Table of Contents

IRS Form 8863 – Education Credits (American Opportunity and Lifetime Learning Credits) – As college tuition continues to climb—with average in-state public university costs exceeding $11,000 annually—tax credits like the American Opportunity Credit (AOTC) and Lifetime Learning Credit (LLC) offer vital relief for students and families. IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), is your key to claiming up to $2,500 per student via AOTC or $2,000 per return with LLC, potentially refunding 40% of AOTC expenses even if you owe no tax. For the 2025 tax year, phaseout thresholds hold steady at $80,000–$90,000 MAGI for singles ($160,000–$180,000 joint), ensuring broad access amid inflation, but eligibility hinges on Form 1098-T data and careful expense tracking.

This SEO-optimized guide, based on the official 2025 Instructions for Form 8863 (Rev. December 2024) and IRS Publication 970 (Tax Benefits for Education), demystifies the form: eligibility, step-by-step filing, deadlines, and strategies to maximize savings. Whether you’re a first-year undergrad eyeing AOTC’s refundable portion or a grad student leveraging LLC’s flexibility, Form 8863 could cut your tax bill by thousands—yet only 20% of eligible families claim it. Download the 2025 PDF from IRS.gov and reclaim your education investment today.

What Is IRS Form 8863?

Form 8863 is a two-page worksheet taxpayers use to calculate and claim two major education credits: the partially refundable AOTC and nonrefundable LLC, based on qualified tuition, fees, and related expenses (QTRE) paid in 2025. Attach it to Form 1040 or 1040-SR (Schedule 3, line 3) after receiving Form 1098-T from your school—though the 1098-T amount may differ from your actual payments.

- Part I: AOTC calculation (up to $2,500 per student; 40% refundable).

- Part II: LLC calculation (20% of up to $10,000; max $2,000 per return).

- Part III: Limitation and total credit (phaseouts by MAGI).

For 2025, the form requires the school’s EIN if claiming AOTC, and you can’t double-dip both credits for the same student in the same year—choose the better option. Qualified expenses include tuition, fees, and (for AOTC) books/supplies needed for enrollment—paid in 2025 for periods starting in 2025 or the first three months of 2026.

Key Fact: AOTC is limited to the first four years of postsecondary education and requires half-time enrollment; LLC has no year or enrollment limits, making it ideal for grad/professional studies.

American Opportunity Credit (AOTC) vs. Lifetime Learning Credit (LLC): Which Is Right for You?

Both credits reduce QTRE taxes but differ in scope and benefits—use Form 8863’s worksheets to compare. Here’s a quick breakdown for 2025:

| Feature | American Opportunity Credit (AOTC) | Lifetime Learning Credit (LLC) |

|---|---|---|

| Maximum Credit | $2,500 per student (100% of first $2,000 + 25% of next $2,000) | $2,000 per return (20% of up to $10,000 QTRE) |

| Refundable Portion | Up to 40% ($1,000 max) even if no tax owed | Nonrefundable; reduces tax to $0 only |

| Eligible Expenses | Tuition, fees, books/supplies, course materials | Tuition, fees (no books/supplies) |

| Enrollment | At least half-time in degree/certificate program | Any enrollment (full/partial, no degree required) |

| Years Allowed | First 4 years of postsecondary education | Unlimited years |

| Students | Per eligible student | Per tax return (any number) |

| Phaseout MAGI (Single) | $80,000–$90,000 | $80,000–$90,000 |

| Phaseout MAGI (Joint) | $160,000–$180,000 | $160,000–$180,000 |

Pro Tip: AOTC often yields more (up to $2,500 vs. $2,000), but LLC suits non-degree courses or beyond year four—run both in tax software to optimize.

Who Can Claim Education Credits on Form 8863?

You (or your spouse) can claim credits for yourself, spouse, or dependents if:

- The student was enrolled at an eligible postsecondary institution (accredited college/university/vocational school; EIN required for AOTC).

- Expenses were paid in 2025 (or first 3 months 2026) for academic periods starting then.

- No felony drug conviction during enrollment.

- Not claimed as a dependent on someone else’s return (except parents for AOTC).

Ineligible If:

- Married filing separately.

- Nonresident alien (unless electing residency).

- Expenses reimbursed tax-free (e.g., employer aid, 529 withdrawals, scholarships).

Students can claim if non-dependents; parents typically do for dependents. Use Form 1098-T (Box 1 payments) but adjust for actual out-of-pocket costs.

Step-by-Step Guide: How to Complete IRS Form 8863 for 2025

The 2025 Form 8863 is user-friendly—download from IRS.gov and pair with tax software for auto-fill from 1098-T. Complete per student for AOTC; aggregate for LLC.

1. Gather Documents

- Form 1098-T (tuition paid).

- Receipts for books/supplies (AOTC only).

- Form 1040 AGI/MAGI calculation.

