Table of Contents

IRS Form 8946 – PTIN Supplemental Application For Foreign Persons Without a Social Security Number – In an increasingly global tax preparation landscape, where over 1.5 million paid preparers filed U.S. returns in 2024, foreign professionals seeking to serve U.S. clients face a unique hurdle: obtaining a Preparer Tax Identification Number (PTIN) without a Social Security Number (SSN). IRS Form 8946, PTIN Supplemental Application for Foreign Persons Without a Social Security Number, is the essential document that verifies identity and foreign status, enabling non-U.S. residents to apply for a PTIN and legally prepare federal tax returns for compensation. As the IRS released the updated Form 8946 (Rev. October 2025) in late 2024, with enhanced requirements for two forms of ID and streamlined online uploads, this form remains a gateway for international tax experts—yet incomplete submissions delay PTIN issuance by 4–6 weeks.

This SEO-optimized guide, based on the official 2025 Form 8946 instructions and IRS Publication 1345 (Handbook for Authorized e-file Providers), covers the form’s purpose, eligibility, step-by-step completion, deadlines, and tips for success. Whether you’re a Canadian accountant targeting U.S. expats or a U.K.-based consultant, Form 8946 unlocks access to the $14 billion PTIN market—file it alongside Form W-12 by January 31, 2026, to prepare for the 2025 filing season. Download the 2025 PDF from IRS.gov and get certified today.

What Is IRS Form 8946?

Form 8946 is a supplemental application required for foreign persons—non-U.S. citizens or non-resident aliens—who cannot obtain an SSN and wish to apply for a PTIN to prepare U.S. federal tax returns for compensation. Since 2011, all paid preparers must use a PTIN instead of an SSN on returns, and Form 8946 establishes identity and foreign status when an SSN is unavailable, preventing unauthorized practice.

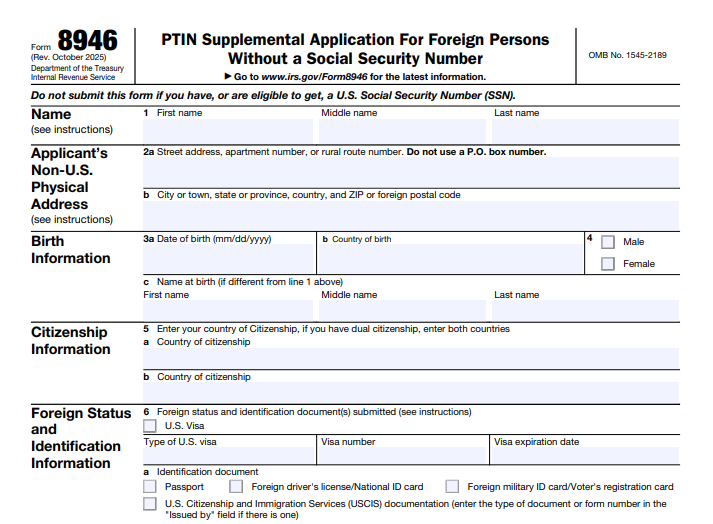

The one-page form (OMB No. 1545-2189) collects:

- Personal details (name, address, date of birth).

- Confirmation of SSN ineligibility (e.g., SSA denial letter).

- Two forms of ID (e.g., passport, driver’s license) with document numbers/expiration dates.

- Certification under perjury.

For 2025 (Rev. October 2025), updates include mandatory online uploads for ID documents via the PTIN account and a $35.95 renewal fee (up from $30.25 in 2024), with applications processed in 4–6 weeks. Submit with Form W-12 (PTIN Application) to IRS, Austin, TX—no e-file for the form itself. A PTIN is valid through December 31 annually and must be renewed yearly.

Key Fact: Foreign preparers without a PTIN face fines up to $100 per return and potential criminal penalties for unauthorized practice—Form 8946 is the compliant path forward.

Who Must File Form 8946?

Form 8946 is required for foreign persons—non-U.S. citizens or non-resident aliens—who are ineligible for an SSN and seek a PTIN to prepare U.S. tax returns for compensation. This includes:

- International Tax Professionals: Accountants, consultants, or bookkeepers abroad preparing U.S. returns for clients.

- Non-Resident Aliens: Those with a permanent non-U.S. address and no SSN eligibility.

- U.S. Citizens with Religious Objection: Who refuse SSNs on conscientious grounds (use Form 8945 instead, but similar process).

Eligibility Criteria:

- No SSN and SSA confirmation of ineligibility (attach denial letter).

- Preparing returns for compensation (volunteers exempt).

