Table of Contents

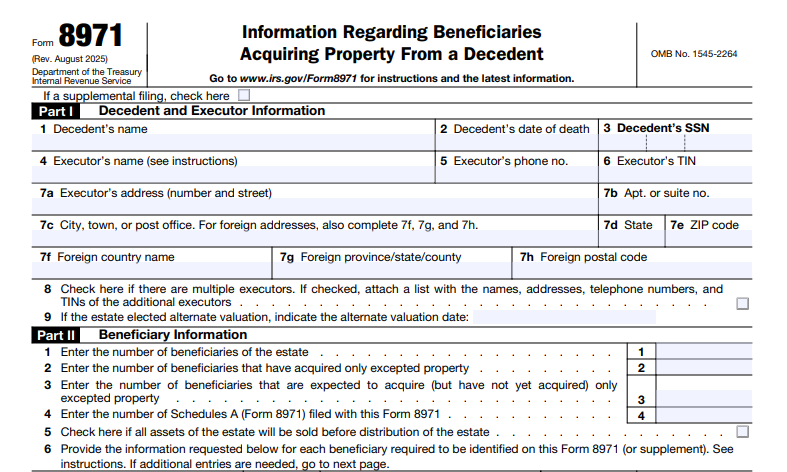

IRS Form 8971 – Information Regarding Beneficiaries Acquiring Property From a Decedent – Estate administration often involves more than just settling debts and distributing assets—it’s about ensuring tax compliance to avoid costly surprises down the line. For executors handling estates that file Form 706, IRS Form 8971—Information Regarding Beneficiaries Acquiring Property From a Decedent—plays a pivotal role in promoting basis consistency between the estate and heirs. This form reports the final estate tax values of inherited property, helping beneficiaries accurately calculate their cost basis for future sales or depreciation. With the 2025 federal estate tax exemption at $13.99 million, more estates may trigger filing if portability or GST elections are involved. This SEO-optimized guide, updated with the latest August 2025 revisions, walks you through Form 8971 requirements, filing steps, and pitfalls, based on official IRS resources.

What Is IRS Form 8971?

IRS Form 8971 is a reporting tool required for executors of certain decedents’ estates to notify the IRS and beneficiaries about the fair market value (FMV) of property interests acquired from the estate. Introduced under the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015, it enforces IRC Section 1014(f) basis consistency rules, preventing discrepancies between estate tax valuations and beneficiary income tax reporting. The form includes Schedules A, which detail property specifics and are furnished solely to beneficiaries.

Key components:

- Basis Consistency: Ensures heirs use the estate’s reported FMV as their starting basis, reducing IRS audits on capital gains.

- Property Reporting: Covers distributed or undistributed assets like real estate, stocks, and business interests.

- Supplemental Filings: Required for value changes from audits or amendments.

The August 2025 revision (OMB No. 1545-2264) adds clarity on supplemental reporting and aligns with final regulations (T.D. 9991) from September 2024. Download the form, Schedule A, and instructions from IRS.gov/Form8971.

Who Needs to File IRS Form 8971 in 2025?

Not every estate files Form 8971—it’s tied to Form 706 or 706-NA requirements. Executors must file if the estate exceeds the $13.99 million threshold or elects portability/GST, even for protective filings.

| Filing Trigger | Details for 2025 |

|---|---|

| Form 706/706-NA Filed | Required for U.S. citizens/residents (706) or nonresidents with U.S. assets >$60,000 (706-NA). |

| Portability Election | Yes, even if no tax due—to transfer DSUE to surviving spouse. |

| GST Allocation | Mandatory for skips to grandchildren or trusts. |

| Protective Filing | To avoid state penalties or satisfy laws, if gross estate qualifies. |

| Excepted Property Only | Still file Form 8971, but no Schedules A if all assets are cash or income in respect of decedent (IRD). |

Multiple executors? All sign; attach a list of names, addresses, TINs. Non-filers (e.g., small estates) skip it entirely.

Filing Deadlines and Where to Send Form 8971

Timeliness is crucial—late filings trigger steep penalties. The due date is the earlier of: 30 days after Form 706’s required filing date (including extensions) or 30 days after actual filing.

- Supplemental Deadlines: 30 days after value changes (e.g., audit final value) or January 31 following beneficiary acquisition for undistributed property.

- Furnishing to Beneficiaries: Same deadline as filing; email, mail, or hand-deliver Schedule A only (not full Form 8971).

- Where to File: Mail Form 8971 + all Schedule A copies to: Internal Revenue Service, Stop 824G, 7940 Kentucky Drive, Florence, KY 41042. (Updated August 2025—do not use prior addresses.) No e-filing; retain proof of delivery.

For 2025 deaths, if Form 706 is due September 30 (with extension), file by October 30.

