Table of Contents

IRS Form 8948 – Preparer Explanation for Not Filing Electronically – In today’s digital age, the IRS strongly encourages electronic filing (e-filing) for tax returns due to its efficiency, accuracy, and speed. However, there are scenarios where paper filing is necessary or preferred. For tax professionals, IRS Form 8948 serves as a crucial document to justify why a return isn’t being e-filed. This guide explores everything you need to know about Form 8948, including its purpose, who must use it, how to complete it, and key considerations for compliance. Whether you’re a tax preparer or a taxpayer curious about the process, this article draws from official IRS sources to provide clear, up-to-date insights as of 2025.

What Is IRS Form 8948?

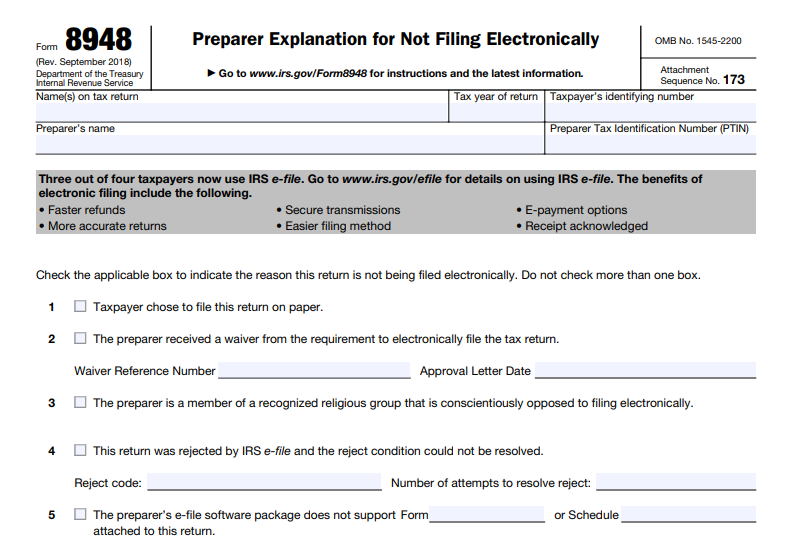

IRS Form 8948, officially titled “Preparer Explanation for Not Filing Electronically,” is a form used by specified tax return preparers to explain why a particular income tax return is being submitted on paper rather than electronically. This form helps the IRS track compliance with the e-file mandate, which requires certain preparers to file electronically unless an exception applies.

The form highlights the benefits of e-filing, such as faster refunds, greater accuracy, secure transmissions, and easier payment options. Despite these advantages, exceptions exist for situations like taxpayer preferences or technical issues. Form 8948 must be attached directly to the paper tax return it’s associated with, ensuring the IRS receives the explanation alongside the filing.

The current version of Form 8948 was revised in September 2018, but IRS resources confirm it’s still applicable for tax years 2018 and later, with no major revisions noted as of August 2025. For returns prior to 2018, preparers should use the older September 2012 revision.

Who Needs to Use Form 8948?

Not every tax preparer is required to use Form 8948. It applies specifically to “specified tax return preparers,” defined as individuals or firms that reasonably expect to file 11 or more “covered returns” in a calendar year. Covered returns generally include income tax returns for individuals (Form 1040 series), estates, and trusts (Form 1041, including 1041-QFT and certain 990-T forms).

For firms, the 11-return threshold is aggregated across all members. For example, if a firm has two preparers each expecting to file six covered returns, the firm totals 12, making all members specified preparers. Exclusions from this count include returns that cannot be e-filed, such as certain amended returns (Form 1040-X) or those with attachments not supported by IRS e-file systems.

Importantly, Form 8948 is not needed if the return inherently cannot be e-filed (e.g., fiscal year returns ending after June 30 or prior-year returns). In such cases, paper filing is allowed without explanation. Payroll tax returns are also not covered under this mandate.

When to File Form 8948

Form 8948 should be prepared and attached when a specified preparer is filing a covered return on paper due to an allowable exception. It must be included with the paper return sent to the IRS. The form is not submitted separately—it’s part of the taxpayer’s filing package.

Key scenarios include:

- When the taxpayer opts for paper filing.

- After receiving an approved hardship waiver.

- In cases of technical rejections or software limitations.