- Not a U.S. citizen or resident alien (per Sec. 7701(b)(1)(A)).

Exceptions:

- U.S. residents/citizens with SSNs: Apply via Form W-12 only.

- Pending SSN: Wait for issuance; don’t file 8946.

- Volunteers: No PTIN needed.

File once for initial PTIN; renew annually via W-12 ($35.95 fee).

Step-by-Step Guide: How to Complete IRS Form 8946 for 2025

The 2025 Form 8946 is a one-page PDF—download from IRS.gov and complete alongside Form W-12. Use black ink; scan IDs for upload.

1. Header: Personal Information

- Name: Full legal name as on passport.

- Mailing Address: Foreign address (no P.O. box if possible).

- Date of Birth: MM/DD/YYYY.

- Country of Citizenship: Non-U.S. nation.

2. Line 1: SSN Ineligibility

- Confirm “I am not eligible for an SSN.”

- Attach SSA denial letter (if available) or explain ineligibility.

3. Line 2: Identity Documents

- List two forms of ID (e.g., passport, national ID, driver’s license).

- Include document type, number, and expiration date for each.

- Scan/notarize copies; upload via PTIN account or mail originals (returned).

4. Line 3: Certification

- Check “I am a foreign person” (non-U.S. citizen/resident).

- Sign/date under perjury.

Pro Tip: Mail with W-12 and $35.95 fee to IRS, Austin, TX 73301-0045; allow 4–6 weeks. Online PTIN account enables ID upload for faster processing.

Deadlines and How to File Form 8946 for 2025

Submit Form 8946 with your initial PTIN application (Form W-12)—no fixed deadline, but renew PTIN by December 31, 2025, for 2026 use. Processing takes 4–6 weeks; apply early for January 2026 filing season.

- Initial: Anytime; PTIN issued upon approval.

- Renewal: Annually by year-end ($35.95 fee).

- Mailing: IRS, Austin, TX 73301-0045; certified mail for tracking.

- Online: Create PTIN account at irs.gov/ptin; upload IDs.

No extensions; late PTIN bars compensated preparation (fines $100+ per return). Retain copies/IDs 3 years.

Common Mistakes to Avoid When Filing Form 8946

Incomplete apps delay 30% of foreign PTINs—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Missing ID Documents | Forgetting two forms. | Scan passport + national ID; note numbers/expirations. | Rejection; 4–6 week delay. |

| No SSA Denial Letter | Assuming not needed. | Attach if available; explain ineligibility. | Application denied. |

| U.S. Address Use | Listing temporary U.S. mailing. | Use permanent foreign address. | Status misclassification. |

| No Certification (Line 3) | Omitting foreign person check. | Confirm non-U.S. citizen/resident. | Ineligible PTIN. |

| Late Renewal | Missing Dec. 31. | Renew annually; $35.95 fee. | Fines $100+/return. |

| Wrong Submission | Mailing without W-12. | Bundle with W-12 and fee. | Incomplete application. |

Refile if rejected; no penalty for good-faith.

2025 Updates and Special Considerations for Form 8946

The 2025 Form 8946 (Rev. October 2025) streamlines for digital:

- OMB No.: 1545-2189; Cat. No. 37764H.

- ID Uploads: Online PTIN account mandatory for scans.

- Fee: $35.95 renewal (up $5.70); initial same.

- Processing: 4–6 weeks; track via PTIN account.

- Religious Objection: Use Form 8945 for U.S. citizens.

- ITIN Holders: Ineligible unless proving foreign status.

- Penalties: $100+ per unauthorized return.

For multi-year prep, renew timely; states may require separate IDs.

Final Thoughts: Unlock U.S. Tax Prep Opportunities with Form 8946 in 2025

IRS Form 8946 empowers foreign tax professionals to obtain a PTIN without an SSN, opening doors to the lucrative U.S. market. For 2025, gather two IDs, confirm ineligibility, and submit with W-12 by December 31—processing in 4–6 weeks positions you for the 2026 season. With $35.95 fees and online uploads, it’s easier than ever.

Consult Pub. 1345 or IRS at 1-877-613-7846. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 8946

What is Form 8946 used for in 2025?

Supplemental PTIN application for foreign persons without SSN to verify identity.

Who needs Form 8946?

Non-U.S. citizens/residents ineligible for SSN applying for PTIN.

What IDs are required for Form 8946?

Two forms (e.g., passport, driver’s license) with numbers/expirations; scan/upload.

When is the 2025 PTIN renewal deadline?

December 31, 2025 ($35.95 fee).

IRS Form 8946 Download and Printable

Download and Print: IRS Form 8946