Table of Contents

IRS Form 8880 – Credit for Qualified Retirement Savings Contributions – Saving for retirement just got a little more rewarding for low- and moderate-income taxpayers, thanks to the Saver’s Credit—a nonrefundable tax break that can slash up to $1,000 ($2,000 if married filing jointly) off your federal bill for contributions to IRAs, 401(k)s, or ABLE accounts. IRS Form 8880, Credit for Qualified Retirement Savings Contributions, is the key form to calculate and claim this incentive, making it easier than ever to turn your nest egg into immediate tax relief. With 2025 income limits rising to $39,500 for singles (up from $38,250 in 2024), more Americans qualify amid inflation pressures, but only about 5-6% of eligible filers claim it—leaving billions on the table annually.

This SEO-optimized guide, based on the official 2025 Form 8880 (Rev. November 2025) and IRS Publication 590-A (Contributions to Individual Retirement Arrangements), walks you through eligibility, step-by-step completion, deadlines, and strategies to maximize your credit. Whether you’re kickstarting a Roth IRA or maxing your 401(k), Form 8880 could deliver a 10%–50% match on up to $2,000 of contributions—effectively free money for your future. Download the 2025 PDF from IRS.gov and supercharge your savings today.

What Is IRS Form 8880?

Form 8880 is a one-page worksheet that helps eligible taxpayers compute the Saver’s Credit under Internal Revenue Code Section 25B, rewarding voluntary contributions to qualified retirement plans with a dollar-for-dollar reduction in tax liability. It’s nonrefundable (reduces tax owed to zero but no cash back) and stacks with deductions like traditional IRA contributions, potentially amplifying savings.

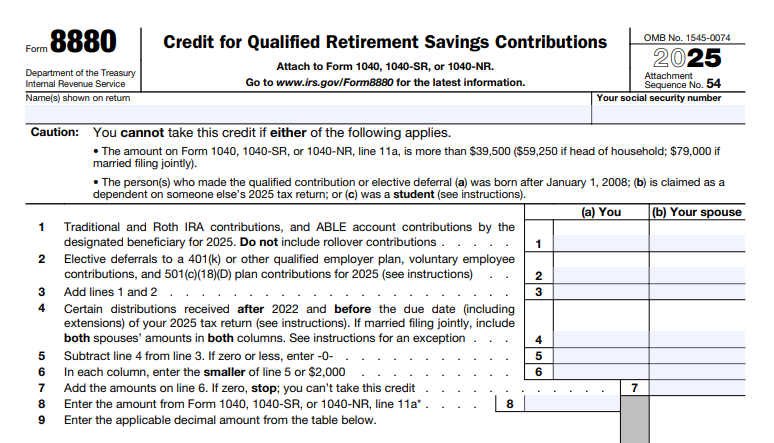

The form breaks down into:

- Part I: Eligible contributions (up to $2,000 per person; $4,000 joint).

- Part II: Adjusted gross income (AGI) check for phaseouts.

- Part III: Credit rate (10%–50%) and final amount.

- Credit Limit Worksheet: Ensures credit ≤ your tax liability.

For 2025, the draft form (released November 4, 2025) previews the Saver’s Match—a 50% government deposit into your account starting 2027 (up to $1,000)—but sticks to the traditional credit for now. Attach to Schedule 3 (Form 1040), line 4; no separate filing.

Key Fact: The credit applies to new money only—rollovers don’t count—and recent distributions (up to 3 prior years) reduce eligible amounts, so time withdrawals carefully.

Who Is Eligible for the Saver’s Credit Using Form 8880?

The Saver’s Credit targets low- to moderate-income workers saving for retirement—file Form 8880 if you meet these criteria:

- Age/Residency: Born before January 2, 2008 (age 18+); U.S. citizen/resident; not a dependent or full-time student.

- Contributions: Made to a traditional/Roth IRA, 401(k)/403(b)/457(b), SIMPLE/SARSEP, or ABLE account (if disability beneficiary).

- AGI Limits (2025): | Filing Status | Full Credit (50%) Up To | Partial (20%) Up To | Partial (10%) Up To | Ineligible Over | |————————|————————-|———————|———————|—————–| | Single/MFS | $23,750 | $25,750–$39,500 | N/A | $39,500 | | HoH/Qualifying Surviving Spouse | $35,625 | $38,625–$59,250 | N/A | $59,250 | | MFJ | $47,500 | $51,500–$79,000 | N/A | $79,000 |

- Max Credit: 50% of $2,000 ($1,000 single; $2,000 joint), but limited to your tax liability.

Exceptions: Full-time students (5+ months enrollment) or dependents can’t claim; distributions from the prior 3 years reduce eligible contributions (e.g., $1,000 2024 withdrawal cuts 2025 limit by $1,000). EITC-eligible folks often qualify too—stack for bigger refunds.

Step-by-Step Guide: How to Complete IRS Form 8880 for 2025

The 2025 Form 8880 is a concise one-pager—grab the draft PDF from IRS.gov and use tax software for auto-calculation. Gather W-2s, 5498s, and prior-year distributions.

