Table of Contents

IRS Form 8919 – Uncollected Social Security and Medicare Tax on Wages – In today’s gig economy, where the line between employee and independent contractor often blurs, many workers find themselves facing unexpected tax challenges. If you were treated as an independent contractor but believe you qualify as an employee, you could be missing out on proper Social Security and Medicare credits while owing uncollected taxes. Enter IRS Form 8919: Uncollected Social Security and Medicare Tax on Wages. This essential form helps misclassified workers report their share of these payroll taxes, ensuring compliance and protecting future benefits.

Whether you’re a freelancer, rideshare driver, or part-time worker, understanding Form 8919 is crucial for accurate tax filing. In this comprehensive guide, we’ll break down everything you need to know about IRS Form 8919, including eligibility, step-by-step instructions, and key updates for tax year 2025. Filed with your Form 1040, this form can prevent penalties and safeguard your retirement security.

What Is IRS Form 8919?

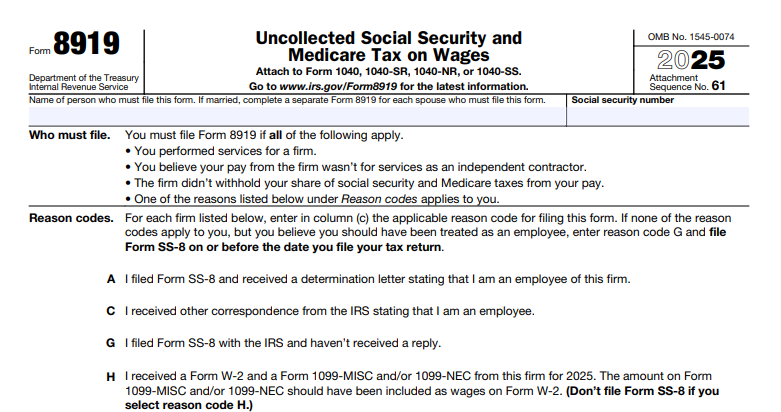

IRS Form 8919 is a one-page tax document designed to calculate and report an employee’s share of uncollected Social Security and Medicare taxes on wages that should have been withheld by an employer. Normally, employers deduct 6.2% for Social Security and 1.45% for Medicare from employee paychecks (with employers matching these amounts). However, if your employer misclassifies you as an independent contractor, they issue a Form 1099-NEC or 1099-MISC instead of a W-2, and no taxes are withheld.

By filing Form 8919, you self-report your portion of these taxes (totaling 7.65% of eligible wages) as an additional tax liability on your return. This not only settles your immediate tax obligation but also credits your earnings toward Social Security benefits and Medicare eligibility. According to the IRS, Form 8919 is specifically for “certain employees to report uncollected social security and Medicare taxes due on compensation.”

For tax year 2025, the form remains straightforward, but note the updated Social Security wage base limit of $176,100—up from $168,600 in 2024. Earnings above this cap are exempt from Social Security tax but still subject to Medicare tax.

Who Needs to File IRS Form 8919?

Not every 1099 recipient needs Form 8919—only those with a reasonable basis to claim employee status. You must file if all of the following apply:

- You performed services as an employee (based on IRS common-law rules, like having set hours, using employer tools, or working under direct supervision).

- Your employer treated you as an independent contractor and issued a Form 1099 for 2025 wages.

- You received no wages reported on a Form W-2 from that firm for the same services.

- You have a reasonable basis for believing you were an employee (more on this below).

If you worked for more than five such firms in 2025, you’ll need multiple Forms 8919 for lines 1–5 but complete the calculations only on one.

Reasonable Basis for Employee Status: The Four Reason Codes

To use Form 8919, select one of these IRS-approved reason codes (entered on the form) to justify your employee claim. No code fits? File Form SS-8 first for an official IRS determination (more on that later).

| Reason Code | Description | Example Scenario |

|---|---|---|

| A | You received a Form W-2 from this firm in a prior year for similar services. | A graphic designer got W-2s in 2024 but a 1099 in 2025 for the same role. |

| B | You received a Form W-2 from another firm for 2025 work that industry peers would classify as employment. | A consultant in your field typically gets W-2s, but your client issued a 1099. |

| C | The IRS previously determined you were an employee of this firm (via audit or Form SS-8). | A past IRS ruling reclassified your role. |

| D | You believe a court would rule you’re an employee based on facts and circumstances. | Extensive documentation shows employee-like control (e.g., required uniforms, schedules). |

Reason Code G (special case): Use if filing Form SS-8 with Form 8919, but submit SS-8 separately.

If none apply, don’t file Form 8919 without IRS guidance—misuse could trigger audits.

