Table of Contents

IRS Form 8936 (Schedule A) – Clean Vehicle Credit Amount – In an era of rising fuel costs and environmental awareness, electric vehicles (EVs) and other clean vehicles offer not just eco-friendly driving but also significant tax savings. The IRS Form 8936 Clean Vehicle Credit is your key to unlocking up to $7,500—or more for businesses—through the federal clean vehicle tax credit. But if you’re transferring the credit to a dealer at purchase or claiming it on your return, you’ll need Schedule A (Form 8936) to calculate the exact amount. This guide breaks down everything you need to know about IRS Form 8936 Schedule A for tax year 2025, helping you maximize your EV tax credit while staying compliant.

Whether you’re eyeing a new Tesla, a used Nissan Leaf, or a commercial fleet van, understanding Schedule A ensures you don’t miss out. Note: These credits apply only to vehicles acquired by September 30, 2025—meaning a binding contract and payment by that date. After that, no credits are available.

What Is the Clean Vehicle Credit?

The Clean Vehicle Credit under Internal Revenue Code Sections 25E, 30D, and 45W rewards buyers of qualifying EVs, plug-in hybrids, and fuel cell vehicles. Introduced and expanded by the Inflation Reduction Act, it incentivizes low- or zero-emission transportation. There are three main types:

- New Clean Vehicle Credit: Up to $7,500 for new qualifying vehicles placed in service after 2022.

- Previously Owned Clean Vehicle Credit: Up to $4,000 (or 30% of the sale price) for used vehicles bought from a dealer.

- Qualified Commercial Clean Vehicle Credit: Up to $7,500 (or $40,000 for heavier vehicles) for businesses and tax-exempt organizations.

Form 8936 computes your total credit, while Schedule A details the calculation per vehicle. You must file both if you transferred the credit to a dealer (reducing your purchase price at sale) or are claiming it directly. Businesses report it as a general business credit on Form 3800.

Who Must File IRS Form 8936 Schedule A?

Not everyone needs Schedule A—it’s required if:

- You elected to transfer the credit to a registered dealer, getting an upfront discount equal to the credit amount.

- You’re a partnership or S corporation claiming the credit.

- You’re an individual, estate, or trust using the vehicle for personal or business purposes.

- You’re a tax-exempt entity electing elective payment (treated as a refund).

If your only credit comes from a pass-through entity (like a K-1), you may skip filing but must report on Form 3800. Always attach Schedule A to your 2025 tax return if transferring—failure to do so could trigger repayment to the dealer.

Income Limits (Modified AGI for 2024 or 2025): | Filing Status | New Clean Vehicle | Previously Owned | |—————————-|——————-|——————| | Single | $150,000 | $75,000 | | Married Filing Jointly | $300,000 | $150,000 | | Head of Household | $225,000 | $112,500 |

Exceeding these? You may owe back the transferred amount.

Vehicle Eligibility: Do You Qualify?

Before tackling Schedule A, confirm your vehicle fits. All must be acquired and placed in service (i.e., possessed) by September 30, 2025, for 2025 eligibility. Key requirements:

New Clean Vehicles

- Battery capacity: ≥7 kWh, externally rechargeable.

- GVWR: <14,000 lbs.

- MSRP: ≤$55,000 (≤$80,000 for vans/SUVs/pickups).

- Final assembly: North America.

- No components from Foreign Entities of Concern (FEOCs).

- Fuel cell option: Hydrogen-powered, same MSRP/assembly rules.

Previously Owned Clean Vehicles

- Model year: ≥2 years before purchase.

- Sale price: ≤$25,000.

- First transfer to you since August 16, 2022; from a dealer.

- Battery: ≥7 kWh; GVWR <14,000 lbs.

- No prior claim in last 3 years; you’re not a dependent.

Qualified Commercial Clean Vehicles

- Battery: ≥15 kWh (≥7 kWh if GVWR <14,000 lbs) or fuel cell.

- Depreciable (or leased by tax-exempts).

- For streets/highways or off-road machinery.

- 2025 Safe Harbor: $7,500 incremental cost for most vehicles <14,000 lbs GVWR (non-compact PHEVs).

Check fueleconomy.gov for qualified models. Dealers must provide a time-of-sale report with VIN, battery capacity, and max credit—submit via IRS Energy Credits Online (ECO) portal.

IRS Form 8936 (Schedule A) Download and Printable

Download and Print: IRS Form 8936 (Schedule A)

Step-by-Step Guide: How to Fill Out Schedule A (Form 8936)

Download the 2025 forms from IRS.gov. Complete one Schedule A per vehicle. Here’s a line-by-line walkthrough.

