Table of Contents

IRS Form 8936 – Clean Vehicle Credits – As electric vehicles (EVs) and plug-in hybrids continue to reshape the automotive landscape, the federal clean vehicle tax credit remains a powerful incentive for eco-conscious buyers and businesses alike. Up to $7,500 for new EVs, $4,000 for used ones, or $40,000 for commercial heavy-duty vehicles, these credits can significantly offset costs—but only if you file correctly. Enter IRS Form 8936, Clean Vehicle Credits, the essential tool for calculating and claiming these benefits under Sections 25E, 30D, and 45W of the Internal Revenue Code.

With the credits set to expire for vehicles acquired after September 30, 2025—thanks to the One Big Beautiful Bill (OBBB) signed into law on July 4, 2025—time is of the essence. This SEO-optimized guide dives into Form 8936 for tax year 2025, covering eligibility, step-by-step filing, and tips to avoid pitfalls. Whether you’re a Tesla enthusiast or fleet manager, learn how to maximize your EV tax credit before the deadline hits.

Note: Vehicles acquired via a binding contract and payment by September 30, 2025, qualify even if placed in service later. After that date, no credits apply.

What Is the Clean Vehicle Credit?

The Clean Vehicle Credit encourages adoption of low-emission vehicles through tax incentives. Expanded by the 2022 Inflation Reduction Act (IRA) and curtailed by the 2025 OBBB, it covers:

- New Clean Vehicle Credit (Section 30D): Up to $7,500 for qualifying new EVs, plug-in hybrids, or fuel cell vehicles (FCVs) placed in service after 2022.

- Previously Owned Clean Vehicle Credit (Section 25E): Up to $4,000 (or 30% of sale price) for used qualifying vehicles bought from a dealer.

- Qualified Commercial Clean Vehicle Credit (Section 45W): Up to $7,500 (or $40,000 for vehicles ≥14,000 lbs GVWR) for businesses, tax-exempts, or governments depreciating clean vehicles.

Form 8936 aggregates these credits, while Schedule A (Form 8936) calculates the amount per vehicle. The personal portion is nonrefundable (offsets tax liability but no cash back), but business credits carry forward via Form 3800. Transferring the credit to a dealer provides instant savings at purchase.

For the latest qualified models, check the IRS list at IRS.gov/CleanVehicles or FuelEconomy.gov.

Who Qualifies for IRS Form 8936 Credits?

Eligibility hinges on vehicle specs, income, and acquisition timing. You must file Form 8936 if claiming or transferring credits—mandatory for transfers to reconcile on your return.

Key Requirements

- Acquisition Deadline: Binding contract and payment by September 30, 2025.

- U.S. Use: Primarily in the United States (exceptions for certain off-road).

- No Resale Intent: Not bought for quick flip (30-day resale voids credit).

- Dealer Reporting: Sellers must submit VIN and details via IRS Energy Credits Online (ECO) portal within 3 days of possession.

Income Limits for Individuals (Modified AGI from 2024 or 2025)

Use Part I of Form 8936 to calculate modified AGI (add back foreign income exclusions, etc.).

| Filing Status | New Clean Vehicle | Previously Owned |

|---|---|---|

| Single/Filing Separately | $150,000 | $75,000 |

| Married Filing Jointly/QSS | $300,000 | $150,000 |

| Head of Household | $225,000 | $112,500 |

No AGI limits for commercial credits or non-individual filers. Exceed limits? Zero personal credit; repay transferred amounts.

Vehicle Eligibility: Does Yours Qualify?

Confirm via the seller’s time-of-sale report (required post-2023). All vehicles need ≥7 kWh battery (≥15 kWh for most commercial), external recharge, and North American final assembly (for new).

New Clean Vehicles (Section 30D)

- MSRP: ≤$55,000 (≤$80,000 for vans/SUVs/pickups).

- GVWR: <14,000 lbs.

- No Foreign Entity of Concern (FEOC) components.

- Examples: 2025 Tesla Model 3, Chevrolet Bolt EUV (check monthly updates).

Previously Owned Clean Vehicles (Section 25E)

- Sale price: ≤$25,000.

- Model year: ≥2 years prior to purchase.

- First post-IRA transfer from a dealer; no prior credit in 3 years.

- Examples: Used 2022 Nissan Leaf under $25K.

Qualified Commercial Clean Vehicles (Section 45W)

- Depreciable or leased by tax-exempts.

- Incremental cost safe harbor: $7,500 for 2025 qualifiers <14,000 lbs GVWR.

- Higher caps for heavy-duty (e.g., electric semis).

- Tax-exempts elect direct payment as refund.

Leased personal vehicles? Lessor claims commercial credit; you get reduced lease payments.

Step-by-Step: How to Complete IRS Form 8936

Download the 2025 Form 8936 and Schedule A from IRS.gov. Use one Schedule A per vehicle. Tax software automates much of this.

