Table of Contents

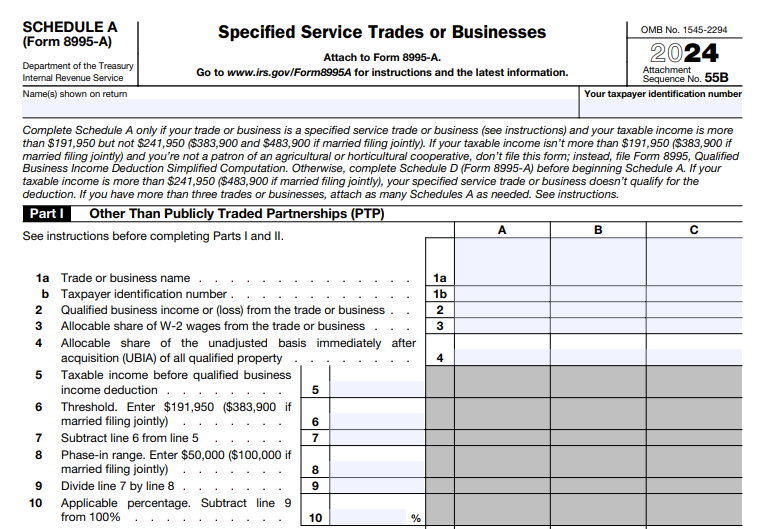

IRS Form 8995-A (Schedule A) – Specified Service Trades or Businesses – If your business involves law, medicine, consulting, or other “specified service trades or businesses” (SSTBs), the Qualified Business Income (QBI) deduction—up to 20% of your pass-through income—can be a game-changer. But SSTBs face strict phase-out rules based on your taxable income, potentially reducing or eliminating the benefit entirely. Schedule A (Form 8995-A) is the IRS worksheet that computes this “applicable percentage” during the phase-in range, ensuring you claim the right amount.

For tax year 2024 (filed in 2025), SSTB phase-outs start at $191,950 (single) or $383,900 (married filing jointly), fully eliminating the deduction above $241,950/$483,900. This SEO-optimized guide covers eligibility, thresholds, line-by-line instructions, and tips to maximize your deduction before it sunsets after 2025. Download the form at IRS.gov/Form8995A.

What Is Schedule A (Form 8995-A) for SSTBs?

Schedule A (Form 8995-A) calculates the phase-in reduction for QBI from SSTBs when your taxable income (before the QBI deduction) falls in the phase-out range. SSTBs are professional services where the principal asset is the reputation or skill of employees/owners, like health, law, accounting, or performing arts.

- Full Deduction: Below threshold ($191,950 single/$383,900 joint for 2024)—100% applicable percentage.

- Phase-In: In range ($191,951–$241,950 single/$383,901–$483,900 joint)—gradual reduction via applicable percentage.

- No Deduction: Above upper limit—0% for SSTB QBI.

Attach to Form 8995-A (used when income > thresholds or complex scenarios); flows to Part I, line 2. PTP SSTB income also phases out here. No changes for 2025 filings beyond inflation adjustments.

Who Must File Schedule A (Form 8995-A) in 2025?

Complete Schedule A if:

- Your trade/business is an SSTB.

- Taxable income > threshold but ≤ upper limit (phase-in range).

- You have QBI from the SSTB (positive or loss).

Use one per SSTB; aggregate if eligible (but can’t aggregate SSTB with non-SSTB). Below threshold? Skip to Form 8995. Above upper? SSTB QBI = $0.

SSTB Examples Table

| Field | SSTB? | Notes |

|---|---|---|

| Law Firm | Yes | Legal services. |

| Medical Practice | Yes | Health services. |

| Accounting Firm | Yes | Accounting/bookkeeping. |

| Consulting (Management) | Yes | If reputation-based. |

| Retail Store | No | Goods sales. |

| Engineering (Non-Health) | Partial | If <10% gross receipts from SSTB services (de minimis rule). |

De minimis: <10% SSTB services if gross receipts ≤$25M; <5% if >$25M.

