Table of Contents

IRS Form 8857 – Request for Innocent Spouse Relief – If you’re facing tax liabilities from a joint return with your spouse or former spouse, you might qualify for relief through IRS Form 8857. This form allows you to request innocent spouse relief, potentially absolving you from paying taxes, penalties, and interest that aren’t your responsibility. In this comprehensive guide, we’ll cover everything you need to know about Form 8857, including eligibility, filing steps, deadlines, and more. Whether you’re dealing with understated taxes due to errors or unpaid balances, understanding this process can provide significant financial protection.

What Is Innocent Spouse Relief?

Innocent spouse relief is a provision from the IRS that relieves you from joint tax liability if your spouse or former spouse is solely responsible for errors or underpayments on a joint tax return. When you file jointly, both parties are typically equally liable for the entire tax debt. However, if you can prove you were unaware of the issues—such as unreported income, incorrect deductions, or inflated credits—you may be eligible for relief.

This relief applies to federal income taxes but not to household employment taxes, individual shared responsibility payments, business taxes, or trust fund recovery penalties. It’s particularly relevant in cases of divorce, separation, or domestic abuse, where one spouse may have been coerced or uninformed.

Types of Relief Available Through Form 8857

Form 8857 isn’t limited to one type of relief. The IRS will evaluate your situation and determine the best fit:

- Innocent Spouse Relief: This is for understated taxes due to your spouse’s erroneous items (e.g., unreported income or improper deductions). You must prove you had no knowledge or reason to know about the errors at the time of signing the return.

- Separation of Liability Relief: Allocates the tax debt between you and your spouse based on individual responsibility. It’s available if you’re divorced, widowed, legally separated, or haven’t lived together for at least 12 months before filing.

- Equitable Relief: A catch-all option if you don’t qualify for the above. It applies to both understated and unpaid taxes (taxes reported but not paid) if holding you liable would be unfair, considering factors like abuse, economic hardship, or compliance history.

Residents of community property states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin) may also qualify for specific relief from community income items, even without a joint return.

Who Qualifies for Innocent Spouse Relief?

Eligibility depends on the type of relief, but common requirements include:

- Filing a joint tax return for the year in question.

- An understatement of tax due to erroneous items attributable to your spouse (e.g., omitted income or false deductions).

- No actual knowledge or reason to know about the errors—determined by what a reasonable person in your situation would know, factoring in education, financial involvement, and any evasion by your spouse.

- It’s unfair to hold you liable, considering benefits received, divorce status, abuse, or economic hardship.

For equitable relief, additional threshold conditions apply, such as no fraudulent asset transfers and timely filing. The IRS considers holistic factors like:

- Marital status (favoring relief if separated or divorced).

- Economic hardship (inability to pay basic living expenses).

- Abuse or financial control (physical, psychological, or emotional, which can outweigh knowledge of errors).

- Compliance with tax laws post-separation.

- Health issues at the time of filing or requesting relief.

Exceptions exist for domestic abuse victims: Relief may be granted even if you knew about errors, if fear or coercion prevented you from challenging them. Partial relief is possible if you’re unaware of only part of the understatement.

Disqualifiers include participating in fraud, signing a closing agreement, or court-denied relief in prior proceedings.

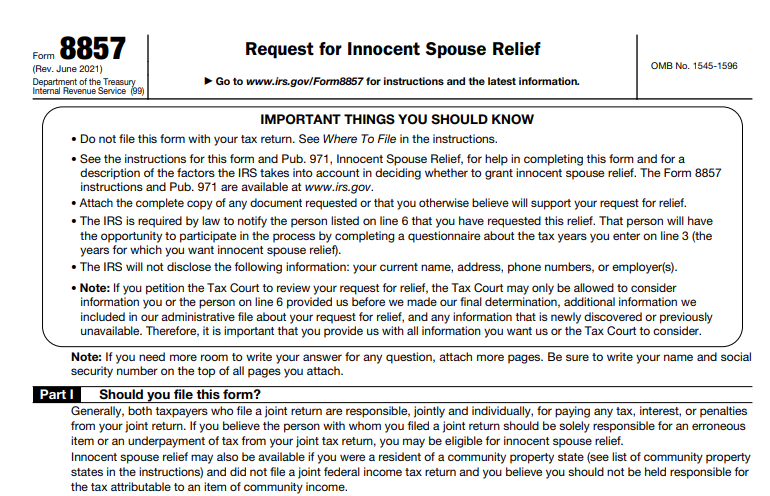

How to File IRS Form 8857: Step-by-Step Guide

Filing Form 8857 is straightforward but requires detailed documentation. You don’t need to specify the relief type—the IRS will decide based on your submission.

