Table of Contents

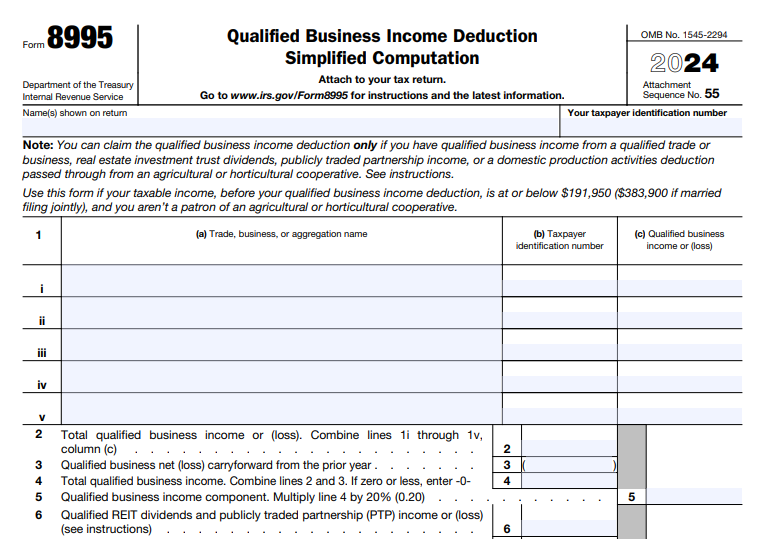

IRS Form 8995 – Qualified Business Income Deduction Simplified Computation – If you own a sole proprietorship, partnership, S-corp, LLC, or rental property, the Section 199A Qualified Business Income (QBI) Deduction is one of the biggest tax breaks still available in 2025 — letting you deduct up to 20% of your business income directly from taxable income.

For most taxpayers with 2024 taxable income under $383,900 (married filing jointly) or $191,950 (single), the calculation is simple and uses IRS Form 8995 — the simplified version of the QBI worksheet.

No W-2 wage limits. No unadjusted basis calculations. No aggregation headaches. Just a fast 20% deduction.

This SEO-optimized 2025 guide explains exactly who can use Form 8995, the 2024 income thresholds, step-by-step instructions, common mistakes, and how to claim thousands in savings when you file in 2025.

What Is IRS Form 8995?

Form 8995, “Qualified Business Income Deduction Simplified Computation,” is the easy-button version of the QBI deduction for taxpayers whose taxable income falls below the phase-out thresholds or who have only non-SSTB income.

- Automatically gives you the full 20% of qualified business income + REIT dividends + PTP income.

- No need to report W-2 wages or property basis (that’s Form 8995-A territory).

- Flows straight to Form 1040, Schedule 1, line 13 → reduces your taxable income dollar-for-dollar.

The deduction expires after December 31, 2025, unless Congress extends it — so 2024 (filed in 2025) is one of your last guaranteed chances.

2024 Income Thresholds – Who Gets the Simple Form 8995?

| Filing Status | 2024 Taxable Income (before QBI) | Form Required |

|---|---|---|

| Single / Head of Household | ≤ $191,950 | Form 8995 (full 20%) |

| Married Filing Jointly | ≤ $383,900 | Form 8995 (full 20%) |

| Single / HoH | $191,951 – $241,950 | Form 8995-A (phase-in rules) |

| MFJ | $383,901 – $483,900 | Form 8995-A (phase-in rules) |

| Above upper limits | Any amount | Form 8995-A (wage/property limits apply) |

Good news for 2025 filings: The thresholds are inflation-adjusted every year. IRS Rev. Proc. 2024-40 set the 2024 numbers shown above (the same ones you’ll use on your 2024 return filed in 2025).

IRS Form 8995 Download and Printable

Download and Print: IRS Form 8995

Who Qualifies for the Full 20% on Form 8995?

You can use the simplified Form 8995 if all of these are true:

- 2024 taxable income (Form 1040 line 15) is below the threshold above.

- You have positive qualified business income from a U.S. trade or business.

- Your business is not a specified service trade or business (SSTB) — or if it is, your income is low enough that the SSTB restriction hasn’t started phasing in.

- You are not a patron of an agricultural/horticultural cooperative (they use Schedule D on 8995-A).

Eligible sources:

- Schedule C (sole prop)

- Schedule E (rental real estate that rises to trade/business level or meets safe harbor)

- Schedule F (farming)

- Schedule K-1 from partnerships, S-corps, trusts (Box 20, codes Z, AA, AB, AC)

Step-by-Step: How to Fill Out Form 8995 (2024 Form, Filed in 2025)

The 2024 Form 8995 is only one page with 17 lines.

| Line | What to Enter (2024 Example) |

|---|---|

| 1 | Total QBI from all activities (add up K-1 Box 20 code Z amounts + Schedule C profit) |

| 2 | QBI losses carried forward from prior years (usually $0) |

| 3 | Total QBI (line 1 + line 2) |

| 4 | Qualified REIT dividends (K-1 Box 20 code AB) |

| 5 | Qualified PTP income (K-1 Box 20 code AC) |

| 6 | Total QBI + REIT + PTP (lines 3 + 4 + 5) |

| 7 | 20% × line 6 → tentative deduction |

| 8 | Your 2024 taxable income (Form 1040 line 15) |

| 9 | Net capital gain (Form 1040 line 16) |

| 10 | Line 8 minus line 9 |

| 11 | 20% × line 10 |

| 12 | Lesser of line 7 or line 11 → this is your actual deduction |

| 15 | Transfer amount from line 12 to Form 1040 Schedule 1 line 13 |

That’s it. TurboTax, H&R Block, TaxAct, and FreeTaxUSA all auto-populate this from your K-1s and schedules.

Common Mistakes That Cost Taxpayers Thousands

- Forgetting to include REIT dividends or PTP income on lines 4–5

- Using Form 8995 when your income is above the threshold → IRS will reject or reduce the deduction

- Including negative QBI (losses) without carrying them forward correctly

- Thinking rental income never qualifies → it can if you meet the 250-hour safe harbor (Notice 2019-07)

2025 Filing Deadlines & Tips

| Event | Date |

|---|---|

| 2024 Tax Return Due | April 15, 2025 |

| Extension (Form 4868) | October 15, 2025 |

| Form 8995 must be attached to return | Same as above |

Pro tips:

- E-file — Form 8995 is fully supported electronically.

Keep your K-1s — the IRS matches Box 20 codes exactly.

If you’re close to the threshold, run both Form 8995 and 8995-A to see which gives the bigger deduction.

Conclusion: Claim Up to $38,390 Off Your Taxes with Form 8995 in 2025

For millions of small-business owners and landlords with 2024 taxable income under $383,900 (MFJ) or $191,950 (single), IRS Form 8995 delivers a straightforward 20% deduction — often worth $10,000–$30,000+ — with almost no extra paperwork.

Don’t leave this money on the table. When you file your 2024 return in 2025, make sure Form 8995 is included.

Download the official 2024 Form 8995 and instructions at → IRS.gov/Form8995

Free filing software with built-in QBI calculator: IRS Free File, TurboTax, TaxAct, and more.

File by April 15, 2025 — and keep the 20% break while it lasts!

Last updated: December 2025 | Sources: IRS Form 8995 & 8995-A Instructions (2024), Rev. Proc. 2024-40, Pub. 535