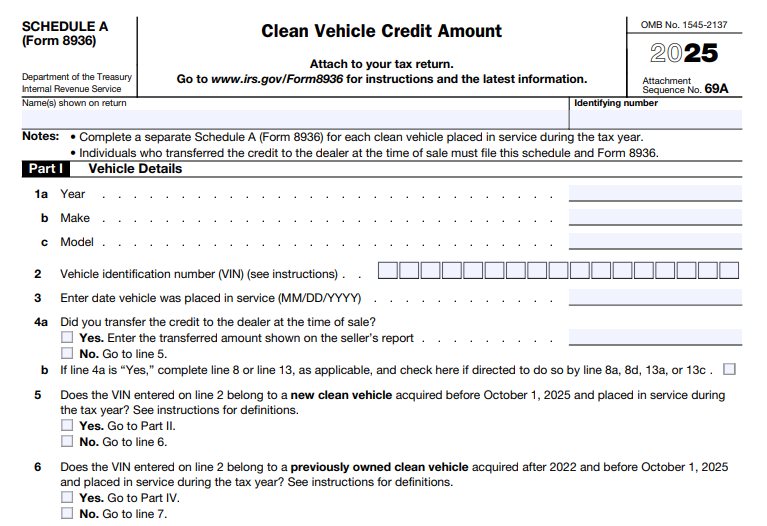

Part I: Vehicle Details

Gather your docs: VIN, purchase date, seller’s report.

- Line 1: Year, make, model.

- Line 2: 17-character VIN.

- Line 3: Date placed in service (possession date).

- Line 4: Credit transferred? Enter “Yes” and amount; report on Schedule 2 (Form 1040), line 1b if needed.

- Lines 5–7: Check “Yes” for your vehicle type (new, used, or commercial). Only one per Schedule A.

Tip: If resold within 30 days, no credit allowed.

Part II: Business/Investment Use for New Clean Vehicles

For the business portion (e.g., fleet or reimbursed employee use).

- Line 9: Tentative credit from seller’s report (up to $7,500).

- Line 10: Business % (business miles/total miles; prorate for partial-year use). Example: 50% business for 6 months = 25%.

- Line 11: Line 9 × Line 10. Carry to Form 8936, Part II.

Part III: Personal Use for New Clean Vehicles

Only if mixed use.

- Line 12: Line 9 minus Line 11. Carry to Form 8936, Part III (nonrefundable personal credit).

AGI Check: Verify limits in Form 8936, Part I. Exceed? Zero credit.

Part IV: Previously Owned Clean Vehicles

- Lines 13a–13g: Confirm no resale, AGI limits, no prior claim, price ≤$25,000, for your use, not a dependent.

- Line 14: Sale price.

- Line 15: 30% of Line 14.

- Line 16: Lesser of Line 15 or $4,000.

- Line 17: Line 16. Carry to Form 8936, Part IV.

Part V: Qualified Commercial Clean Vehicles

For businesses/tax-exempts.

- Line 18a: Elective payment number (if applicable).

- Lines 18b–18e: Confirm depreciable, for use/lease, power source (30% if zero-emission), GVWR.

- Line 19: Basis (purchase price).

- Line 20: Subtract Section 179 deduction (Form 4562).

- Line 23: Incremental cost ($7,500 safe harbor for 2025 qualifiers).

- Lines 24–25: 15% (or 30%) of adjusted basis, lesser of that or Line 23; cap at $7,500 ($40,000 for heavy vehicles).

- Line 26: Final credit. Carry to Form 8936, Part V.

Basis Reduction: Subtract claimed/transferred credit from vehicle’s depreciable basis.

Common Mistakes to Avoid When Filing Schedule A

- Missing Seller’s Report: No report = no credit. Ensure dealer submitted via ECO.

- Wrong Vehicle Type: Can’t double-dip (e.g., new and commercial).

- AGI Miscalculation: Use the lower of current/prior year AGI; includes foreign exclusions.

- Partial-Year Proration: Forget to adjust business % for mid-year changes.

- Post-9/30/2025 Purchases: Zero credit—plan ahead.

- No Recapture: If use changes (e.g., business to personal), report on next return.

FAQs About IRS Form 8936 Schedule A

Q: Can I transfer the credit and still file Schedule A?

A: Yes—transferring gives instant savings, but file to reconcile. Repay if ineligible later.

Q: What’s the deadline for 2025 credits?

A: Acquire by September 30, 2025; file with your 2025 return (due April 2026).

Q: Leased vehicles qualify?

A: Yes, for commercial credits if lessor passes it through; personal leases don’t.

Q: Where do I get forms?

A: IRS.gov/forms-pubs/about-form-8936. Use tax software for auto-calculation.

Final Thoughts: Claim Your Clean Vehicle Credit Today

IRS Form 8936 Schedule A simplifies claiming your clean vehicle credit, turning green driving into real savings. With credits sunsetting after September 30, 2025, act fast—buy, transfer, and file correctly to avoid pitfalls. Consult a tax pro for complex cases, and visit IRS.gov/CleanVehicles for VIN lookups and updates. Drive clean, save green!

This article is for informational purposes only and not tax advice. Always refer to official IRS guidance.