Table of Contents

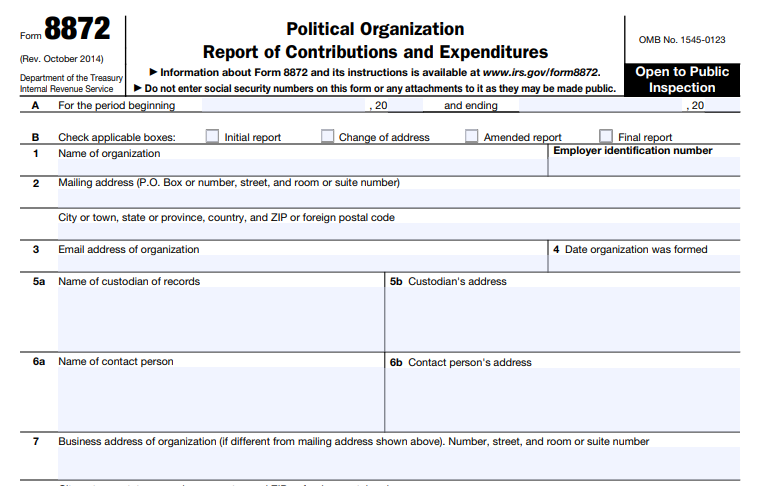

IRS Form 8872 – Political Organization Report of Contributions and Expenditures – is a key compliance document for tax-exempt political organizations under Section 527 of the Internal Revenue Code. These organizations—often political action committees (PACs), parties, or campaign committees—must file this form to disclose certain contributions and expenditures, promoting transparency in political financing.

As of 2025, filing requirements remain focused on electronic submission, with no major recent changes noted beyond mandatory e-filing established in prior years. This guide covers who must file, what to report, deadlines, and penalties, based on official IRS guidelines.

What Is IRS Form 8872?

Form 8872 is used by tax-exempt Section 527 political organizations to report:

- Contributions of $200 or more from any person in a calendar year (including name, address, occupation, and employer if an individual).

- Expenditures of $500 or more to any person in a calendar year (including name, address, amount, date, and purpose).

Organizations do not need to report independent expenditures in certain cases, and foreign addresses may not be entered in the electronic system.

The form ensures public disclosure of funding sources and spending for political activities, such as influencing elections or nominations.

Who Must File Form 8872?

Most tax-exempt Section 527 political organizations must file Form 8872 if they accept contributions or make expenditures for exempt functions during the year, unless an exception applies.

Exceptions include:

- Organizations not required to file Form 8871 (e.g., those already reporting to the FEC as political committees).

- Qualified state or local political organizations that report similar information under state law.

- Organizations with gross receipts under $25,000 (in some contexts tied to other filings).

Generally, organizations must first file Form 8871 (Notice of Section 527 Status) to claim tax-exempt status, and those required to file periodic reports use Form 8872.

IRS Form 8872 Download and Printable

Download and Print: IRS Form 8872

Filing Requirements and How to File

- Electronic Filing Mandatory: All Form 8872 reports must be filed electronically via the IRS website at IRS.gov/polorgs. Paper filings are not accepted for periods beginning after December 31, 2019.

- To file, use the username and password obtained after submitting Form 8871 and Form 8453-X.

- Organizations choose monthly or quarterly/semi-annual scheduling for the entire calendar year.

Form 8872 Deadlines for 2025 (Non-Election Year)

2025 is an odd-numbered, non-election year for federal purposes, so no pre- or post-election reports are required.

- Monthly Filers:

- Reports due by the 20th day after the end of each month.

- December report due January 31, 2026.

- First report starts in the month contributions or expenditures begin.

- Quarterly/Semi-Annual Filers:

- Mid-year report (Jan 1–Jun 30): Due July 31, 2025.

- Year-end report (Jul 1–Dec 31): Due January 31, 2026.

In even-numbered election years (e.g., 2026), additional pre- and post-general election reports apply, and monthly filers skip October/November regular reports.

What to Report on Form 8872

- Contributions: Aggregate $200+ per donor per year – include amount, date, donor details.

- Expenditures: Aggregate $500+ per recipient per year – include amount, date, purpose, recipient details.

- Reports cover only the specific period (monthly or quarterly).

Amended reports can be filed if needed, and a final report is required upon termination.

Penalties for Non-Compliance

Failure to file timely or accurately can result in penalties equal to the higher of $25,000 or a percentage (typically 21% for recent years) of unreported amounts. Late filing may also affect tax-exempt status.

Related Forms

- Form 8871: Initial notice for Section 527 status.

- Form 990/990-EZ: Annual information return for organizations with $25,000+ gross receipts.

- Form 1120-POL: Income tax return if taxable income exists (e.g., investment income).

For the latest forms and instructions, visit the official IRS page: About Form 8872.

This reporting promotes accountability in political funding. Consult a tax professional or the IRS for organization-specific advice, as requirements can vary. Public disclosures are searchable on the IRS website for transparency.