Table of Contents

IRS Form 8966 – FATCA Report – In an increasingly interconnected global economy, ensuring compliance with the Foreign Account Tax Compliance Act (FATCA) is non-negotiable for foreign financial institutions (FFIs), withholding agents, and other entities holding U.S. accounts. IRS Form 8966, the “FATCA Report,” is the cornerstone tool for reporting U.S. account holders, substantial U.S. owners of passive non-financial foreign entities (NFFEs), and related details to the IRS—helping combat offshore tax evasion while avoiding 30% withholding on U.S.-source payments. If you’re a compliance officer searching for “Form 8966 instructions 2025,” a FFI executive navigating “FATCA certification deadline 2025,” or a tax advisor tackling “Model 2 IGA reporting updates,” this SEO-optimized guide equips you with everything needed for seamless filing.

Sourced from the IRS’s official 2024 instructions (applicable to 2025 filings, due March 31, 2026) and recent guidance like Notice 2025-50, we’ll cover eligibility, step-by-step completion, and 2025-specific changes such as enhanced penalties and TIN relief extensions. With FATCA certifications due July 1, 2025, for the 2024 period, missing deadlines could cost up to $50,000 per violation—don’t let non-compliance derail your operations. Let’s demystify Form 8966 for tax year 2025.

What Is IRS Form 8966?

Form 8966 is the IRS-mandated report under FATCA (IRC Chapter 4) for disclosing information on U.S. reportable accounts, substantial U.S. owners (25%+ ownership) of passive NFFEs, specified U.S. persons holding equity/debt in owner-documented FFIs (ODFFIs), and pooled account data for certain FFIs. This electronic or paper form (five parts) ensures the IRS receives details like account balances, income, and taxpayer identification numbers (TINs), facilitating automatic exchange of information via intergovernmental agreements (IGAs).

Key purposes:

- Prevent Tax Evasion: Tracks U.S. persons’ foreign assets to ensure worldwide income reporting.

- Avoid Withholding: Compliant FFIs dodge 30% FATCA withholding on withholdable payments (e.g., U.S. dividends, interest).

- IGA Alignment: Supports Model 1 (report to local authority) and Model 2 (direct to IRS) frameworks.

For 2025, filers use the 2024 form version (Rev. Dec. 2024), with submissions via the International Data Exchange Service (IDES). It’s not for U.S. taxpayers (they file Form 8938); instead, it’s FFIs’ responsibility. Non-filers risk GIIN revocation and penalties starting at $10,000.

Who Must File IRS Form 8966 in 2025?

Form 8966 is required for entities under FATCA’s Chapter 4 status, excluding those solely under Model 1 IGAs (they report locally). File a separate form per U.S. owner, account, or pool.

Eligible Filers

| Filer Type | Filing Requirement | Key Notes |

|---|---|---|

| Participating FFIs (PFFIs) | Required for U.S. accounts | Report individual accounts >$50K (preexisting) or $0 (new); pooled for non-U.S. |

| Reporting Model 2 FFIs | Required for U.S. accounts and non-consenting pools | Direct IRS filing; align with IGA dates |

| Sponsoring Entities | Required for Sponsored FFIs/NFFEs | Report on behalf of sponsored entities |

| Direct Reporting NFFEs | Required for substantial U.S. owners | Per passive NFFE with 25%+ U.S. ownership |

| Withholding Agents | Required for ODFFIs | Report specified U.S. persons’ interests |

Exclusions: Model 1 FFIs (local reporting); U.S. branches of FFIs (use Form 1042-S). Thresholds: No minimum account value for new accounts post-2014.

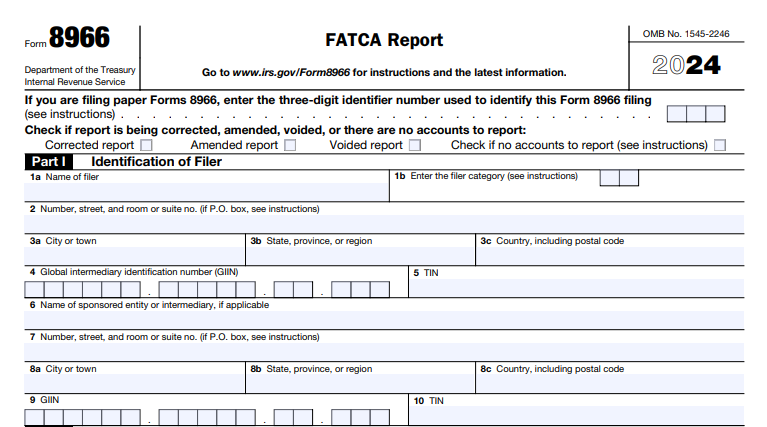

IRS Form 8966 Download and Printable

Download and Print: IRS Form 8966

Recent Changes to IRS Form 8966 for 2025

The IRS’s 2024 instructions (Rev. Dec. 2024) apply to 2025 filings, with no form redesign but procedural and penalty updates amid global enforcement:

