Table of Contents

IRS Form 941 (Schedule B) – Report of Tax Liability for Semiweekly Schedule Depositors – In the world of payroll taxes, staying compliant with IRS requirements is crucial for businesses. One key form that often comes into play for employers with significant tax liabilities is IRS Form 941 Schedule B, also known as the Report of Tax Liability for Semiweekly Schedule Depositors. This schedule helps the IRS ensure that federal employment taxes are deposited on time, preventing penalties and ensuring smooth operations. Whether you’re a business owner, HR professional, or accountant, understanding how to handle Form 941 Schedule B in 2025 can save you time and money. In this guide, we’ll break down everything you need to know, from who must file to step-by-step instructions and common pitfalls.

What Is IRS Form 941 Schedule B?

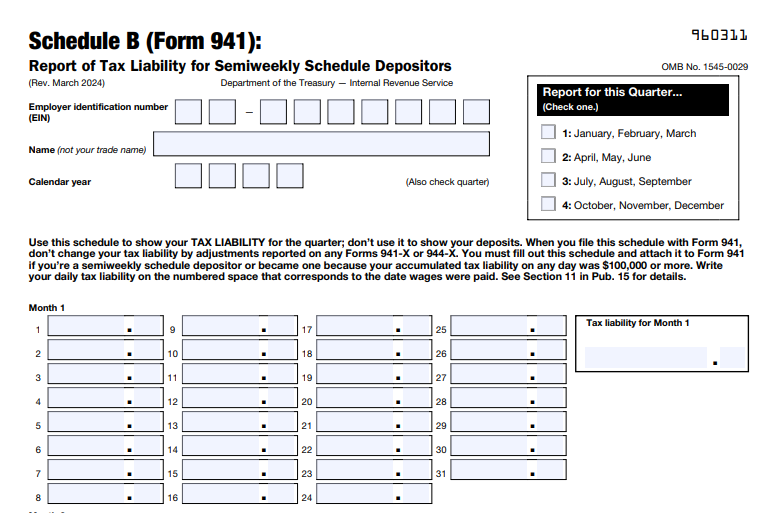

IRS Form 941 Schedule B is an attachment to Form 941, the Employer’s Quarterly Federal Tax Return. It requires employers to report their federal employment tax liabilities on a daily basis for each payroll date within the quarter. Specifically, it covers federal income tax withheld from employees’ wages, as well as both the employer and employee portions of social security and Medicare taxes. It also includes any Additional Medicare Tax withheld on wages exceeding $200,000 in a calendar year.

The primary purpose of Schedule B is to allow the IRS to verify whether you’ve made timely deposits of your employment taxes. It’s not a record of actual deposits—those are tracked through electronic funds transfers—but rather a detailed breakdown of your tax liabilities tied to payday dates. For 2025, the form has been updated with a June 2025 revision, reflecting ongoing adjustments like the removal of lines for COVID-19-related credits that are no longer applicable after 2023.

Who Needs to File Form 941 Schedule B?

Not every employer filing Form 941 needs to attach Schedule B. You’re required to file it if you’re classified as a semiweekly schedule depositor. This classification applies if:

- You reported more than $50,000 in employment taxes during the lookback period (for 2025, this is July 1, 2023, to June 30, 2024).

- You accumulated a tax liability of $100,000 or more on any single day in the current or prior calendar year (this triggers the “next-day deposit rule” and makes you a semiweekly depositor for the rest of the year and the following year).

If you become a semiweekly depositor mid-quarter, you must complete Schedule B for the entire quarter. However, skip it if your total tax liability on Form 941, line 12, is less than $2,500 for the quarter. Note that this form isn’t used with Form 944 (annual filers); those employers use Form 945-A instead if they’re semiweekly depositors.

Special considerations for 2025 include thresholds for certain employees: Social security and Medicare taxes apply to household employees paid $2,800 or more and election workers paid $2,400 or more in cash or equivalent.

