Table of Contents

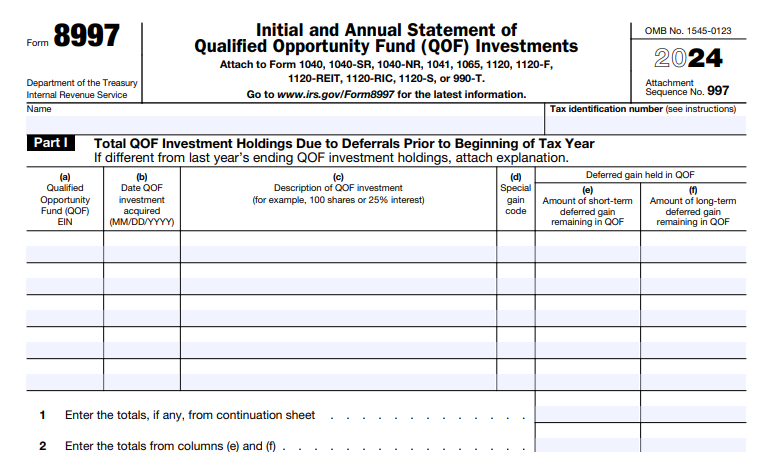

IRS Form 8997 – Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments – The Qualified Opportunity Zone (QOZ) program, revitalized by the One Big Beautiful Bill Act (OBBBA) in July 2025, continues to drive billions in investments into economically distressed communities—offering tax deferrals, basis step-ups, and permanent gain exclusions for savvy investors. But unlocking these benefits requires meticulous reporting. IRS Form 8997, the “Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments,” is your annual compliance checkpoint, tracking holdings, deferrals, and dispositions to avoid audits and penalties.

For tax year 2024 (filed in 2025), Form 8997 remains essential for deferring gains until December 31, 2026, or earlier sale. With OBBBA’s permanent extension effective for post-2026 investments—including rolling 5-year deferrals and new Qualified Rural Opportunity Funds (QROFs)—this guide covers Form 8997 filing requirements for 2025, updates, and strategies. Download the 2024 form at IRS.gov/Form8997.

What Is IRS Form 8997?

Form 8997 provides the IRS with a “snapshot” of your QOF investments: holdings at year-start/end, new deferrals, and sales. It’s required annually for any QOF interest held during the year, even if no activity occurs. Key benefits it supports:

- Deferral: Postpone tax on eligible capital gains (e.g., from stock/real estate sales) invested in a QOF within 180 days.

- Step-Ups: 10% basis increase after 5 years (permanent for post-2026 investments); up to 30% for QROFs.

- Exclusion: Permanent exclusion of post-investment appreciation after 10 years (capped at 30-year FMV).

Under pre-OBBBA rules (for 2024), deferrals end December 31, 2026. OBBBA shifts to rolling 5-year deferrals post-2026, with states redesignating zones every 10 years starting July 1, 2026. File with your federal return (e.g., Form 1040); attach to Schedule D via Form 8949 for dispositions.

Who Must File Form 8997 in 2025?

Any taxpayer holding a QOF investment at any point in 2024 must file, including:

- Individuals: Deferring personal capital gains.

- Pass-Throughs: Partnerships/S corps report on Form 1065/1120-S; allocate to owners via K-1 (who file individually).

- C Corporations: Direct filers.

- Estates/Trusts: For qualifying investments.

No filing if no QOF held in 2024. Foreign taxpayers? Additional rules apply (see instructions). Even “mixed-fund” investments (qualified + non-qualified portions) require full reporting.

QOF Investor Filing Thresholds Table (Tax Year 2024)

| Investor Type | QOF Held in 2024? | File Form 8997? | Additional Forms |

|---|---|---|---|

| Individual (Form 1040) | Yes | Yes | Form 8949/Schedule D for deferrals/dispositions |

| Partnership (Form 1065) | Yes | Yes (aggregate) | K-1 to partners; self-certify QOF on Form 8996 |

| S Corp (Form 1120-S) | Yes | Yes | K-1 to shareholders |

| C Corp (Form 1120) | Yes | Yes | Direct reporting |

| No Holdings | N/A | No | N/A |

QOFs self-certify annually via Form 8996 (attached to their return).

When Is Form 8997 Due in 2025?

Attach to your timely filed 2024 federal return (including extensions). For calendar-year filers: April 15, 2025 (or October 15 extended). Fiscal-year? Align with your return due date.

