Table of Contents

IRS Form 8879-TE – IRS E-file Signature Authorization for a Tax Exempt Entity – Every nonprofit, private foundation, political organization, or trust that e-files a Form 990, 990-PF, 990-T, 1120-POL, 5227, 4720, 5330, or 8868 now relies on IRS Form 8879-TE — the official electronic signature authorization that has almost completely replaced the old paper Form 8453-TE.

For tax year 2024 returns filed in 2025, Form 8879-TE is the REQUIRED method when an Electronic Return Originator (ERO), paid preparer, or software provider transmits your exempt-organization return. This one-page form lets an authorized officer electronically sign the return and authorize direct debit payments — all without printing, scanning, or mailing anything to the IRS.

This SEO-optimized 2025 guide explains exactly who must use Form 8879-TE, deadlines, step-by-step completion, differences from 8453-TE, and how to avoid the most common (and expensive) mistakes.

What Is IRS Form 8879-TE?

Form 8879-TE, “IRS e-file Signature Authorization for a Tax Exempt Entity,” is the electronic equivalent of a wet-ink signature for exempt-organization returns. By signing it, an officer:

- Declares the return is true, correct, and complete

- Authorizes the ERO/transmitter to submit it to the IRS

- Authorizes electronic funds withdrawal (EFW) for any balance due or extension payment

The IRS never wants to see the signed 8879-TE — your ERO retains it for 3 years. The form is not mailed and is not attached to the e-filed return.

Who Must Use Form 8879-TE in 2025?

| Situation | Required Form |

|---|---|

| E-filing any 990 series, 990-T, 1120-POL, 5227, 4720, 5330, 8038-CP, or 8868 | 8879-TE |

| Using a paid preparer or software that transmits for you | 8879-TE |

| Self-preparing and self-transmitting (e.g., Tax990 direct e-file) | 8879-TE still required (officer signs electronically in software) |

| Paper filing (rare hardship waiver) | Form 8453-TE instead |

Key rule: If an ERO is involved in any way, you must use Form 8879-TE. Form 8453-TE is now limited to extremely rare cases where the IRS specifically requests a paper signature.

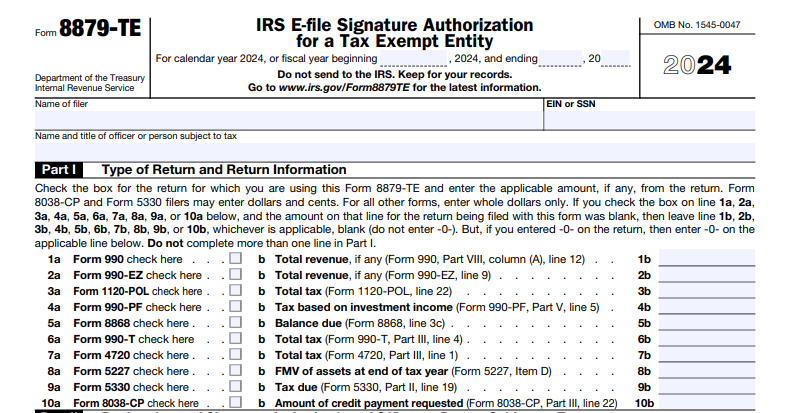

IRS Form 8879-TE Download and Printable

Download and Print: IRS Form 8879-TE

2025 Deadlines – Same as Your Return

| Return Type | Original Due Date (Calendar Year) | With Extension |

|---|---|---|

| Forms 990, 990-EZ, 990-PF, 990-T, 1120-POL | May 15, 2025 | Nov 17, 2025 |

| Form 5227 (Split-Interest Trust) | April 15, 2025 | Oct 15, 2025 |

| Forms 4720, 5330 | Varies by excise event | 6 months |

| Form 8868 extension payment | Same as original return date | N/A |

The 8879-TE must be signed before the return is transmitted.

Step-by-Step: How to Complete Form 8879-TE (2024 Form Used in 2025)

The 2024 form is current as of February 2025)

- Part I – Tax Return Information

- Line 1: Check the box for the form being filed (e.g., Form 990)

- Line 2: EIN and name of the organization

- Line 3: Total assets (from Form 990 Part X, line 16, column B)

- Line 4: Balance due or extension payment amount (if any)

- Part II – Declaration of Officer

- Officer prints name, title, and date

- Officer personally signs (wet ink or secure electronic signature in software)

- Checks box consenting to electronic funds withdrawal (if paying)

- Part III – Declaration of Electronic Return Originator (ERO)

- ERO firm name, PTIN, date, and signature

- ERO retains the completed form for 3 years

Most modern software (Tax990, ExpressTaxExempt, TurboTax Nonprofit, Thomson Reuters ONESOURCE) lets the officer sign electronically with a PIN or knowledge-based authentication — no printing required.

Form 8879-TE vs. Form 8453-TE – Quick Comparison

| Feature | 8879-TE (2025 Standard) | 8453-TE (Rare) |

|---|---|---|

| Electronic signature allowed | Yes | No (wet ink only) |

| Mailed to IRS | Never | Only if IRS requests |

| Used with paid preparer/ERO | Required | Not allowed |

| Direct debit authorization | Yes | Yes |

| Retention period | 3 years by ERO | 3 years by organization |

Bottom line: In 2025, 99% of filers will use 8879-TE.

Common Mistakes That Trigger IRS Rejections

- Officer signs after transmission → return rejected

- Wrong EIN or form type checked → immediate rejection

- Balance-due amount on line 4 doesn’t match the return → rejection + late-payment penalty

- Using old 8453-TE when ERO is involved → automatic rejection

- Not retaining signed copy → $280+ penalty if audited

Best Practices for 2025 Filings

- Sign 8879-TE the same day you approve the final return

- Use software with built for exempt orgs (Tax990, ExpressTaxExempt, File990) — they auto-generate and store the form

- If paying by EFW, verify bank info twice — bounced payments accrue 7% interest + penalties

- Keep the signed PDF in your permanent records (cloud + backup recommended)

- For board approval: Have the officer sign only after board review and vote

Conclusion: Make 8879-TE Your 2025 E-File Superpower

IRS Form 8879-TE is the simple, secure, and now-required way every tax-exempt entity authorizes its 2025 e-filings. One signature replaces mountains of paper, speeds processing to 24–48 hours for acknowledgments, and keeps you fully compliant with the Taxpayer First Act mandates.

Download the current form at → IRS.gov/Form8879TE

Top-rated e-file providers that handle 8879-TE automatically: Tax990, ExpressTaxExempt, File990.org

File by May 15, 2025 (or your extended deadline) — and let your officer sign electronically with confidence.

Last updated: December 2025 | Sources: IRS Form 8879-TE Instructions (2024), IR-2024-28 (Feb 2025 e-file expansion), Pub. 4163