Table of Contents

IRS Form 8960 – Net Investment Income Tax Individuals, Estates, and Trusts – High-net-worth individuals, estates, and trusts often face an additional 3.8% tax on investment earnings, but understanding IRS Form 8960, “Net Investment Income Tax—Individuals, Estates, and Trusts,” can help you calculate and minimize this liability accurately. Enacted under the Affordable Care Act, the Net Investment Income Tax (NIIT) targets unearned income above certain thresholds, affecting about 2.5 million taxpayers annually. For the 2025 tax year, with no major legislative changes from the Tax Cuts and Jobs Act extensions and miscellaneous deduction suspensions continuing through 2025, Form 8960 remains a key attachment to Form 1040 or 1041.

This SEO-optimized guide, based on the latest IRS resources, walks you through Form 8960 for filings due in 2026. From thresholds to worksheets, learn how to compute NIIT and avoid common pitfalls. Download the draft 2025 Form 8960 and instructions from IRS.gov to ensure compliance by April 15, 2026.

What Is IRS Form 8960?

IRS Form 8960 helps taxpayers compute the NIIT, a 3.8% surtax on net investment income (NII) for individuals, estates, and trusts. It applies to the lesser of your NII or the amount by which your modified adjusted gross income (MAGI) exceeds statutory thresholds. NII generally includes passive income like interest, dividends, capital gains, annuities, royalties, and rental income, minus allocable deductions.

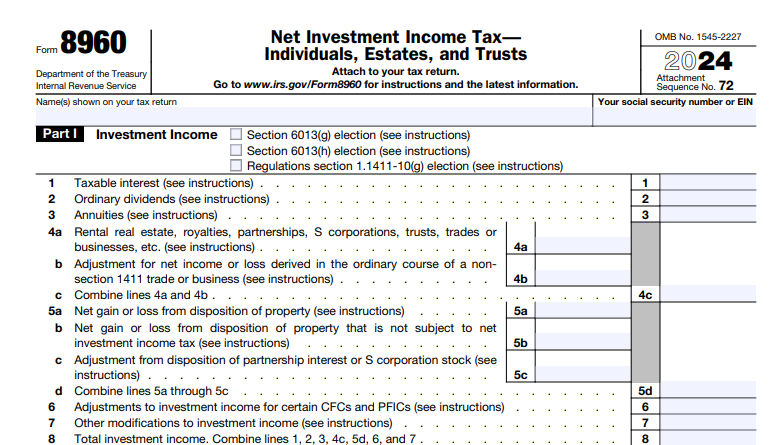

The form attaches to your tax return (e.g., Form 1040 line 17 or Form 1041 Schedule G line 1b) and includes three parts:

- Part I: NII calculation.

- Part II: Adjustments for deductions.

- Part III: NIIT computation based on MAGI thresholds.

For 2025, the form mirrors 2024 with stable rates and thresholds—no inflation adjustments to the $250,000 MFJ limit, as confirmed in recent IRS guidance.

Who Needs to File IRS Form 8960 in 2025?

Attach Form 8960 if your MAGI exceeds the threshold and you have NII of $1 or more. Thresholds are fixed:

| Filing Status | MAGI Threshold |

|---|---|

| Married Filing Jointly / Qualifying Surviving Spouse | $250,000 |

| Married Filing Separately | $125,000 |

| Single / Head of Household | $200,000 |

| Estates and Trusts | Highest tax bracket start (e.g., $15,200 for 2024; check 2025 Form 1041 instructions) |

- Individuals: U.S. citizens/residents with investment income; nonresidents generally exempt unless electing resident status. Dual-status filers compute only for U.S. residency periods.

- Estates and Trusts: Domestic entities with undistributed NII and AGI over the threshold; excludes grantor trusts, charitable trusts, and certain electing trusts.

- Exceptions: No filing if below thresholds or no NII (e.g., wages, self-employment income excluded). Bankruptcy estates use $125,000 threshold.

Even with no tax due, file if thresholds met to report NII accurately.

IRS Form 8960 Download and Printable

Download and Print: IRS Form 8960

Key Components of IRS Form 8960

Form 8960 breaks NIIT into manageable parts, with worksheets for complex items like NOLs and recoveries.

- Part I (Lines 1–8): Gross NII from interest/dividends (line 1), annuities/royalties/rents (line 2), passive activities (line 3), trading businesses (line 4), net gains (line 5, adjusted for non-NIIT dispositions), other income (line 6), minus NOL recoveries (line 7) and self-charged interest (line 8).

