Table of Contents

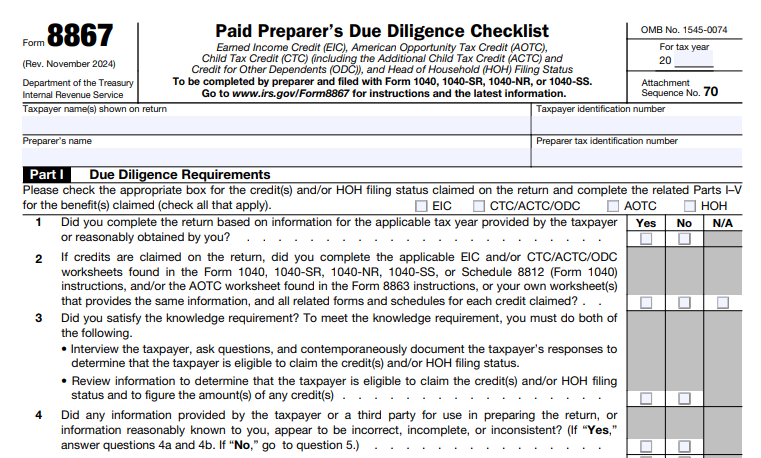

IRS Form 8867 – Paid Preparer’s Due Diligence Checklist – In the world of tax preparation, accuracy and compliance are paramount. For paid tax preparers handling returns that claim specific credits or filing statuses, IRS Form 8867 plays a crucial role. This form, officially titled the Paid Preparer’s Due Diligence Checklist, ensures that preparers exercise proper care when determining eligibility for benefits like the Earned Income Credit (EIC), Child Tax Credit (CTC) including the Additional Child Tax Credit (ACTC) and Credit for Other Dependents (ODC), American Opportunity Tax Credit (AOTC), and Head of Household (HOH) filing status. Updated in November 2024, it helps prevent errors and protects both taxpayers and preparers from potential audits or penalties.

Whether you’re a seasoned tax professional or a business owner navigating tax services, understanding Form 8867 can streamline your processes and enhance compliance. In this guide, we’ll break down everything you need to know about IRS Form 8867, including its purpose, completion requirements, and key resources.

What Is IRS Form 8867 and Why Does It Matter?

IRS Form 8867 is a mandatory checklist for paid tax return preparers who assist clients in claiming certain tax benefits. Its primary purpose is to document that the preparer has met due diligence requirements under Treasury Regulations, specifically sections 6695(g) and 1.6695-2. By completing this form, preparers certify that they’ve interviewed the taxpayer, reviewed necessary documents, and accurately determined eligibility and credit amounts.

Failing to adhere to these standards can lead to significant penalties—up to $635 per failure (adjusted for inflation, potentially reaching $2,540 for all benefits in 2025). This form not only safeguards against IRS scrutiny but also promotes ethical tax preparation practices, reducing the risk of fraudulent claims.

Key benefits covered by Form 8867 include:

- Earned Income Credit (EIC): A refundable credit for low- to moderate-income workers.

- Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), and Credit for Other Dependents (ODC): Credits for qualifying children and dependents.

- American Opportunity Tax Credit (AOTC): An education credit for qualified tuition expenses.

- Head of Household (HOH) Filing Status: A status that may lower tax liability for eligible unmarried taxpayers.

Preparers must file Form 8867 with the tax return (or amended return) when any of these are claimed. For electronic filings, it’s submitted digitally; otherwise, it’s attached to the paper return.

Who Must Complete and File IRS Form 8867?

Any paid tax return preparer who determines eligibility for the EIC, CTC/ACTC/ODC, AOTC, or HOH status must complete Form 8867. This includes both signing and nonsigning preparers. If multiple preparers are involved (e.g., one handles EIC and another AOTC), each may need to submit a separate form—up to four for e-filed returns.

Nonsigning preparers provide the completed form to the signing preparer, who then files it. The form must be based on current-year information, though certain elections (like prior-year earned income for EIC/ACTC, if applicable) require dual-year computations.

Record retention is essential: Keep copies of Form 8867, worksheets, taxpayer documents, and notes for three years from the return’s due date or filing date.

IRS Form 8867 Download and Printable

Download and Print: IRS Form 8867

Step-by-Step Guide to Completing IRS Form 8867

Form 8867 is divided into six parts, each focusing on due diligence and specific questions for the claimed benefits. Preparers answer with “Yes,” “No,” or “N/A” and must certify compliance in Part VI.

Part I: General Due Diligence Requirements

This section (Lines 1–8) applies to all claims:

- Confirm use of current-year info and completion of required worksheets (e.g., from Form 1040 instructions or Schedule 8812).

- Ensure no incorrect or inconsistent information was ignored, and make reasonable inquiries (documented contemporaneously).

- List documents relied upon, like school records for child residency or receipts for business expenses.

- Inform taxpayers about potential audits and attach Form 8862 if prior credits were denied.

- Review Schedule C for self-employed taxpayers.

Part II: Questions for EIC

- 9a: Eligibility for qualifying children or childless EIC.

- 9b: Child residency verification.

- 9c: Explanation of tiebreaker rules for multiple claimants.

Part III: Questions for CTC/ACTC/ODC

- 10: Dependent status and U.S. residency/citizenship.

- 11: Residency rules and custodial parent releases.

- 12: Rules for divorced/separated parents, including Form 8332.

Part IV: Questions for AOTC

- 13: Substantiation of expenses via Form 1098-T and receipts.

Part V: Questions for HOH

- 14: Unmarried status and home maintenance costs for a qualifying person.

Part VI: Certification

Certify that all information is true and complete.

Use IRS worksheets or equivalents for computations, and document all inquiries.

Penalties for Non-Compliance with Due Diligence

The IRS imposes a $635 penalty (inflation-adjusted) for each failure to meet due diligence standards per credit or status claimed. This can add up quickly if multiple benefits are involved. Proper documentation and training are key to avoidance.

Essential Resources for Tax Preparers

The IRS offers a toolkit for due diligence compliance:

- Form 8867 PDF and Instructions.

- Due Diligence Training (eligible for CE credits).

- Supporting Forms like 886-H-EIC, 886-H-DEP, and 14815 for documentation.

- Videos and guides on knowledge and recordkeeping.

Visit the IRS EITC Central for more.

Final Thoughts on IRS Form 8867

Mastering IRS Form 8867 is essential for paid preparers to ensure accurate tax filings and avoid penalties. By following due diligence protocols, you not only comply with regulations but also build trust with clients. Stay updated via IRS.gov for any 2025 changes, and consider IRS training to enhance your expertise.

For the latest forms and instructions, always refer to official IRS sources. If you’re a preparer, integrating these practices can optimize your workflow and improve client satisfaction.