Step-by-Step Guide to Completing IRS Form 8971

Gather Form 706 schedules, appraisals, and beneficiary details first. The form is straightforward but precise.

- Header Info (Lines 1-5): Decedent’s name, SSN, death date; executor’s name, address, phone, TIN.

- Multiple Executors (Line 8): Check box and attach list.

- Beneficiaries (Line 6): List each required recipient (name, address, TIN)—all who acquire non-excepted property.

- Property Totals (Lines 7-9): Sum estate tax values from Schedules A; Line 9 totals all reported property.

- Signature: Executor signs under perjury; date and title (e.g., “Executor”).

- Prepare Schedules A: One per beneficiary, detailing property (description, FMV, date acquired). Attach copies to Form 8971 for IRS; furnish originals to heirs.

- Supplements: Check “Supplemental Filing” box; explain changes.

Use the August 2025 instructions for line-by-line help; inconsequential errors (e.g., typos not hindering processing) avoid penalties.

What Property Must Be Reported on Schedule A?

Report only non-excepted property acquired by beneficiaries. Excepted: Cash (U.S. dollars), IRD (e.g., unpaid wages), certain foreign trusts.

| Column | Description |

|---|---|

| (a) | Property description (e.g., “100 shares XYZ stock”). |

| (b) | Date acquired by beneficiary. |

| (c) | Date estate tax value determined (usually death/alternate date). |

| (d) | Estate tax FMV (from Form 706). |

| (e) | Check if value increased estate tax liability (triggers strict basis rules). |

| (f) | Fair market value at acquisition (if different). |

| (g) | Any other IRS-required info (e.g., unit value). |

| (h) | Total per beneficiary. |

Optional Schedules A for excepted property or pre-acquisition reports. For trusts, report to trustees as beneficiaries.

IRS Form 8971 Download and Printable

Download and Print: IRS Form 8971

Recent Updates to Form 8971 for 2025

The August 2025 revision incorporates T.D. 9991 final regs, enhancing duty-to-supplement guidance and clarifying revocable trust reporting. Key changes:

- Address Update: New Florence, KY mailing (effective August 7, 2025).

- Supplemental Clarity: 30-day window for audit changes; AICPA-recommended examples for after-discovered assets.

- Penalty Inflation Adjustments: Maximums rise annually (e.g., $3,193,000 for large estates).

These align with AICPA feedback for better compliance.

Common Mistakes When Filing Form 8971 and How to Avoid Them

Executors often stumble on details—here’s how to sidestep:

- Missing Beneficiaries: Forgetting trusts or contingent heirs—review Form 706 Schedules fully.

- Incorrect FMV: Using cost basis instead of estate tax value—cross-reference appraisals.

- Late Supplements: Delaying for undistributed assets—calendar January 31 deadlines.

- Furnishing Full Form: Sharing Form 8971 with heirs (privacy violation)—send only Schedule A.

- No Proof of Delivery: Email without receipts—use certified mail or tracked email.

Engage a CPA early; the AICPA notes unclear supplement duties as a top issue.

Penalties for Late or Incorrect Form 8971 Filings

Non-compliance stings under IRC Sections 6721/6722:

- Failure to File/Furnish: $310 per Form 8971 or Schedule A (inflation-adjusted; up to $3,193,000/year max, $1,064,000 reduced).

- Late After 30 Days: $2,600 per form.

- Inaccurate Info: Same as above; applies to supplements.

- Reasonable Cause Waiver: Illness or unavoidable delay may excuse—document everything.

Only one penalty per Form 8971; inconsequential omissions (e.g., minor typos) are safe. Penalties apply even for no-tax-due estates.

Frequently Asked Questions About IRS Form 8971

Do I file Form 8971 if no Form 706 is required?

No—only estates filing 706/706-NA trigger it, including protective or election-only returns.

Can I email Schedule A to beneficiaries?

Yes—retained electronic proof suffices; no consent needed.

What if values change after filing?

Supplement within 30 days of the change or by January 31 post-acquisition.

Is e-filing available for Form 8971?

No—paper mail only to the Florence, KY address.

Does Form 8971 affect estate tax payment?

No—it’s informational for basis tracking, not tax computation.

For more, check IRS.gov/Form8971.

Final Thoughts: Simplify Estate Compliance with Form 8971 in 2025

IRS Form 8971 bridges estate tax reporting and beneficiary basis rules, safeguarding against audits and penalties in an era of rising exemptions. With 2025 updates emphasizing supplements and clear deadlines, executors can file confidently by leveraging professional appraisals and timely communications. Download the August 2025 version today from IRS.gov to stay ahead.

Proper execution honors the decedent’s wishes while minimizing tax risks—consult an estate tax advisor for your unique scenario.

This article is informational only and not tax advice. Always consult IRS resources or a qualified professional.