Table of Contents

IRS Form 8888 – Allocation of Refund – If you’re eagerly awaiting your federal tax refund, why settle for a single lump sum when you can strategically split it across multiple accounts? IRS Form 8888, officially known as the Allocation of Refund, empowers taxpayers to direct deposit their overpayment into up to three separate U.S. financial accounts—or even request a paper check for any remainder. This simple attachment to your Form 1040 (or 1040-SR, 1040-SS, or 1040-NR) can supercharge your financial planning, whether you’re boosting savings, funding retirement, or diversifying investments. In this comprehensive guide, we’ll break down everything about IRS Form 8888 for tax year 2025, including eligibility, step-by-step instructions, and key updates like the end of savings bond purchases.

With the IRS phasing out most paper refund checks starting September 30, 2025—to enhance security, accelerate processing, and reduce costs—direct deposit via Form 8888 is more essential than ever. Expect your refund in as little as 21 days with e-filing. Ready to maximize your refund? Let’s dive in.

What Is IRS Form 8888?

IRS Form 8888 is a one-page attachment that allows eligible taxpayers to allocate their federal income tax refund across multiple direct deposit accounts or a combination of deposits and a paper check. Introduced to streamline refund distribution, it eliminates the need for manual transfers between accounts post-refund.

Key Features of Form 8888:

- Split Refunds: Divide your refund into up to three portions for different accounts.

- Account Types: Includes checking, savings, IRAs, HSAs, Archer MSAs, Coverdell ESAs, mutual funds, brokerage firms, credit unions, or TreasuryDirect accounts.

- Minimum Deposit: $1 per account.

- No Fees: The IRS doesn’t charge for direct deposits, but check with your financial institution for any rules.

This form is ideal for families splitting refunds (e.g., one portion for emergencies, another for college savings) or individuals kickstarting retirement contributions.

Who Should File IRS Form 8888?

You should file Form 8888 if:

- You’re due a refund on your 2025 tax return (filed in early 2026).

- You want to direct deposit into two or more accounts, or mix deposits with a paper check.

- Your refund exceeds $1 per allocated account.

Who Should Not File:

- If depositing the entire refund into one account, use the direct deposit line on Form 1040 instead—no Form 8888 needed.

- Filers of Form 8379 (Injured Spouse Allocation) cannot use Form 8888 for multiple accounts or savings bonds.

- Amended returns (Form 1040-X) for tax years before 2021 don’t support Form 8888; for 2021 and later, it can be attached to e-filed amendments.

Joint filers must ensure accounts are in at least one spouse’s name, and financial institutions accept joint refunds into individual accounts.

Recent Changes to IRS Form 8888 for 2025

The 2025 revision (Rev. December 2025) reflects IRS modernization efforts:

- No More Savings Bonds: As of January 1, 2025, you can no longer use Form 8888 to purchase paper U.S. Series I savings bonds. Instead, buy them directly via TreasuryDirect.gov.

- Paper Check Phase-Out: Most refunds now require direct deposit; paper checks are limited to specific cases like rejected deposits.

- Electronic Focus: E-filing with Form 8888 ensures faster processing—up to 21 days versus weeks for paper.

These updates prioritize efficiency and security, aligning with Executive Order mandates for electronic payments. Always verify your financial institution’s direct deposit policies to avoid rejections.

Benefits of Using IRS Form 8888 to Allocate Your Refund

Splitting your refund isn’t just convenient—it’s smart money management. Here’s why taxpayers love it:

| Benefit | Description |

|---|---|

| Faster Access | Direct deposits hit accounts 1-3 weeks quicker than paper checks, especially post-2025 phase-out. |

| Financial Diversification | Allocate to high-yield savings (e.g., 4-5% APY), IRAs for tax advantages, or HSAs for medical expenses. |

| Goal-Oriented Saving | Direct funds toward debt payoff, emergencies, or education without temptation to spend. |

| Family Flexibility | Joint filers can split for individual goals, like one spouse’s Roth IRA and shared vacation fund. |

| No Extra Cost | Free service from the IRS; avoids bank transfer fees. |

In 2024, the average refund was $3,453—imagine growing that across accounts earning interest!

