Table of Contents

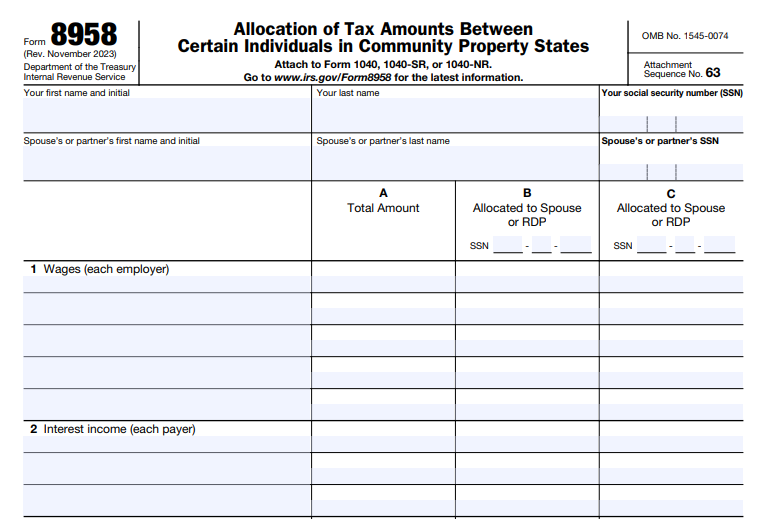

IRS Form 8958 – Allocation of Tax Amounts Between Certain Individuals in Community Property States – If you’re married or in a registered domestic partnership and live in a community property state, filing taxes separately requires special attention to how income, deductions, and credits are divided. IRS Form 8958, titled Allocation of Tax Amounts Between Certain Individuals in Community Property States, is the key tool for properly allocating these items when filing Married Filing Separately (MFS) or equivalent.

This guide explains what Form 8958 is, who needs it, how it works, and important considerations based on the latest IRS guidance as of 2025.

What Are Community Property States?

There are nine U.S. community property states where assets and income earned during marriage are generally considered jointly owned:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

In these states, community property laws treat most income earned by either spouse during the marriage as belonging equally to both (50/50 split). This applies even if only one spouse’s name appears on paychecks, investment accounts, or other income sources.

Separate property includes assets owned before marriage, inheritances, or gifts to one spouse.

Note: Registered domestic partners (RDPs) in California, Nevada, and Washington must also follow similar community property rules for federal taxes.

What Is IRS Form 8958?

Form 8958 is used to allocate tax items (such as wages, interest, dividends, deductions, credits, and withholding) between spouses or RDPs who file separate federal tax returns but are subject to community property laws.

The form helps reconcile discrepancies between:

- What employers/payers report to the IRS (often under one spouse’s Social Security Number), and

- What each spouse reports on their individual Form 1040 (or 1040-SR/1040-NR).

Without Form 8958, your reported income may not match IRS records, potentially triggering notices or audits.

Both spouses (or RDPs) must complete and attach their own Form 8958 to their separate tax returns.

Who Needs to File Form 8958?

You must use Form 8958 if:

- You are married or an RDP with community property rights.

- You reside in (or are domiciled in) one of the nine community property states.

- You file a separate federal tax return (Married Filing Separately).

- Community income needs to be split (most cases when filing separately).

Exceptions:

- If you file jointly, you do not need Form 8958.

- Special rules apply for certain income types (e.g., self-employment tax is generally allocated to the earning spouse).

For detailed rules, refer to IRS Publication 555 (Community Property), revised December 2024.

IRS Form 8958 Download and Printable

Download and Print: IRS Form 8958

How Does Form 8958 Work?

The form has sections for identifying different types of income and tax items:

- Wages, Salaries, and Tips — Typically split 50/50 if community income.

- Interest and Dividends — From community accounts, split equally.

- Self-Employment Income — Often allocated to the spouse who earned it.

- Other Income (e.g., rents, pensions, partnership distributions) — Depends on state law and whether it’s community or separate.

- Deductions and Credits — Community expenses are generally split; separate ones stay with the owner.

- Federal Income Tax Withheld — Usually split 50/50 for community wages.

You list totals for each category (combined for both spouses), then allocate amounts to “You” (the filer) and “Spouse/RDP.”

The allocated amounts are then reported on your individual Form 1040 lines.

Key Rule: Generally, community income is split 50/50, but some states treat income from separate property differently (e.g., as community in Idaho, Louisiana, Texas, Wisconsin).

Step-by-Step Guide to Completing Form 8958

- Gather all income documents (W-2s, 1099s, etc.) for both spouses.

- Determine community vs. separate income under your state’s laws (consult Pub. 555).

- Fill in totals in the middle columns.

- Allocate to each person in the left/right columns.

- Transfer your allocated shares to your Form 1040.

- Attach Form 8958 to your return.

The latest version is Form 8958 (Rev. November 2023), still current as of late 2025. Check IRS.gov for any updates.

Common Mistakes to Avoid

- Forgetting to attach Form 8958 — This can cause processing delays.

- Incorrectly classifying income as separate when it’s community.

- Not coordinating allocations with your spouse/RDP — Your forms must match to avoid IRS mismatches.

- Ignoring state-specific variations (e.g., income from separate property).

Benefits of Filing Separately vs. Jointly

Filing jointly often results in lower taxes, but separate filing may be advantageous if:

- One spouse has high medical expenses or miscellaneous deductions.

- You want to limit liability for the other’s tax debts.

However, in community property states, separate filing requires the extra step of Form 8958.

Where to Get Help

- Download Form 8958 and instructions from IRS.gov.

- Read Publication 555 for in-depth community property rules.

- Consult a tax professional for complex situations, such as mixed separate/community assets or RDPs.

Properly using Form 8958 ensures compliance with IRS rules and accurate reporting of your share of community income. For the most current information, always visit official IRS sources.