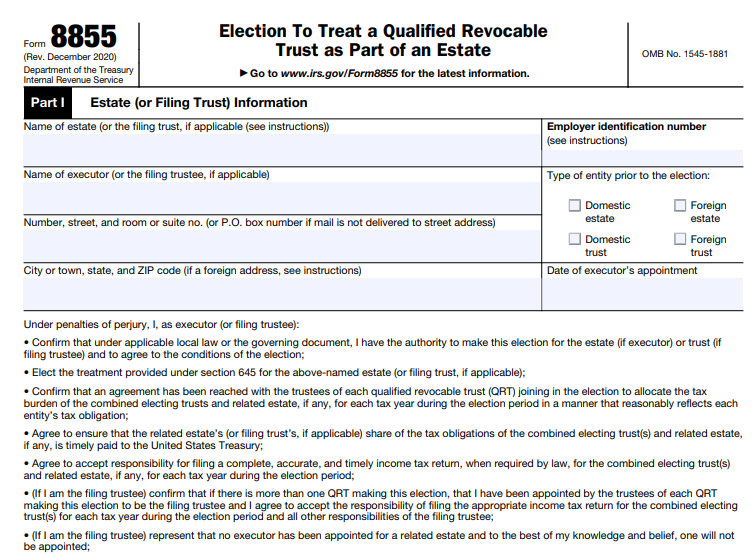

IRS Form 8855 – Election to Treat a Qualified Revocable Trust as Part of an Estate – In estate planning, navigating tax implications after a loved one’s passing can be complex. One valuable tool for simplifying this process is IRS Form 8855, which allows for the Section 645 election. This election treats a qualified revocable trust (QRT) as part of the decedent’s estate for federal income tax purposes, potentially streamlining reporting and offering tax advantages. If you’re an executor, trustee, or involved in estate administration, understanding Form 8855 is essential for optimizing tax outcomes.

What Is a Qualified Revocable Trust (QRT)?

A QRT is a trust that the decedent (grantor) could revoke or modify during their lifetime without needing approval from an adverse party. Typically, this includes revocable living trusts used in estate planning to avoid probate. Upon the grantor’s death, the trust becomes irrevocable, but under Section 645 of the Internal Revenue Code, it can be elected to be treated as part of the estate. To qualify, the trust must have been owned by the decedent under IRC Section 676 due to their revocation power.

Purpose of IRS Form 8855 and the Section 645 Election

Form 8855 is the official document used to make the Section 645 election, enabling the QRT to be taxed as part of the related estate rather than as a separate entity. This combines the trust and estate for income tax reporting, meaning only one Form 1041 (U.S. Income Tax Return for Estates and Trusts) needs to be filed instead of separate returns. The election applies during a specified period and helps manage assets like S corporation stock or charitable contributions more efficiently.

Who Can Make the Election?

The election is made jointly by the trustee(s) of the QRT and the executor of the estate, if one exists. If no executor is appointed (e.g., no probate estate), the trustee(s) can make the election alone. For multiple QRTs, all must participate, and one may be designated as the “filing trust.” Each QRT requires a new Employer Identification Number (EIN) after the decedent’s death.

Benefits of Making the Section 645 Election

Opting for this election offers several advantages:

- Simplified Tax Filing: Combines reporting into a single Form 1041, reducing administrative burdens and costs.

- Fiscal Year Flexibility: Allows the trust to adopt the estate’s fiscal year instead of a mandatory calendar year, potentially deferring income taxes.

- Charitable Deductions: Enables deductions for amounts set aside for charities, not just those paid out.

- S Corporation Stock Holding: Permits the trust to hold S corp shares without needing a Qualified Subchapter S Trust (QSST) or Electing Small Business Trust (ESBT) election during the period.

- Estimated Tax Relief: Exempts the combined entity from estimated tax payments for up to two years post-death.

- Passive Loss Rules: Waives the active participation requirement for passive activity losses under Section 469 for two years.

- Higher Exemption: Provides a $600 personal exemption (estate level) versus $100–$300 for trusts.

These benefits are particularly useful in volatile markets or when managing complex estates.

IRS Form 8855 Download and Printable

Download and Print: IRS Form 8855

How to File IRS Form 8855

To complete Form 8855:

- Download the form from the IRS website.

- Fill in Part I with details about the electing trust and estate (names, EINs, addresses).

- If an executor exists, they complete Part II; trustees handle Part III.

- Sign and date the form—only one signature per role is typically needed unless required otherwise.

- Mail to the appropriate IRS center based on your state (e.g., Kansas City, MO, for eastern states; Ogden, UT, for western states).

Attach it to the initial Form 1041 if filing one. If an executor is appointed later, file a revised Form 8855 within 90 days.

Filing Deadlines for Form 8855

The form must be filed by the due date (including extensions) of the estate’s or QRT’s first Form 1041. Use Form 7004 for a 5.5-month extension. If no Form 706 (estate tax return) is required, the election period ends two years after death; if filed, it extends to six months after final estate tax determination or two years, whichever is later.

Irrevocability and Termination of the Election

Once made, the election is irrevocable. It terminates upon full asset distribution or at the end of the election period. After termination, the trust reverts to separate reporting on a calendar-year basis.

When Should You Consider the Section 645 Election?

This election is ideal for estates with S corp holdings, charitable intentions, or multiple trusts. It’s especially beneficial during economic downturns for better cash flow management. However, evaluate if the trust qualifies and consider the irrevocable nature—consult a tax professional to tailor it to your situation.

Conclusion

IRS Form 8855 and the Section 645 election provide a strategic way to simplify tax compliance and maximize benefits in estate administration. By treating a QRT as part of the estate, you can reduce paperwork, defer taxes, and access deductions that might otherwise be unavailable. Always use current IRS guidance and seek expert advice for your specific circumstances.

Frequently Asked Questions (FAQs)

What happens if I miss the filing deadline for Form 8855?

The election cannot be made late, so it’s critical to file by the Form 1041 due date (with extensions).

Can multiple trusts make the election together?

Yes, all QRTs related to the estate can join, with one designated as the filing trust.

Is the election available for foreign trusts?

It can apply, but reporting requirements may vary, such as using Form 1040-NR for foreign estates.

What if there’s no estate executor?

The trustee(s) can make the election independently.