Step-by-Step Guide: How to Fill Out IRS Form 8888

Download the latest Form 8888 PDF from IRS.gov (Rev. December 2025). Use tax software like TurboTax for auto-population, or fill manually. Attach to your return—e-file for speed.

Preparation Tips:

- Gather routing (9 digits) and account numbers from a voided check.

- Establish accounts (e.g., IRA) beforehand; confirm eligibility limits (e.g., IRA contributions).

- Total allocations must match your refund exactly, or the IRS may default to the first account.

Line-by-Line Instructions:

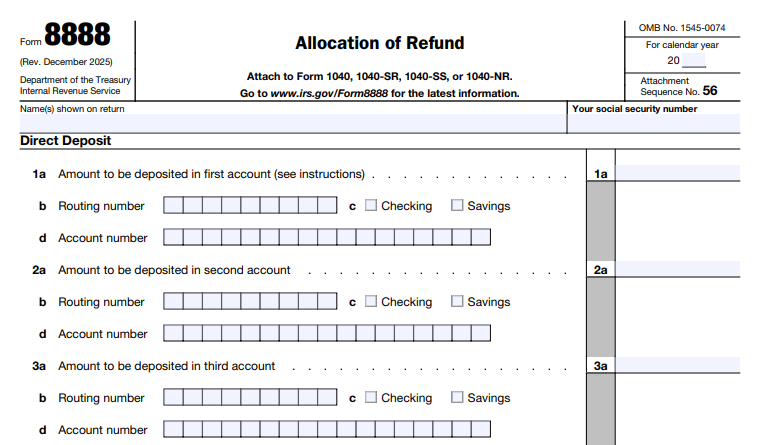

- Your Name and SSN: Enter as shown on Form 1040. For joint returns, list both spouses’ names and SSNs.

- Part I: Direct Deposits to Accounts (Lines 1-3 for up to 3 accounts)

- Line 1a: Amount to first account (min. $1).

- Line 1b: 9-digit routing number.

- Line 1c: Account number.

- Line 1d: Check “Checking” or “Savings.”

- Repeat for Lines 2 and 3.

- Part II: Savings Bonds (Discontinued for 2025—Skip or enter $0. Buy via TreasuryDirect.gov instead.)

- Part III: Check (Line 7): Amount for paper check (if any remainder).

- Part IV: Total Allocation (Line 8): Sum of Lines 1a, 2a, 3a, 4, 5a (if applicable), 6a, and 7. Must equal your Form 1040 refund line.

Pro Tip: Avoid erasures or white-outs—the IRS will reject and delay your refund. Double-check math; errors send everything to the first account.

IRS Form 8888 Download and Printable

Download and Print: IRS Form 8888

Filing IRS Form 8888: Deadlines and Tips

- When: Attach to your 2025 tax return, due April 15, 2026 (or October 15 with extension).

- How: E-file via IRS Free File, tax software, or mail with paper return.

- Tracking: Use “Where’s My Refund?” on IRS.gov after 24 hours for e-filed returns.

- Common Pitfalls: Mismatched totals or invalid routing numbers cause rejections—verify with your bank.

If filing Form 8888, skip bank products for fees paid from refunds in some software.

Frequently Asked Questions About IRS Form 8888

Can I Use Form 8888 for State Refunds?

No—state refunds follow separate processes. Form 8888 is federal only.

What If My Refund Changes Due to Audit or Offset?

Allocations adjust proportionally; offsets (e.g., debts) apply first to the total refund.

Can Non-Residents File Form 8888?

Yes, if filing Form 1040-NR and accounts are U.S.-based.

How Do I Amend If I Mess Up Form 8888?

File Form 1040-X; reattach corrected Form 8888 for 2021+ years.

Final Thoughts: Allocate Smartly with IRS Form 8888

IRS Form 8888 transforms your tax refund from a one-and-done windfall into a tailored financial boost. By splitting deposits into IRAs, HSAs, or high-interest savings, you’re not just getting money back—you’re building wealth. With 2025’s push toward electronic refunds, now’s the time to e-file and allocate strategically.

Download Form 8888 today at IRS.gov and consult a tax pro for personalized advice. Got questions? Check IRS.gov/Form8888 for the latest. Happy filing—and even happier refunding!