Table of Contents

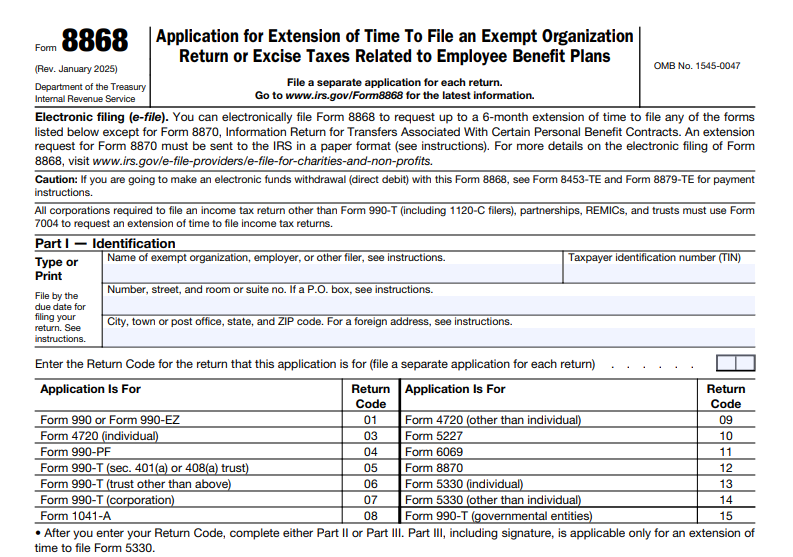

IRS Form 8868 – Application for Extension of Time To File an Exempt Organization Return or Excise Taxes Related to Employee Benefit Plans – Nonprofit organizations, trusts, and exempt entities play a crucial role in serving communities, but tax filing deadlines can strain limited resources. If you’re facing delays in compiling Form 990, 990-T, or related returns, IRS Form 8868—the Application for Extension of Time to File an Exempt Organization Return—provides an automatic 6-month extension, pushing your due date from May 15 to November 15 for calendar-year filers. For 2025, with over 1.8 million Form 990 filings annually and the January 2025 revision incorporating updates for Form 990-T (proxy tax for governmental entities), Form 8868 remains a lifeline to avoid $20 daily penalties per month (max $10,000 or 5% of gross receipts). This SEO-optimized guide, based on the latest IRS instructions, covers eligibility, filing steps, and e-filing options to ensure compliance without late fees.

What Is IRS Form 8868?

IRS Form 8868 is a simple application granting an automatic 6-month extension to file certain exempt organization returns, including Form 990 (annual information), 990-EZ (short form), 990-PF (private foundations), 990-T (unrelated business income), 5227 (split-interest trusts), 4720 (foundation taxes), and 6069 (foreign organizations). It also covers up to a 6-month extension for Form 5330 (excise taxes on employee benefit plans), though not automatic—approval depends on completeness. No reason needed for most forms; simply file timely to extend.

Key features:

- Automatic for Most: 6 months for 990-series, 1041-A, 5227; up to 6 months for 5330/6069.

- No Extension for Form 990-N: E-Postcard filers ineligible.

- Payment Requirement: Pay estimated tax by original due date to avoid interest (0.5%/month).

The January 2025 revision (Rev. 1-2025) adds Form 990-T for governmental entities and clarifies e-filing via authorized providers. Download the form and instructions from IRS.gov/Form8868.

Who Needs IRS Form 8868 in 2025?

Exempt organizations, trusts, and plan sponsors unable to file by the original deadline (e.g., May 15 for calendar-year 990s) must use Form 8868. It’s ideal for nonprofits gathering donor data or trusts compiling beneficiary info.

| Eligible Filer | Covered Returns | Extension Length |

|---|---|---|

| Nonprofits | Form 990, 990-EZ, 990-PF, 990-T | Automatic 6 months (to Nov 15, 2025, for calendar year). |

| Split-Interest Trusts | Form 5227 | Automatic 6 months. |

| Private Foundations | Form 4720 | Automatic 6 months. |

| Employee Benefit Plans | Form 5330 | Up to 6 months (not automatic—file timely with estimate). |

| Foreign Orgs | Form 6069 | Up to 6 months. |

Ineligible: Form 990-N (e-Postcard). Multiple entities? Attach schedule with names/EINs. E-file via providers like TaxZerone for instant approval.

