Table of Contents

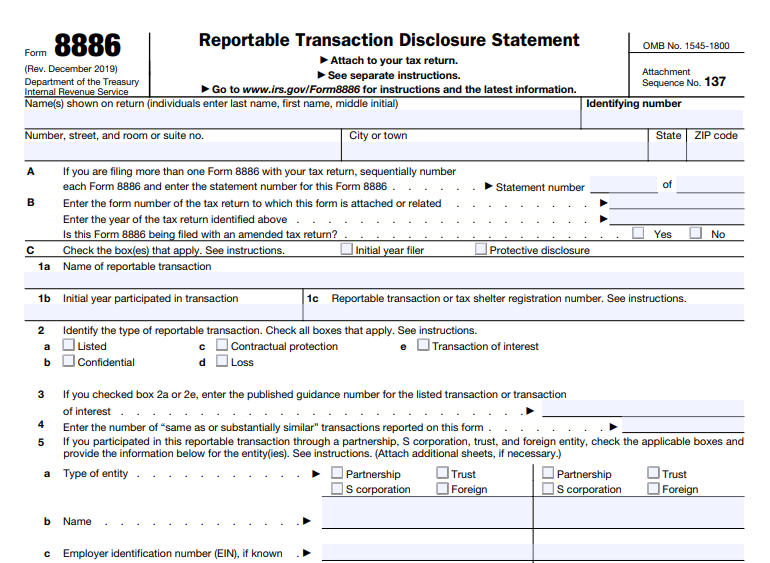

IRS Form 8886 – Reportable Transaction Disclosure Statement – IRS Form 8886, Reportable Transaction Disclosure Statement, is a critical compliance tool required by the Internal Revenue Service (IRS) for taxpayers participating in certain transactions that may have potential for tax avoidance. Filing this form promotes transparency and helps the IRS identify potentially abusive tax strategies. As of 2025, the requirements remain governed by Treasury Regulations section 1.6011-4, with the latest form revision from December 2019 and instructions from October 2022.

Understanding Form 8886 is essential for individuals, corporations, partnerships, and other entities to avoid significant penalties. This article covers what constitutes a reportable transaction, who must file, how to complete and submit the form, and recent updates.

What Is a Reportable Transaction?

A reportable transaction is any transaction that the IRS identifies as having a potential for tax avoidance or evasion. Taxpayers who participate in such transactions and file a U.S. tax return must disclose details using Form 8886.

The IRS defines five main categories of reportable transactions under Reg. § 1.6011-4:

- Listed Transactions — Transactions identical or substantially similar to those the IRS has specifically identified as tax avoidance schemes through notices, regulations, or other guidance.

- Transactions of Interest — Transactions that the IRS believes may have potential for abuse but lacks sufficient information to classify as listed (e.g., certain micro-captive insurance arrangements designated in 2025 final regulations).

- Confidential Transactions — Transactions offered under conditions of confidentiality.

- Transactions with Contractual Protection — Transactions where fees are refundable or contingent on the tax benefits being sustained.

- Loss Transactions — Transactions resulting in significant Section 165 losses exceeding thresholds (e.g., $2 million for corporations in a single year).

Note: The former “book-tax difference” category has been largely eliminated or modified in recent years.

Recent examples include partnership related-party basis-shifting transactions designated as transactions of interest in January 2025 final regulations, and updates to micro-captive insurance rules.

Who Must File Form 8886?

Any taxpayer (including individuals, trusts, estates, partnerships, S corporations, and C corporations) who participates in a reportable transaction and is required to file a federal tax return must disclose it.

- Participation includes direct involvement or allocation through pass-through entities (e.g., partners report their share of losses).

- Material advisors may have separate disclosure obligations on Form 8918.

- Protective disclosures are allowed if uncertainty exists about whether a transaction qualifies.

Form 8886 must be filed for each tax year in which participation occurs, even if benefits span multiple years.

IRS Form 8886 Download and Printable

Download and Print: IRS Form 8886

How to File IRS Form 8886

Filing Requirements

- Attach Form 8886 to your annual tax return (e.g., Form 1040, 1120, 1065).

- For the initial year of disclosure for a specific transaction, send a separate copy to the Office of Tax Shelter Analysis (OTSA).

- Fax option (ongoing as of 2025): 844-253-2553.

- Mail alternative: Internal Revenue Service, OTSA Mail Stop 4915, 1973 North Rulon White Boulevard, Ogden, Utah 84404.

- Electronic filing: If e-filing your return, ensure the OTSA copy matches exactly and uses the official form.

- Use the most current version available on IRS.gov

Key Information Required on Form 8886

- Description of the transaction and expected tax benefits.

- Identities of parties involved (promoters, advisors).

- Type of reportable transaction (check applicable boxes).

- Tax result protection details, if any.

- Detailed explanation allowing the IRS to understand the tax structure.

Incomplete disclosures (e.g., “information provided upon request”) are invalid.

For the latest form and instructions, visit IRS.gov/Form8886.

Penalties for Non-Compliance

Failure to properly file Form 8886 can trigger severe penalties under IRC Section 6707A:

- The penalty is 75% of the decrease in tax resulting from the transaction.

- Minimums: $5,000 for individuals; $10,000 for others.

- Maximums: $100,000 for individuals; $200,000 for others (higher for listed transactions: up to $200,000/$400,000).

- Additional accuracy-related penalties under Section 6662A may apply.

- The IRS may rescind penalties in cases of reasonable cause, especially if a late but complete disclosure is filed promptly.

Material advisors face separate penalties for non-disclosure.

Recent Updates and Changes (as of 2025)

- In January 2025, the IRS issued final regulations on micro-captive insurance transactions, classifying some as listed and others as transactions of interest.

- Certain basis-shifting transactions in partnerships were designated as transactions of interest.

- Ongoing fax option for OTSA copies (introduced temporarily but still available).

- No major form revisions since 2019, but always check IRS.gov for updates.

The IRS continues to refine reportable transaction rules following court decisions requiring Administrative Procedure Act compliance for designations.

Conclusion

Filing IRS Form 8886 is a proactive step to ensure compliance and avoid costly penalties when engaging in complex transactions. If you’re unsure whether a transaction qualifies as reportable, consider a protective filing or consult a tax professional. For official guidance, refer directly to IRS resources, including the Instructions for Form 8886 and Reg. § 1.6011-4.

Staying informed on reportable transactions helps maintain good standing with the IRS while navigating legitimate tax planning opportunities.