2024–2025 QBI SSTB Phase-Out Thresholds

Thresholds adjust annually for inflation. For 2024 (filed 2025):

| Filing Status | Threshold (Full 100%) | Phase-In Range (0–100% Reduction) | Upper Limit (0% Deduction) |

|---|---|---|---|

| Single/Head of Household | $191,950 | $191,951–$241,950 | $241,951+ |

| Married Filing Jointly | $383,900 | $383,901–$483,900 | $483,901+ |

For 2025 (filed 2026): $197,300 single/$394,600 joint (phase-in to $247,300/$494,600). Range width: $50,000 single/$100,000 joint.

IRS Form 8995-A (Schedule A) Download and Printable

Download and Print: IRS Form 8995-A (Schedule A)

When Is Schedule A (Form 8995-A) Due in 2025?

Attach to Form 8995-A with your 2024 Form 1040 by April 15, 2025 (or October 15 extended). No separate deadline—deduction reduces AGI on Schedule 1, line 13.

| Tax Year End | Original Due Date | Extended Due Date |

|---|---|---|

| Dec. 31, 2024 | April 15, 2025 | October 15, 2025 |

How to Complete Schedule A (Form 8995-A): Step-by-Step (2024 Form)

Use the 2024 Schedule A; one per SSTB. Complete Schedule D first if patron reduction applies. Enter on Form 8995-A, line 2 (or Schedule C, line 2 if wage-limited).

Line-by-Line Guide

- Name/TIN: SSTB name and EIN/SSN.

- QBI or (Loss): Net QBI from SSTB (from Part I or K-1 Box 20, Code Z). Losses carry forward but phase separately.

- Qualified PTP Income or (Loss): If PTP SSTB (K-1 Box 20, Code AC).

- Total: Line 2 + 3.

- Taxable Income Before QBI: From Form 8995-A, line 26.

- Threshold: $191,950 single/$383,900 joint.

- Excess: Line 5 – 6 (if negative, 100% applicable; skip to line 11).

- Phase-In Range: $50,000 single/$100,000 joint.

- Ratio: Line 7 ÷ 8 (e.g., 0.50 = 50% phased).

- Applicable %: 1.00 – line 9 (e.g., 0.50 = 50% deductible).

- Adjusted QBI: Line 4 × line 10 (positive only; enter on Form 8995-A, line 2/4 or Schedule C). 12–15: Repeat for up to 3 more SSTBs; total on line 16.

Pro Tip: For losses, applicable % applies when allowed in taxable income. Use software for multi-SSTB calcs.

Recent Changes to Schedule A (Form 8995-A) for 2025 Filings

No structural updates to Schedule A for 2024 (filed 2025)—focus remains on phase-in ratio. Key notes:

- Threshold Inflation: 2024 figures as above; 2025 at $197,300/$394,600 (Rev. Proc. 2024-40).

- No Extension Yet: QBI sunsets post-2025; proposals (e.g., Ways & Means) for 23% rate/permanence pending.

- Negative Dividends Fix: Exclude negatives on Form 8995-A, line 34 (since 2021).

Monitor IRS.gov for 2025 drafts.

Penalties for Errors on Schedule A

- Underclaim: Miss phase-in = 20% accuracy penalty on understated tax.

- Incorrect %: Audit risk high; IRS matches K-1s.

- Late Filing: 5% monthly on tax due (max 25%).

Abate for reasonable cause; amend via 1040-X.

Best Practices for Schedule A Compliance in 2025

- Classify Early: Review if SSTB (Pub. 535); de minimis for hybrid.

- Income Planning: Bunch deductions to stay below threshold.

- Aggregate Non-SSTB: Boost via Schedule B (can’t mix with SSTB).

- Software: TurboTax/H&R Block auto-phases; retain K-1s/worksheets 3+ years.

- Pro Help: CPA for PTPs or multi-entity.

Conclusion: Navigate SSTB Phase-Outs with Schedule A in 2025

IRS Form 8995-A Schedule A ensures fair QBI access for SSTBs in the phase-in range—potentially saving $38,000+ on $383,900 joint income. With thresholds at $383,900 (2024) rising to $394,600 (2025), review now before the April 15, 2025, deadline.

Download at IRS.gov/Form8995A; see Pub. 535. Consult a tax advisor—optimize before sunset.

Last updated: December 2025. Verify IRS sources.