Table of Contents

IRS Form 8995-A – Qualified Business Income Deduction – Small business owners, freelancers, and partners in pass-through entities—listen up: The Qualified Business Income (QBI) Deduction under Section 199A could slash up to 20% off your taxable income, saving thousands in taxes. But with income thresholds, wage limits, and specified service trade or business (SSTB) phase-outs, it’s not a one-size-fits-all perk. Enter IRS Form 8995-A, the detailed worksheet for calculating this deduction when your situation gets complex.

For tax year 2024 (filed in 2025), the QBI deduction remains a lifeline for sole proprietors, partnerships, S corps, LLCs, trusts, and estates—available through 2025 unless extended. This SEO-optimized guide breaks down Form 8995-A filing requirements, eligibility, limits, step-by-step instructions, and updates like inflation-adjusted thresholds. Maximize your savings with IRS Publication 535 and download the form at IRS.gov/Form8995A.

What Is IRS Form 8995-A and the QBI Deduction?

Form 8995-A, “Qualified Business Income Deduction,” is the advanced version of Form 8995 for taxpayers with taxable income exceeding the simplified threshold or complex scenarios like aggregations, SSTBs, or patronage from cooperatives. It computes up to 20% of your QBI—net income from domestic qualified trades or businesses—plus 20% of qualified REIT dividends and publicly traded partnership (PTP) income.

The QBI deduction flows to Form 1040, Schedule 1, line 13, reducing taxable income without itemizing. For 2024, it’s limited to the lesser of 20% QBI or 20% taxable income minus net capital gains. No carryover for unused portions.

Key caveat: Excludes C corps, wages, and certain investment income. SSTBs (e.g., law, health, consulting) face full phase-out above income caps.

Who Must File Form 8995-A in 2025?

Use Form 8995-A if your 2024 taxable income (before QBI) exceeds the simplified threshold or you have:

- Multiple trades/businesses requiring aggregation (Schedule B).

- SSTB income needing phase-out calculations (Schedule A).

- W-2 wage/unadjusted basis limits (Schedule C).

- Patronage dividends from ag/horticultural co-ops (Schedule D).

- Aggregated businesses or PTP losses.

If below thresholds and simple, use Form 8995. All filers attach to Form 1040/1041/1065/1120-S.

QBI Eligibility Quick Check Table (Tax Year 2024, Filed 2025)

| Business Type | Eligible? | Notes |

|---|---|---|

| Sole Proprietorship (Schedule C) | Yes | Full QBI if under thresholds. |

| Partnership/S Corp (K-1) | Yes | Allocable share only. |

| Trust/Estate | Yes | Beneficiary portion. |

| SSTB (e.g., Doctor, Lawyer) | Partial | Phases out above $191,950 single/$383,900 joint. |

| Rental Real Estate (Safe Harbor) | Yes | If meets IRS criteria (Notice 2019-07). |

| C Corp | No | Corporate tax applies. |

2024–2025 QBI Thresholds and Phase-Outs

Thresholds are inflation-adjusted annually. For 2024 (filed 2025):

| Filing Status | Threshold (Full Deduction) | Phase-In Range (Limitations Apply) | Upper Limit (SSTB No Deduction) |

|---|---|---|---|

| Single/Head of Household | $191,950 | $191,951–$241,950 | $241,951+ |

| Married Filing Jointly | $383,900 | $383,901–$483,900 | $483,901+ |

- Below Threshold: Full 20% QBI; no wage/property limits.

- Phase-In: Gradual reduction for SSTBs; wage limit (greater of 50% W-2 wages or 25% wages + 2.5% unadjusted basis) applies proportionally.

- Above Upper: SSTBs get $0; non-SSTBs limited to wage formula.

Wage limit: Deduction ≤ greater of 50% of W-2 wages or 25% wages + 2.5% qualified property basis.

When Is Form 8995-A Due in 2025?

Attach to your 2024 Form 1040 by April 15, 2025 (or October 15 extended via Form 4868). No separate filing—deduction reduces tax owed. Amend prior years with Form 1040-X if needed.