Key 2025 Filing Deadlines Table

| Tax Year End | Original Due Date | Extended Due Date (Form 7004/4868) |

|---|---|---|

| December 31, 2024 | April 15, 2025 | October 15, 2025 |

| June 30, 2025 | October 15, 2025 | April 15, 2026 |

| QOF Self-Cert (Form 8996) | Same as above | Same as above |

Amendments: File Form 1040-X with revised 8997 if needed. Late filing risks penalty abatement denial.

IRS Form 8997 Download and Pintable

Download and Print: IRS Form 8997

How to Complete IRS Form 8997: Step-by-Step (2024 Form)

The 2024 form has four parts; use one per QOF if multiple. Gather Form 1099-B (from QOF), prior-year 8997, and investment records. Report in U.S. dollars.

Part I: QOF Investments at Beginning of Tax Year

- Columns (a)–(g): List each QOF (name, EIN, acquisition date, deferred gain amount, basis, FMV at start, holding period if >5 years).

- Carry from prior-year Part IV.

Part II: QOF Investments Acquired During Tax Year

- Lines 1–5: New investments (QOF details, deferral election date, gain deferred, basis invested).

- Line 6: Total new deferrals (report on Form 8949, column (g) adjustment code “R”).

Part III: QOF Investments Disposed During Tax Year

- Columns (a)–(h): Sales/exchanges (QOF, disposition date, proceeds, basis, gain recognized—including deferred portion).

- Check if no 1099-B received; attach computation.

- Flow to Form 8949/Schedule D.

Part IV: QOF Investments at End of Tax Year

- Summarize holdings (from Parts I/II minus III); carry to next year’s Part I.

- Totals from (e)–(f) to Schedule D if applicable.

Pro Tip: For >5-year holds, adjust basis per instructions (10% step-up). E-file supported; software like TurboTax integrates with Schedule D.

E-Filing Requirements for Form 8997

E-file with your return via IRS Modernized e-File (MeF)—mandatory for most (10+ forms). Paper OK for small filers; mail to IRS per instructions. Faster processing; auto-checks for QOF EINs.

Recent Changes to Form 8997 for 2025 Filings

The 2024 form is unchanged structurally, but OBBBA impacts reporting:

- Permanent Extension: No 2026 sunset; rolling 5-year deferrals post-2026 (recognition at sale or 5 years).

- QROFs: New rural funds with 30% step-up (vs. 10% for QOFs); 50% substantial improvement (from 100%) effective July 4, 2025.

- Zone Redesignations: States propose July 1, 2026; effective January 1, 2027—track for future investments.

- No Interim Gain Deferral: Post-2026 sales don’t auto-defer unless new election.

- Reporting Enhancements: New Sections 6039K/L require QOF/QOZB annual filings post-July 4, 2025.

For 2024, stick to legacy rules; 2025 forms may add QROF lines.

Penalties for Late or Incomplete Form 8997 Filing

Non-compliance erodes benefits:

- Failure to File: $10,000+ per year (Section 6651); escalates for continued failure.

- Incomplete Reporting: Disallowed deferrals; 20% accuracy penalty on underpaid tax.

- QOF Non-Certification: Loss of qualified status; retroactive taxation.

Reasonable cause waives; abate via letter. Audits focus on basis adjustments.

Best Practices for Form 8997 Compliance in 2025

- Track Annually: Use QOF statements for accurate FMV/basis; reconcile with K-1s.

- Elect Deferral Timely: Within 180 days; note on 8949.

- Leverage OBBBA: Plan rural QROFs for enhanced step-ups; monitor zone redesigns.

- Software/Pro Help: TurboTax for individuals; CPA for pass-throughs/complex holds.

- Retain Records: 7+ years of docs, including 1099-Bs and elections.

Conclusion: Secure QOZ Benefits with Form 8997 in 2025

IRS Form 8997 is the guardian of your QOF investments—ensuring deferrals up to December 31, 2026 (legacy) or rolling 5 years (post-OBBBA), plus step-ups and exclusions. With April 15, 2025, deadlines and permanent program life, file accurately to sustain economic impact and tax savings.

Download the 2024 form/instructions at IRS.gov/Form8997. For guidance, review Pub. 544 or call 800-829-1040. Invest in zones—report with confidence.

Last updated: December 2025. Consult IRS sources or a tax advisor for advice.