IRS Form 941 (Schedule B) Download and Printable

Download and Print: IRS Form 941 (Schedule B)

How to Fill Out IRS Form 941 Schedule B: Step-by-Step Instructions

Filling out Schedule B is straightforward but requires accuracy to avoid penalties. Here’s a detailed walkthrough based on the official 2025 instructions:

- Enter Your Business Information: At the top, provide your Employer Identification Number (EIN), business name, and address. Ensure this matches exactly what’s on your Form 941 or Form 941-X.

- Specify the Calendar Year and Quarter: Enter the year (e.g., 2025) and check the box for the relevant quarter, such as January to March for Q1.

- Report Tax Liability by Date: The form is divided into three monthly sections, each with 31 lines corresponding to calendar days. Enter your tax liability on the line for the date wages were paid (not when they were accrued or deposited).

- Example: If you pay wages on April 4 and April 18, 2025, enter the liabilities on Month 1 (April), lines 4 and 18.

- For bonuses or irregular payments, add them to the regular payday liability on the appropriate date.

- If you hit the $100,000 threshold mid-quarter (e.g., on April 25), start reporting from that date onward.

- Calculate the Total Liability: Sum up all entries for the quarter. This total must match the amount on Form 941, line 12. If it doesn’t, double-check your calculations.

- Handle Adjustments for Credits: If claiming the qualified small business payroll tax credit for increasing research activities (up to $500,000 for tax years after 2022), reduce your employer social security tax liability first (capped at $250,000 per quarter) on the first applicable payday, then Medicare if excess remains. Don’t reduce below zero, and carry forward any unused credit.

For visual clarity, here’s a simple table outlining the monthly structure:

| Month in Quarter | Dates Covered | Key Notes |

|---|---|---|

| Month 1 (e.g., Jan/Apr/Jul/Oct) | Lines 1–31 | Report liabilities on payday dates |

| Month 2 (e.g., Feb/May/Aug/Nov) | Lines 1–31 | Adjust for short months (e.g., Feb has 28/29 days) |

| Month 3 (e.g., Mar/Jun/Sep/Dec) | Lines 1–31 | Total must align with Form 941 |

Deposit Rules for Semiweekly Schedule Depositors

As a semiweekly depositor, your deposit schedule is stricter than monthly depositors. Deposits must be made electronically via EFTPS or similar systems. The rules are:

- If payday is Wednesday, Thursday, or Friday, deposit by the following Wednesday.

- If payday is Saturday, Sunday, Monday, or Tuesday, deposit by the following Friday.

If you accumulate $100,000 or more in liability on any day, deposit by the next business day. Holidays and weekends extend the deadline to the next business day. For last-minute issues, use the same-day wire payment option through your financial institution.

Deadlines and Filing Requirements for 2025

Attach Schedule B to Form 941 and file by the last day of the month following the quarter (e.g., April 30 for Q1 2025). If you’ve made full, timely deposits, you get an extra 10 days. Electronic filing is recommended to avoid errors. Use the March 2025 revision of Form 941 for all quarters unless updates are announced.

Penalties for Non-Compliance

Failing to file Schedule B or deposit on time can lead to severe penalties. The IRS may impose an “averaged” failure-to-deposit (FTD) penalty if Schedule B is incomplete. Additionally, a 100% trust fund recovery penalty could apply to responsible persons if trust fund taxes (income, social security, Medicare) aren’t paid. To correct errors, file an amended Schedule B with Form 941-X.

Common Mistakes and Tips for Success

Common errors include misreporting payday dates, mismatched totals with Form 941, or forgetting to adjust for credits. Tips:

- Use payroll software to track liabilities automatically.

- Double-check EIN and business details.

- Stay updated via IRS.gov for any mid-year changes.

By mastering IRS Form 941 Schedule B, you ensure compliance and avoid costly penalties in 2025. If you’re unsure, consult a tax professional or visit the IRS website for the latest forms and instructions.