Filing Deadlines and Extensions for Form 8868 in 2025

File by the original return due date—no extensions for Form 8868 itself. For calendar-year filers, May 15, 2025, grants until November 15, 2025. Fiscal-year example: Ending June 30, 2025—file by November 15, 2025, for May 15, 2026, extension.

| Return Type | Original Due Date (Calendar Year) | Extension Deadline | Extended Due Date |

|---|---|---|---|

| Form 990 Series | May 15, 2025 | May 15, 2025 | November 15, 2025 |

| Form 5330 | July 31, 2025 | July 31, 2025 | January 31, 2026 (up to 6 months). |

| Form 5227 | April 15, 2025 | April 15, 2025 | October 15, 2025. |

- E-Filing: Via authorized providers (e.g., ExpressExtension)—instant IRS acceptance.

- Paper Filing: Mail to IRS center per instructions (e.g., Ogden, UT for most).

- Payment: Estimate/pay tax by original due to avoid interest; attach Form 7004 if business return.

Late Form 8868 = no extension; penalties accrue from original due date.

IRS Form 8868 Download and Printable

Download and Print: IRS Form 8868

Step-by-Step Guide to Completing IRS Form 8868

The two-page form is simple—fillable PDF available. Gather EIN, tax year, and estimated tax.

- Part I: Identification – Organization name, address, EIN, tax year (e.g., “Calendar year 2024”).

- Part II: Automatic Extension – Check forms for 6-month auto-extension (e.g., 990, 990-T, 5227); enter due date (e.g., May 15, 2025).

- Part III: Form 5330 Extension – If applicable, check and estimate tax due; pay with voucher.

- Signature: Officer/trustee signs under perjury; title, date.

- Attach Schedule: If multi-org, list names/EINs.

- File: E-file for speed or mail; pay estimated tax via EFTPS.

For Form 990-T governmental entities, automatic 6 months from November 15, 2025. Confirmation: IRS notice within weeks.

Common Mistakes When Filing Form 8868 and How to Avoid Them

Extensions are automatic if timely, but errors void them:

- Late Submission: After original due—file by May 15, 2025, for 990.

- Wrong Forms: Checking ineligible (e.g., 990-N)—review Part II.

- No Payment: For 5330/6069—estimate/pay to avoid interest.

- Multi-Org Oversight: Forgetting schedule—attach list.

- E-File Glitches: Provider errors—use IRS-approved (e.g., TaxZerone).

E-file minimizes issues; retain confirmation.

Penalties for Late Filing Without Form 8868 in 2025

Missing the extension triggers failure-to-file penalties: $20/day per return (max $10,000 or 5% gross receipts for 990s). For 5330, $290/month (max $29,000). Interest accrues on unpaid tax (0.5%/month). Reasonable cause waives; e-file avoids mailing delays.

Frequently Asked Questions About IRS Form 8868

What’s the 2025 deadline for Form 990 extensions?

May 15, 2025, for calendar-year—extends to November 15, 2025.

Can I e-file Form 8868?

Yes—via providers like ExpressExtension; instant approval.

Does Form 8868 extend payment deadlines?

No—pay estimated tax by original due to avoid interest.

Is Form 990-T eligible for automatic extension?

Yes—6 months, including governmental entities.

What if I miss the Form 8868 deadline?

No extension—penalties start accruing.

Visit IRS.gov/Form8868 for more.

Final Thoughts: Secure Your Nonprofit Extension with IRS Form 8868 in 2025

IRS Form 8868 is a nonprofit’s best friend, granting automatic 6-month extensions for 990-series filings to avoid $20 daily penalties—vital for over 1.8 million organizations facing May 15, 2025, deadlines. The January 2025 revision’s e-filing ease makes it seamless; file by due date, pay estimates, and breathe easy until November 15. Download from IRS.gov today and use providers like TaxZerone for instant confirmation—extensions aren’t delays; they’re strategic planning.

Informational only—not tax advice. Consult IRS.gov or a professional.