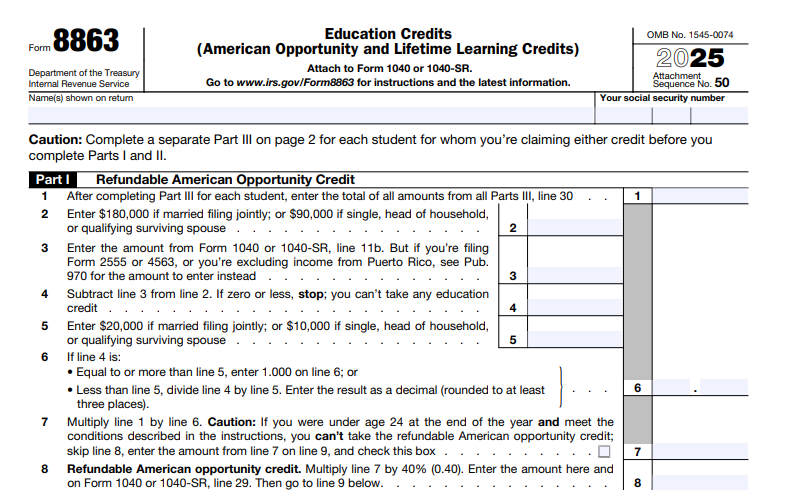

2. Part I: American Opportunity Credit (Lines 1–8)

- Line 1: Student name/SSN/EIN (school’s).

- Line 2: Adjusted QTRE (tuition + fees + books; subtract tax-free aid).

- Line 3: Multiply line 2 by 100% (up to $2,000).

- Line 4: Excess over $2,000 × 25% (up to $500).

- Line 5: Total tentative credit ($0–$2,500).

- Line 6: Refundable portion (40% of line 5, up to $1,000).

- Line 7: Nonrefundable (line 5 – 6).

- Line 8: Add for all AOTC students.

3. Part II: Lifetime Learning Credit (Lines 9–18)

- Line 9: Adjusted QTRE (tuition/fees only; up to $10,000).

- Line 10: Multiply by 20% ($0–$2,000).

- Line 11: Add for all LLC students (max $2,000 total).

4. Part III: Credit Limit (Lines 19–31)

- Line 19: MAGI from 1040.

- Line 20–23: Phaseout reduction (e.g., for AOTC single: ($MAGI – $80,000)/$10,000 × credit).

- Line 24: Allowed credit after phaseout.

- Line 25–31: Apply to tax liability; enter on Schedule 3.

Pro Tip: Can’t claim both for one student—Part I/II auto-compares; choose higher.

Deadlines and How to File Form 8863 for 2025

Attach Form 8863 to your 2025 Form 1040—due April 15, 2026 (extendable to October 15 via Form 4868). E-file (90%+ returns) or paper mail to IRS center.

- Expense Deadline: Pay by April 15, 2026, for first-quarter 2026 periods.

- 1098-T Receipt: By January 31, 2026; request if missing.

- Amended Claims: File 1040-X within 3 years for missed credits.

Refunds via direct deposit in 21 days; paper slower.

Common Mistakes to Avoid When Filing Form 8863

Phaseout errors deny 30% of claims—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Double-Dipping Credits | Claiming AOTC + LLC for one student. | Use Part I/II comparison; choose one. | IRS disallowance; repay + interest. |

| Ignoring Phaseouts (Part III) | Using AGI vs. MAGI. | Add tax-exempt interest; check $80K–$90K single. | Reduced/zero credit. |

| Wrong Expenses (Line 2/9) | Including room/board. | Limit to tuition/fees/books (AOTC); subtract aid. | Audit; $5,000 accuracy penalty. |

| Missing EIN (Line 1) | No 1098-T Box 2. | Request from school; required for AOTC. | Credit denial. |

| Late Payment Inclusion | Post-April 15 for Q1 2026. | Pay by deadline; designate year. | Lost credit. |

| Student Ineligibility | Felony conviction or >4 years. | Verify half-time/degree pursuit. | Repayment + 20% penalty. |

Amend with 1040-X; retain records 3 years.

IRS Form 8863 Download and Printable

Download and Print: IRS Form 8863

2025 Updates and Special Considerations for Form 8863

The 2025 instructions (Rev. Dec. 2024) confirm steady parameters:

- Phaseouts: Unchanged at $80K–$90K single/$160K–$180K joint (no inflation adjustment).

- AOTC Max: $2,500/student (40% refundable); first 4 years only.

- LLC Max: $2,000/return; unlimited years/job skills OK.

- 1098-T Requirement: Needed for AOTC; optional for LLC if substantiated.

- Coordination: Can’t claim with 529/employer aid for same expenses.

- Expats: Eligible if U.S. tax resident; FEIE may lower MAGI.

Monitor for TCJA sunset post-2025—phaseouts could drop to $4,000–$5,000 single.

Final Thoughts: Reclaim Your Education Costs with Form 8863 in 2025

IRS Form 8863 unlocks up to $2,500 in AOTC relief or $2,000 via LLC, turning tuition burdens into tax wins for 2025. With phaseouts at $80,000–$90,000 MAGI (single), verify eligibility via 1098-T, run both credits, and file by April 15, 2026, for refunds up to $1,000. Don’t overlook this—over 70% of families qualify but underclaim.

Pair with 529s for max savings; consult Pub. 970 or a CPA for complexities. This guide is informational; always check IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 8863

What is the 2025 AOTC maximum credit?

$2,500 per student (100% first $2,000 + 25% next $2,000; 40% refundable).

Can I claim both AOTC and LLC in 2025?

No—for the same student/year; choose the higher via Form 8863.

What is the 2025 MAGI phaseout for education credits?

$80,000–$90,000 single; $160,000–$180,000 joint.

Do I need Form 1098-T to file Form 8863?

Yes for AOTC; helpful but not required for LLC if expenses substantiated.