- Check Eligibility: Use the form’s initial questions (lines 1-2) to confirm if innocent spouse relief applies or if you need Form 8379 for injured spouse allocation instead.

- Gather Information: Include your SSN/ITIN, current address, spouse’s details, tax years involved, and explanations of erroneous items, your lack of knowledge, and why liability is unfair.

- Complete the Form: Detail circumstances like forged signatures, duress, property transfers, or abuse (refer to Revenue Procedure 2013-34 for abuse claims).

- Attach Supporting Documents: Provide bank statements, canceled checks, or proof of payments made with your own funds (for refunds). Redact sensitive info and label attachments with your name and SSN.

- Sign and Date: The form must be signed; unsigned submissions are returned. If using a preparer, they must include their PTIN.

- Submit: Mail via USPS to P.O. Box 120053, Covington, KY 41012; private delivery to 7940 Kentucky Drive, Stop 840F, Florence, KY 41042; or fax to 855-233-8558. Do not attach to your tax return.

For multiple years, file separate forms or attach a statement.

Required Documents and Attachments for Form 8857

To strengthen your case, include:

- Proof of payments (e.g., bank records showing funds came from your separate account).

- Evidence of abuse or financial control (e.g., police reports, medical records).

- Divorce decrees or separation agreements showing legal obligations.

- Financial statements demonstrating economic hardship.

The IRS may request more info during review.

IRS Form 8857 Download and Printable

Download and Print: IRS Form 8857

Deadlines for Filing Form 8857

Timing is critical:

- Innocent Spouse and Separation of Liability: Within 2 years of the IRS’s first collection attempt (e.g., notice of offset, levy, or lawsuit).

- Equitable Relief (Balance Due): Within the 10-year collection statute (suspended during review).

- Equitable Relief (Refund/Credit): Within 3 years of filing the return or 2 years of paying the tax, whichever is later.

- Community Income Relief: No later than 6 months before the assessment period expires (usually 3 years from filing), or 30 days after IRS exam contact.

File as soon as you learn of the liability to avoid complications. If no IRS response within 6 months, you can petition Tax Court.

What Happens After You File Form 8857?

The IRS reviews your request, which may take 6 months or longer. They’ll notify your spouse (unless abuse warrants nondisclosure) and allow participation. Collection activities pause, but interest accrues.

You’ll receive a determination letter. If denied, appeal within 30 days or petition Tax Court within 90 days. Both spouses can appeal.

Common FAQs About IRS Form 8857

Can I Get a Refund Through Innocent Spouse Relief?

Yes, for innocent spouse and equitable relief if you made payments with your own funds, within refund timelines. No refunds for separation of liability.

What If I’m in a Community Property State?

You may qualify for relief from community income even without a joint return, based on state laws but overridden for IRS allocation.

Are There Any 2025 Updates to Form 8857?

As of 2025, no major changes are noted beyond ongoing reviews. Check IRS.gov for the latest, as pages were updated in March and November 2025.

Should I Hire a Professional?

Complex cases involving abuse or large debts benefit from tax attorneys or enrolled agents familiar with IRS procedures.

Conclusion: Protect Yourself with Innocent Spouse Relief

Navigating tax liabilities from a joint return can be overwhelming, but IRS Form 8857 offers a lifeline for those unfairly burdened. By understanding eligibility, gathering evidence, and filing promptly, you can seek relief and move forward financially. For personalized advice, consult IRS Publication 971 or a tax professional. Always verify details on official IRS sources to ensure compliance in 2025.