Preparers should file Form 8948 for tax years 2018 onward. If a return can be partially e-filed (with unsupported attachments sent via Form 8453 or 8453-F), the main return must still be e-filed, and Form 8948 isn’t used.

As of October 2025, there are no new mandates or changes to the e-file requirements that alter Form 8948’s usage, though preparers should check IRS updates for any legislative developments.

How to Fill Out IRS Form 8948: A Step-by-Step Guide

Filling out Form 8948 is straightforward but requires accuracy to avoid delays or penalties. Here’s a step-by-step breakdown based on official instructions:

- Enter Taxpayer Information: At the top, input the name(s) as they appear on the tax return, the tax year (e.g., 2025), and the taxpayer’s identifying number (SSN or EIN). For joint returns, use the first SSN listed.

- Preparer Details: Provide the preparer’s name and full Preparer Tax Identification Number (PTIN). This is mandatory and helps the IRS verify compliance.

- Select the Reason (Check One Box Only): Choose from the six options:

- Box 1: Taxpayer chose paper filing. Keep a signed taxpayer choice statement in your records—do not attach it to the return.

- Box 2: Approved waiver. Enter the waiver reference number and approval date from your Form 8944 approval letter.

- Box 3: Member of a recognized religious group opposed to electronic filing (group must have existed since December 31, 1950).

- Box 4: E-file rejection couldn’t be resolved. Include the reject code and number of resolution attempts.

- Box 5: Software doesn’t support an attached form or schedule. List the unsupported form/schedule numbers.

- Box 6: Other reasons:

- 6a: Foreign preparer without SSN living abroad (must have applied for PTIN via Form 8946).

- 6b: Ineligible due to IRS sanction (reference your sanction letter).

- 6c: Other technological difficulties—describe in detail.

- Attach and File: Staple or attach Form 8948 to the front of the paper return. Mail it to the appropriate IRS address for the return type.

Do not check multiple boxes or use Form 8948 for returns the IRS doesn’t accept electronically. Always retain records like waiver letters or rejection details for audits.

IRS Form 8948 Download and Printable

Download and Print: IRS Form 8948

Common Reasons for Not E-Filing and Using Form 8948

The most frequent reasons preparers cite on Form 8948 include:

- Taxpayer Preference (Box 1): Many taxpayers prefer paper for personal reasons, like familiarity or privacy concerns. Preparers must document this choice separately.

- Technical Issues (Boxes 4 and 5): Rejections or software limitations are common, especially with niche forms.

- Administrative Exemptions (Boxes 2, 3, 6): Waivers for hardship, religious beliefs, or ineligibility provide relief for unique situations.

If a return can’t be e-filed at all (e.g., due to IRS system limitations), skip Form 8948 entirely.

Penalties for Non-Compliance with the E-File Mandate

Failing to e-file without a valid exception or properly completed Form 8948 can lead to penalties under Internal Revenue Code Section 6011(e)(3). While specific penalty amounts aren’t detailed in all resources, non-compliance may result in fines or further sanctions. To avoid issues, preparers should apply for waivers by February 15 via Form 8944 if anticipating hardship.

The IRS emphasizes that acts like providing mailing instructions don’t count as “filing” by the preparer, so taxpayers can mail returns themselves without triggering the mandate.

Recent Updates to Form 8948 as of 2025

As of August 2025, the IRS has not introduced significant changes to Form 8948 or the e-file mandate. The form now requires the tax year and preparer’s PTIN explicitly, a change from pre-2018 versions. Forms 1040-A and 1040-EZ have been consolidated into Form 1040, streamlining references.

For foreign preparers, Form 8946 remains key for PTIN applications, and sanctioned preparers can use Box 6b until resolved. Always visit www.irs.gov/Form8948 for the latest developments, as legislation could impact requirements.

Conclusion: Ensuring Compliance with IRS Form 8948

IRS Form 8948 plays a vital role in maintaining transparency under the e-file mandate, allowing preparers to document legitimate reasons for paper filings. By understanding when and how to use it, tax professionals can avoid penalties and serve clients effectively. If you’re a preparer, prioritize e-filing where possible to leverage its benefits, but don’t hesitate to use Form 8948 for valid exceptions.

For the most accurate advice, consult the official IRS website or a tax professional. This article is for informational purposes only and is based on IRS publications current as of December 2025. If you have questions about your specific situation, reach out to the IRS directly.