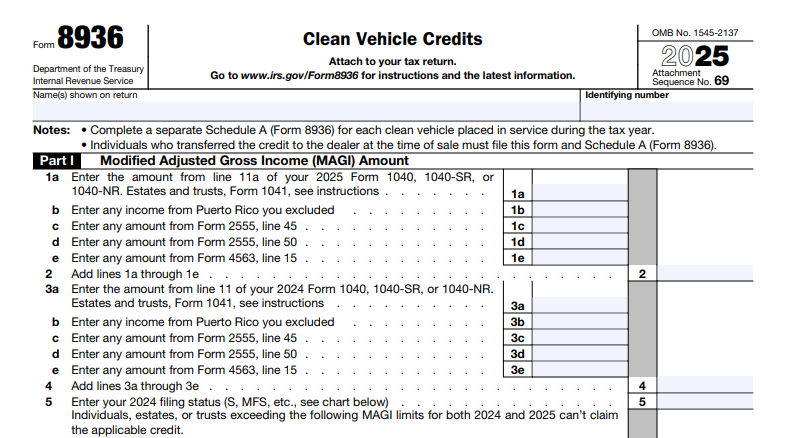

Part I: Modified AGI

- Line 1–3: AGI from Form 1040 (or 2024 return if lower).

- Line 4–5: Add exclusions (e.g., foreign earned income).

- Line 6: Total modified AGI—compare to limits.

Part II: Business/Investment Use – New Clean Vehicles

- Line 5: Tentative credit from Schedule A (up to $7,500).

- Line 6: From pass-through entities (K-1).

- Line 7–8: Total; report on Form 3800.

Part III: Personal Use – New Clean Vehicles

- Line 10: Schedule A personal amount.

- Line 11–12: Total nonrefundable credit; enter on Schedule 3 (Form 1040), line 6.

Part IV: Previously Owned Clean Vehicles

- Line 14: Credit from Schedule A (≤$4,000).

- Line 15–16: Nonrefundable; to Schedule 3.

Part V: Qualified Commercial Clean Vehicles

- Line 19: From Schedule A.

- Line 20–21: To Form 3800 as general business credit.

Schedule A: Per-Vehicle Calculation

- Part I: VIN, year/make/model, in-service date, transfer yes/no.

- Parts II/III: New vehicles—prorate business % (miles or time).

- Part IV: Used—confirm price, no prior claims.

- Part V: Commercial—basis minus Section 179, apply 15%/30% rate.

Basis Adjustment: Reduce vehicle’s depreciable basis by claimed/transferred credit.

Transferring Your Clean Vehicle Credit: Instant Savings Option

For new or used vehicles post-2023, elect to transfer up to the full credit to a registered dealer for upfront discount. Benefits:

- No waiting for tax time.

- Dealer gets reimbursed by IRS.

File Form 8936/Schedule A anyway to verify eligibility. If AGI exceeds limits or vehicle disqualifies, repay the dealer (reported as income). Portal registration closes September 30, 2025.

Common Mistakes with IRS Form 8936 and How to Avoid Them

- Missing Dealer Report: No report = no credit. Request copy at sale.

- AGI Errors: Use the lower of 2024/2025 AGI; includes trusts/estates.

- Post-Deadline Purchases: Acquisition means contract + payment by 9/30/25.

- Double-Dipping: Can’t claim new and commercial on one vehicle.

- No Proration: Adjust business use for partial years.

- Recapture Oversight: Report changes (e.g., resale) on future returns.

Consult IRS FAQs on returns/cancellations for transfer reversals.

FAQs: IRS Form 8936 Clean Vehicle Credits

Q: Can I claim the credit for a leased EV?

A: Personal leases: No direct claim. Commercial leases: Lessor claims; you benefit via lower payments.

Q: What’s the 2025 filing deadline?

A: April 15, 2026 (or extension) for 2025 returns. Credits for pre-10/1/25 acquisitions.

Q: Do fuel cell vehicles qualify?

A: Yes, if hydrogen-powered and meeting other rules.

Q: Where’s the qualified vehicles list?

A: IRS.gov/CleanVehicles—updated monthly.

Wrapping Up: Secure Your Clean Vehicle Credit Before It’s Gone

IRS Form 8936 is your gateway to substantial savings on clean vehicles in 2025, but the September 30 acquisition cutoff looms large. From income checks to VIN verification, proper filing ensures compliance and maximizes benefits. With the OBBB ending these IRA-era incentives early, now’s the time to buy, transfer, and claim.

For personalized advice, consult a tax professional. Visit IRS.gov/Form8936 for forms, instructions, and ECO portal access. Drive green—save big—before the credits sunset!

This article provides general information based on 2025 IRS guidance and is not tax advice. Always verify with official sources.

IRS Form 8936 Download and Printable

Download and Print: IRS Form 8936