Table of Contents

IRS Form 8869 – Qualified Subchapter S Subsidiary Election – known as the Qualified Subchapter S Subsidiary Election, allows a parent S corporation to treat one or more wholly-owned subsidiaries as qualified subchapter S subsidiaries (QSubs). This election simplifies federal tax reporting by treating the subsidiary as a disregarded entity, effectively deeming it to liquidate into the parent for tax purposes.

As of December 2025, the latest version of Form 8869 is the December 2020 revision, per the official IRS website. This guide covers eligibility, benefits, filing requirements, and key considerations using current IRS guidelines.

What Is a Qualified Subchapter S Subsidiary (QSub)?

A QSub is a domestic corporation that meets specific criteria under Internal Revenue Code (IRC) Section 1361(b)(3). When a valid QSub election is made via Form 8869:

- The subsidiary is not treated as a separate corporation for federal income tax purposes.

- All assets, liabilities, income, deductions, and credits of the QSub flow through to the parent S corporation.

- This results in a deemed tax-free liquidation of the subsidiary into the parent (generally under IRC Sections 332 and 337, if requirements are met).

QSubs provide S corporations flexibility similar to LLCs, allowing multiple entities for legal or operational reasons while maintaining single-entity tax treatment.

Eligibility Requirements for QSub Election

To qualify for a QSub election:

- Parent Company: Must be a valid S corporation.

- Subsidiary:

- Must be a domestic U.S. corporation.

- 100% of its stock must be owned by the parent S corporation.

- Must not be an “ineligible corporation,” such as:

- Financial institutions using the reserve method for bad debts (IRC Section 585 or 593).

- Insurance companies taxed under Subchapter L.

- Domestic International Sales Corporations (DISCs) or former DISCs.

- The subsidiary must otherwise be eligible to be an S corporation itself.

Multiple subsidiaries can be elected on separate Forms 8869, though one form can cover multiple if desired (each requires detailed information).

Benefits of Filing Form 8869

Making a QSub election offers several advantages:

- Simplified Tax Compliance: Only the parent S corporation files Form 1120-S; no separate return is needed for the QSub.

- Pass-Through Taxation: Maintains S corporation flow-through benefits without separate entity taxation.

- Asset Protection and Operations: Subsidiaries remain separate for non-tax purposes (e.g., liability isolation, contracts).

- No Immediate Tax on Election: The deemed liquidation is generally tax-free if conditions are met.

- Flexibility in Structuring: Useful for holding companies, acquisitions, or reorganizations (e.g., F reorganizations under Rev. Rul. 2008-18).

However, termination of QSub status (e.g., by selling shares) triggers a deemed new corporation formation, potentially creating taxable events.

IRS Form 8869 Download and Printable

Download and Print: IRS Form 8869

How to File IRS Form 8869

When to File

- Generally, file no earlier than 12 months before or no later than 2 months and 15 days after the desired effective date.

- For new subsidiaries, the election can be effective on the formation date.

- Retroactive elections are limited; prospective are common.

Where to File

- Mail to the IRS service center where the subsidiary filed (or would file) its most recent tax return.

- Exception: For newly formed subsidiaries with election effective upon formation, file where the parent filed its most recent return.

No electronic filing is available; paper filing is required.

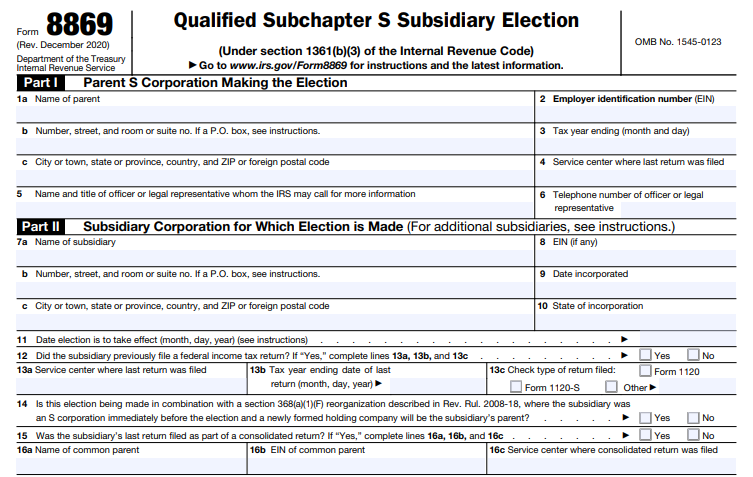

Key Form Sections

- Part I: Parent S corporation details (name, EIN, address).

- Part II: Subsidiary details (name, EIN, address, effective date).

- Provide prior filing information if the subsidiary filed returns before.

- Check boxes for special situations (e.g., F reorganization).

- Signed by an authorized officer of the parent (e.g., president, treasurer).

Processing and Confirmation

- IRS typically responds within 60 days (acceptance or rejection).

- You may receive CP 279 (acceptance) or other notices.

- Proof of filing: Use certified mail or check for IRS stamped copy.

Common Mistakes and Late Election Relief

- Failing to meet timing rules renders the election invalid.

- Late relief may be available under certain revenue procedures (e.g., for inadvertent errors), but consult a tax professional.

- If ineligible at the effective date, the election fails even if timely filed.

Frequently Asked Questions About Form 8869

Is Form 8869 still current in 2025?

Yes, the December 2020 version remains the latest.

Does the QSub need its own EIN?

Yes, but write “Applied For” if pending.

What if the election is for multiple subsidiaries?

File separate forms or include details for each.

Can the election be revoked?

Generally no, without IRS consent; termination occurs automatically if eligibility ceases.

For the most accurate guidance, download Form 8869 and instructions directly from IRS.gov/Form8869. Always consult a qualified tax advisor, as individual circumstances vary.

This election can significantly streamline operations for S corporations with subsidiaries—ensure compliance to maximize benefits.