1. Part I: Eligible Contributions (Lines 1–6)

- Line 1: Traditional/Roth IRA contributions (Form 5498, Box 1/10).

- Line 2: Elective deferrals to 401(k)/403(b)/457(b)/SIMPLE (W-2, Box 12 codes D/E/F/S).

- Line 3: ABLE contributions (if applicable).

- Line 4: Subtract recent distributions (e.g., 1099-R from 2022–2025).

- Line 5: Per-person limit ($2,000; sum for joint).

- Line 6: Total eligible (smaller of 4 or 5).

2. Part II: AGI and Rate (Lines 7–9)

- Line 7: AGI from Form 1040, line 11.

- Line 8: Filing status (single/MFS, HoH, MFJ).

- Line 9: Credit rate (50%/20%/10% based on AGI table above).

3. Part III: Credit Calculation (Lines 10–13)

- Line 10: Line 6 × line 9 rate.

- Line 11: Credit limit (your tax from Form 1040, line 16 minus other nonrefundables).

- Line 12: Smaller of 10 or 11.

- Line 13: Final credit (enter on Schedule 3, line 4).

Pro Tip: Use the Credit Limit Worksheet (instructions page 2) to cap against liability; software like TurboTax auto-fills from W-2s.

Deadlines and How to File Form 8880 for 2025

Attach Form 8880 to your 2025 Form 1040/SR/NR—due April 15, 2026 (or October 15 with Form 4868 extension). E-file via software (90%+ of returns) or paper mail to your IRS center.

- IRA Deadline: Contribute by April 15, 2026, for 2025 credit (postmark counts).

- No Separate Filing: Integrates with 1040; nonrefundable, so pay taxes first.

- Amended Returns: Use Form 1040-X with revised 8880 if AGI changes.

Refunds average 21 days for e-file/direct deposit.

Common Mistakes to Avoid When Filing Form 8880

Overlooking eligibility phases out 40% of claims—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| AGI Overestimation (Line 7) | Forgetting IRA deduction. | Subtract contributions first; use Pub. 590-A worksheet. | Ineligible; missed $1,000 credit. |

| Ignoring Distributions (Line 4) | Recent 401(k) withdrawals. | Subtract from 1099-Rs (last 3 years); time rollovers. | Reduced eligible amount. |

| Wrong Rate (Line 9) | Misreading phaseouts. | Use 2025 table; singles phase at $23,750–$39,500. | Underclaimed credit. |

| Student/Dependent Oversight | Claiming as full-time student. | Exclude if 5+ months enrolled or claimed dependent. | IRS disallowance + interest. |

| Not Stacking with EITC | Assuming mutual exclusion. | Both eligible; claim on Schedule 3. | Missed combo refund. |

| Late IRA Contribution | Missing April 15, 2026. | Postmark by deadline; designate for 2025. | Lost credit opportunity. |

Amend with 1040-X within 3 years; no penalty for good-faith errors.

2025 Updates and Special Considerations for Form 8880

The 2025 Form 8880 draft (Rev. Nov. 2025) previews SECURE 2.0 changes:

- Income Limits: Singles $39,500 (up $1,250); MFJ $79,000 (up $2,500); HoH $59,250 (up $1,875).

- Max Credit: $1,000 single/$2,000 joint (50% of $2,000/person).

- ABLE Inclusion: Disability beneficiaries qualify; limit $19,000.

- Saver’s Match Preview: 2027 shift to 50% deposit (up to $1,000)—Form 8880 for ABLE only post-2026.

- Nonrefundable: Reduces tax to $0; excess lost (no carryforward).

- Expats: FEIE reduces AGI, boosting eligibility.

Combine with IRA deduction ($7,000 limit) for double dip.

Final Thoughts: Maximize Your Retirement Boost with Form 8880 in 2025

IRS Form 8880 turns everyday retirement contributions into a powerful tax credit, offering up to 50% back on $2,000 for qualifying savers. With 2025 limits at $39,500 (single), contribute by April 15, 2026, and file by October 15 to claim—don’t miss out on this underused gem averaging $194 per claimant. Use Free File if AGI <$84,000 for guided prep.

Consult Pub. 590-A or a tax pro for distributions. This guide is informational; verify IRS.gov.

Not tax advice. Always use official IRS resources.

FAQs About IRS Form 8880

What is the 2025 Saver’s Credit income limit?

$39,500 single; $59,250 HoH; $79,000 MFJ.

Can I claim the Saver’s Credit with an IRA contribution in 2025?

Yes, up to $2,000 eligible; 50% credit if AGI ≤$23,750 (single).

Is the Saver’s Credit refundable in 2025?

No—nonrefundable; reduces tax to $0 but no cash beyond.

When does the Saver’s Match replace Form 8880?

2027 (filed 2028); 50% match up to $1,000 deposited directly.

IRS Form 8880 Download and Printable

Download and Print: IRS Form 8880