- Filing Deadline Confirmation: For 2025 calendar year, due March 31, 2026; automatic 90-day extension via Form 8809-I.

- Certification Deadline: FATCA Responsible Officer certifications for 2024 period due July 1, 2025; new login via Login.gov/ID.me.

- TIN Relief Extensions: France extends U.S. TIN relief to 2027; deadlines shifted to July 15, 2025, for some IGAs.

- Penalty Enhancements: Late filings within 30 days: $60; after August 1: $330; intentional: $660 per return. Up to $50,000 for errors/delays; higher scrutiny on high-volume filers.

- Digital Asset Expansion: FY2025 Greenbook proposes digital brokers report substantial foreign owners of passive entities holding crypto, raising $3.49B (2025-2034).

- Global Alignment: OECD/CRS updates broaden scope; Switzerland/Finland deadlines June 30/January 31, 2025.

No post-release changes to Form 8966 per IRS updates as of November 2025.

Step-by-Step Guide: How to Complete IRS Form 8966 for 2025

Use the 2024 form; e-file via IDES (Pub. 5124). Gather GIIN, account data, and TINs. Complete only relevant parts.

Part I: Filer Information

- Line 1a: Name, address, country.

- Line 1b: Chapter 4 status (e.g., PFFI: 01; Model 2: 02).

- Line 1c: GIIN; optional 3-digit ID for paper filers.

Part II: Reporting Financial Institution Identifying Information

- For Sponsored/Direct Reporting NFFEs: Entity name, GIIN, filer category.

Part III: Specified U.S. Person

- For ODFFIs: U.S. person’s name, address, TIN, account balance, income.

Part IV: Substantial U.S. Owners of Passive NFFEs

- Owner details: Name, address, TIN, ownership %; separate form per owner.

Part V: Pooled Reporting Information

- For FFIs: Aggregate U.S./non-U.S. accounts by pool (e.g., $0-$50K, >$1M); number of accounts, total value, gross dividends/interest.

Example: A PFFI with 100 U.S. accounts ($0-$50K pool, total $2M balance, $50K dividends): Enter pool code 01, 100 accounts, $2M value, $50K income on Part V.

Filing

- Due: March 31, 2026; extend to June 30 via Form 8809-I (mail to Austin, TX).

- E-File: Mandatory for >250 forms; paper to Ogden, UT.

- Corrections: Amended returns with “Corrected” box checked.

Common Mistakes to Avoid When Filing Form 8966

FATCA audits are rising—sidestep these with diligence:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Missing GIIN/TIN | Incomplete due diligence | Validate via IRS FFI List; use relief if unavailable. |

| Incorrect Pooling | Misclassifying accounts | Follow Part V codes; aggregate only permitted pools. |

| Late Certification | Forgetting July 1, 2025, deadline | Use Login.gov; certify annually for compliance. |

| Paper Filing Errors | No 3-digit ID | Assign unique number per form. |

| Ignoring Digital Assets | Overlooking Greenbook proposal | Prepare for 2025 broker reporting on crypto entities. |

Retain records 6 years; amend promptly.

Why File Form 8966 Accurately? Real-World Impact for 2025

A mid-sized FFI with 1,000 U.S. accounts avoids $300K+ in withholding by compliant reporting, per IRS estimates. With 2025’s TIN extensions and penalty hikes, precision prevents GIIN loss and fines up to $50K—vital amid OECD/CRS expansions.

Final Thoughts: Achieve FATCA Compliance with Form 8966 in 2025

IRS Form 8966 is your gateway to FATCA adherence, but 2025’s deadlines (March 31, 2026, filing; July 1, 2025, certification) and global tweaks demand proactive steps. By mastering filer categories, pooling, and extensions, you’ll safeguard operations.

Download the 2024 form/instructions from IRS.gov and consult a FATCA specialist. For more, explore Pub. 5118 or our Form 8938 guide. Questions on “FATCA penalties 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your situation.