IRS Form 8919 download and printable

Download and print: IRS Form 8919

Step-by-Step Guide: How to Fill Out IRS Form 8919 for 2025

Form 8919 is divided into two main sections: employer-specific details (lines 1–5) and tax calculations (lines 6–13). Download the latest PDF from IRS.gov. Use tax software like TurboTax for guided entry, or complete manually.

Part I: Employer Information (Lines 1–5)

For each misclassifying employer:

- Column (a): Firm’s name.

- Column (b): Firm’s EIN (from 1099).

- Column (c): Reason code (A–D or G).

- Column (d): Total wages from 1099 (Box 1).

- Column (e): Any group-term life insurance exclusions (rare; usually $0).

- Column (f): Subtract (e) from (d); this is your taxable wages.

If over five employers, attach extra forms for lines 1–5 only.

Part II: Uncollected Social Security and Medicare Tax (Lines 6–13)

- Line 6: Total column (f) amounts (wages subject to tax). Report this on Form 1040, line 1 (or 1040-NR, line 1a). Also enter on Form 8959, line 3, if calculating Additional Medicare Tax.

- Line 7: Pre-filled with 2025 Social Security wage base: $176,100.

- Line 8: Total Social Security wages/tips from all W-2s (Box 3) + unreported tips (Form 4137) + railroad compensation.

- Line 9: Subtract line 7 from line 8 (excess wages not subject to SS tax).

- Line 10: Subtract line 9 from line 6 (SS-taxable portion of misclassified wages).

- Line 11: Multiply line 10 by 6.2% (your SS tax share).

- Line 12: Multiply line 6 by 1.45% (your Medicare tax share). If wages + other income exceed $200,000 (single), use Form 8959 for extra 0.9%.

- Line 13: Add lines 11 + 12. This total goes to Schedule 2 (Form 1040), line 13 as additional tax.

Pro Tip: Double-check math—errors here affect your refund or balance due. For RRTA (railroad) workers, cap line 8 at the wage base.

Filing Deadlines and How to Submit Form 8919

Attach Form 8919 to your Form 1040 (or 1040-SR/1040-NR) and file by April 15, 2026, for 2025 taxes (extensions available via Form 4868). E-file via IRS Free File, tax software, or a preparer for faster processing. Paper filers mail to your regional IRS center (addresses in Form 1040 instructions).

Pay any tax due with your return to avoid penalties. If you owe over $1,000, consider an installment agreement via IRS.gov.

Common Mistakes to Avoid When Filing IRS Form 8919

- Wrong Reason Code: Pick one that fits; otherwise, file Form SS-8 first.

- Overstating Wages: Exclude non-taxable items like reimbursements.

- Forgetting Form 8959: Required if total income triggers Additional Medicare Tax.

- Multiple Calculations: Do lines 6–13 on only one form.

- No Documentation: Keep 1099s, contracts, and work logs for audits.

What Is Form SS-8, and When Should You File It?

If no reason code applies or you want an official ruling, submit Form SS-8: Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. This free form prompts the IRS to review your relationship with the firm (can take 6+ months). File it before or with Form 8919, but don’t attach it to your return—mail separately to: IRS, Attn: SS-8, Cooley Law School Coop, 300 S. Capitol Ave., Lansing, MI 48933.

A favorable SS-8 ruling credits your record retroactively and may shift liability to the employer.

2025 Updates and Recent Changes to IRS Form 8919

The core structure of Form 8919 hasn’t changed significantly, but the Social Security wage base increased to $176,100 for 2025, automatically updating line 7. No major legislative shifts affect the form per IRS post-release notes, though broader tax reforms (e.g., from the One Big Beautiful Bill) may indirectly impact related deductions. Always check IRS.gov for drafts or corrections.

Why Filing IRS Form 8919 Matters: Protect Your Benefits and Avoid Penalties

Misclassification isn’t just a paperwork issue—it erodes your Social Security earnings record, potentially reducing retirement benefits or disability claims. By filing Form 8919, you ensure proper crediting while paying only your share (the employer owes the rest). Plus, it flags the issue for IRS review, which could lead to back taxes from your employer.

Failure to file when required can result in underpayment penalties (up to 20% of unpaid tax) and interest. In 2025, with rising gig work, proactive filing is key.

Final Thoughts: Take Control of Your Tax Situation with IRS Form 8919

Navigating uncollected Social Security and Medicare tax on wages doesn’t have to be overwhelming. IRS Form 8919 empowers you to correct misclassification errors, comply with tax laws, and secure your financial future. If your situation involves multiple employers or complex facts, consult a tax professional or use IRS resources like the Taxpayer Advocate Service.

Ready to file? Download Form 8919 from IRS.gov and start today. For personalized advice, visit a VITA site or call the IRS at 800-829-1040.

This article is for informational purposes only and not tax advice. Consult a qualified professional for your specific situation. Sources updated as of December 2025.