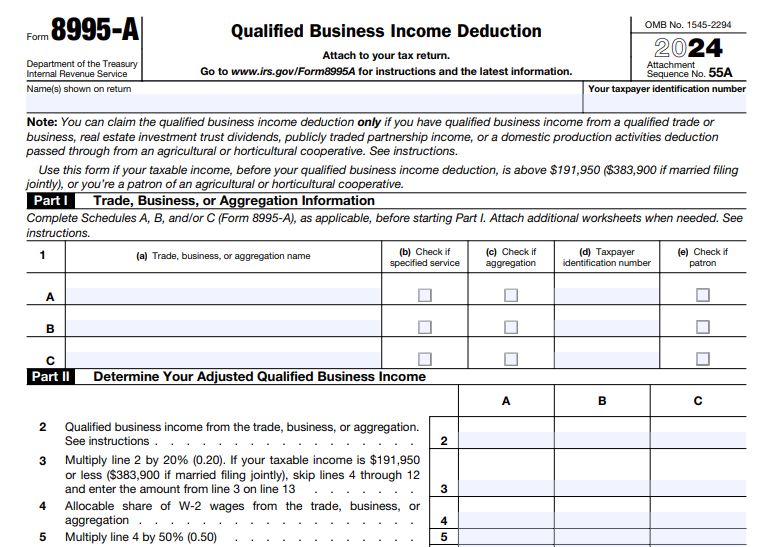

IRS Form 8995-A Download and Printable

Download and Print: IRS Form 8995-A

Key 2025 QBI Filing Deadlines Table

| Tax Year End | Original Due Date | Extended Due Date |

|---|---|---|

| December 31, 2024 | April 15, 2025 | October 15, 2025 |

| Fiscal Year (e.g., June 30, 2024) | October 15, 2024 | April 15, 2025 |

How to Complete IRS Form 8995-A: Step-by-Step (2024 Form)

The 2024 Form 8995-A has four parts plus Schedules A–D. Gather K-1s, Schedule C, REIT/PTP statements. Use accrual or cash method consistently; report positive QBI only (losses carry forward).

Part I: Trade, Business, or Aggregation Information

- Lines 1–4: List each business (name, EIN, QBI from K-1/Schedule C, W-2 wages, UBIA of qualified property).

- Line 5: Total QBI, wages, UBIA (attach Schedule B if aggregated).

Part II: Calculation of the QBI Component

- Line 6: 20% of QBI (line 5 × 0.20).

- Line 7: Overall taxable income limit (20% of taxable income minus net capital gains).

- Line 8: QBI component (smaller of line 6 or 7).

Part III: Calculate the REIT/PTP Component

- Line 9–10: Qualified REIT dividends + PTP income.

- Line 11: 20% of total (line 10).

- Line 12: Overall limit (same as line 7).

- Line 13: REIT/PTP component (smaller of line 11 or 12).

Part IV: Total QBI Deduction

- Line 14: Total deduction (line 8 + 13).

Schedules:

- A (SSTB Phase-In): Applicable percentage = 100% minus (excess income / $50,000 single/$100,000 joint) × 100%.

- C (Wage Limit): Compute limited amount; phase-in if applicable.

- D (Co-Op Patronage): Reduce QBI by patronage amount.

Pro Tip: Aggregate businesses if common control/factors (up to 6); attach statement. Software like TurboTax auto-fills from K-1s.

E-Filing Form 8995-A

E-file with your 1040 via IRS Free File or approved software—mandatory for most (10+ forms). Faster processing; error checks for phase-outs.

Recent Changes to Form 8995-A for 2025 Filings

- Threshold Adjustments: 2024 figures as above; 2025 rises to $197,300 single/$394,600 joint (phase-out to $247,300/$494,600).

- No Negative Dividends: Exclude negatives on line 34 (since 2021).

- TCJA Sunset: Expires after 2025 unless extended; plan for 2026 changes.

- OBBBA Rumors: Proposals for permanence and expanded phase-ins (e.g., $150K joint range from 2026) pending legislation.

Penalties for Errors on Form 8995-A

- Underpayment: 20% accuracy penalty on understated tax.

- Late Filing: 5% monthly (max 25%).

- No Penalty for Overclaim: But audit risk high for SSTBs.

Abate for reasonable cause; retain records 3+ years.

Best Practices for QBI Deduction on Form 8995-A in 2025

- Maximize QBI: Pay W-2 wages, acquire depreciable assets for UBIA boost.

- Aggregate Strategically: Combine rentals with active businesses if eligible.

- SSTB Workaround: Separate non-service income (e.g., product sales).

- Software/CPA: Use for wage calcs; review K-1s early.

- Safe Harbor Rentals: Elect via statement for QBI inclusion.

Conclusion: Claim Your 20% QBI Deduction with Form 8995-A in 2025

IRS Form 8995-A empowers pass-through owners to deduct up to 20% of QBI—potentially $39,480 off $197,400 income—while navigating thresholds like $383,900 joint. With the deduction sunsetting post-2025, act now for 2024 filings due April 15, 2025.

Download at IRS.gov/Form8995A; see Pub. 535 for details. Consult a CPA—your business’s tax edge awaits.

Last updated: December 2025. Verify IRS sources for advice.