- Part II (Lines 9–12): Deductions like investment interest (line 9a), state/local taxes (line 9b), miscellaneous expenses (line 9c, suspended through 2025), and trader adjustments (line 10). Line 12 nets these against Part I.

- Part III (Lines 13–21): MAGI computation (line 13, adding back foreign exclusions/CFC inclusions), threshold application for individuals (lines 14–17) or estates/trusts (lines 18–21, deducting distributions/charitable contributions).

Worksheets cover MAGI adjustments, NOL allocations (section 1411 NOL limited to NII-attributable portion), deduction recoveries (tax benefit rule), and trader allocations.

How to Complete IRS Form 8960: Step-by-Step Guide for 2025

Gather Schedule B/D/E/K-1 data, Form 2555 (foreign income), and prior-year NOLs. Use tax software for worksheets.

Step 1: Compute NII (Part I)

- Lines 1–4: Enter gross income from Forms 1040 Schedule B (interest/dividends), D (gains), E (rentals/passives), and K-1s.

- Line 5: Use Net Gains Worksheet to exclude non-NIIT gains (e.g., active business property).

- Line 7: Deduction Recoveries Worksheet caps at prior NIIT benefit.

- Line 8: Negative for self-charged interest offsets.

Step 2: Apply Deductions (Part II)

- Line 9: Allocable itemized deductions (e.g., investment interest from Form 4952); miscellaneous suspended through 2025.

- Line 10: Trader Worksheet for multi-business allocations.

- Line 12: Total NII (Part I minus Part II).

Step 3: Calculate NIIT (Part III)

- Line 13: MAGI Worksheet (AGI + foreign/CFC adjustments).

- Lines 14–17 (Individuals): Excess over threshold; 3.8% of lesser of NII or excess.

- Lines 18–21 (Estates/Trusts): Undistributed NII after distributions (line 18b) and charitable deductions; excess AGI over bracket start.

Enter total NIIT on your return. E-file for faster refunds.

Example: Single filer with $220,000 MAGI, $25,000 NII. Excess: $20,000. NIIT: 3.8% × $20,000 = $760.

Key Changes to IRS Form 8960 for 2025

The 2025 draft aligns with 2024 instructions, with no substantive updates:

- Suspensions Continue: Miscellaneous deductions (section 67) and overall itemized limits (section 68) remain suspended through 2025.

- Thresholds Stable: No inflation adjustments; $250,000 MFJ unchanged.

- ESBT Adjustments: Line 18b refinements for electing small business trusts, per 2018 changes.

- Digital Assets: Treated as NII, consistent with 2024.

Check IRS.gov/Form8960 for final 2025 revisions, expected December 2025.

Common Mistakes to Avoid When Filing Form 8960

- MAGI Miscalculations: Forgetting CFC/PFIC inclusions—use MAGI Worksheet.

- Passive Activity Errors: Treating rentals as nonpassive without real estate pro safe harbor (>500 hours).

- NOL Overstatements: Section 1411 NOL limited to NII portion; no pre-2013 carryforwards.

- Deduction Allocations: Pro-rating state taxes incorrectly; foreign taxes ineligible if crediting.

- Trust Oversights: Forgetting to deduct distributions (line 18b) or charitable contributions.

Audits focus on high-income filers; retain K-1s and worksheets.

Tips for Minimizing NIIT on IRS Form 8960 in 2025

- Harvest Losses: Offset capital gains to reduce NII.

- Roth Conversions: Shift to tax-free growth, avoiding future NII.

- Group Activities: Elect to treat rentals as nonpassive if qualifying.

- Charitable Planning: Trusts—maximize section 642(c) deductions.

- Software Leverage: TurboTax auto-computes worksheets and integrates with Schedule D.

- Professional Advice: CPAs handle CFC/PFIC complexities.

Strategic timing can defer NIIT indefinitely.

Final Thoughts: Master NIIT Compliance with IRS Form 8960 in 2025

IRS Form 8960 ensures the 3.8% NIIT is applied fairly to investment income, but proactive planning keeps it minimal for 2025 filers. With stable rules and suspended limitations, now’s the time to review your portfolio for optimizations.

For the official 2025 draft Form 8960 and instructions, visit IRS.gov/Form8960. High earners or trusts? A tax advisor can unlock savings. Start your MAGI projection today for a smoother 2026.