Table of Contents

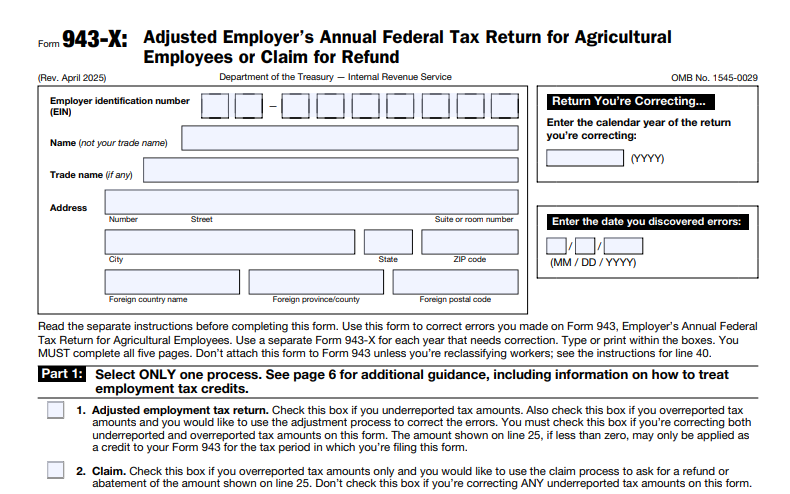

IRS Form 943-X – Adjusted Employer’s Annual Federal Tax Return for Agricultural Employees or Claim for Refund – Agricultural employers face unique payroll tax challenges, from seasonal hiring to tracking cash wages and crew leader arrangements. If errors surface on your original Form 943—such as underreported Social Security wages or overclaimed credits—the IRS provides a straightforward fix: Form 943-X, Adjusted Employer’s Annual Federal Tax Return for Agricultural Employees or Claim for Refund. For tax year 2025, with the Social Security wage base at $176,100 and Medicare rates steady at 1.45% (2.9% total), timely corrections prevent penalties up to 25% of unpaid taxes. This SEO-optimized guide, based on the IRS’s April 2025 revision, equips farm operators and agribusinesses with filing steps, deadlines, and strategies to ensure compliance and recover overpayments efficiently.

What Is IRS Form 943-X?

IRS Form 943-X allows agricultural employers to correct errors on a previously filed Form 943, which reports annual federal income tax withholding, Social Security, and Medicare taxes for farmworkers. It handles underreported taxes (pay additional), overreported amounts (claim refund or adjustment), and credits like the employee retention credit (ERC) for qualified 2025 wages. Unlike quarterly Form 941-X, Form 943-X is annual, aligning with the seasonal nature of farm labor.

Key purposes:

- Error Correction: Adjust wages, tips, or taxes for cash payments, H-2A workers, or household employees.

- Refund Claims: Recover overwithheld taxes; process takes 6-8 weeks.

- Credit Adjustments: Correct ERC or qualified sick/family leave wages from prior years.

The April 2025 revision (Rev. 04/2025) removes outdated COVID-era lines (e.g., 37-38 for recovery startups) and emphasizes e-filing via Modernized e-File (MeF). Download the form and instructions from IRS.gov/Form943X.

Who Needs to File IRS Form 943-X in 2025?

File Form 943-X if you discover errors on your 2024 Form 943 (due January 31, 2025) that affect tax liability, such as miscalculated wages over the $176,100 Social Security base or incorrect withholding on non-cash fringe benefits. No filing if errors don’t change taxes.

| Scenario | Filing Required? | Details |

|---|---|---|

| Underreported Wages/Taxes | Yes | E.g., omitted $5,000 in cash wages—pay additional by discovery date’s due date (e.g., January 31, 2026, for 2025 errors). |

| Overreported Withholding | Yes | Claim refund if period of limitations open (3 years from due date); notify SSA via W-2c if employee-affected. |

| Credit Errors (e.g., ERC) | Yes | Adjust qualified wages; limitations for 2021 expired April 15, 2025—file for 2024/2025 promptly. |

| No Tax Impact | No | E.g., offsetting errors; document internally. |

| Third-Party Sick Pay | Yes | Coordinate with Forms 941-X or W-2c. |

Use EIN; file separately for each year. Agricultural employers include farms, nurseries, and greenhouses paying ≥$2,500 in cash wages to ≥10 workers (or ≥$20,000 total) in any calendar quarter.

Filing Deadlines and Extensions for Form 943-X

No fixed deadline—file within the statute of limitations: 3 years from Form 943 due date (January 31) or 2 years from tax payment, whichever is later. For 2024 errors discovered November 28, 2025, file by January 31, 2028.

- Payment Due: Additional taxes by the original due date or discovery date’s equivalent (e.g., January 31, 2026, for 2025 discoveries) to avoid interest (0.5%/month).

- Refunds: Claim before limitations expire; no interest on refunds under $10.

- Extensions: No automatic for filing, but request via letter (up to 6 months); pay estimates timely. E-file via MeF for faster processing.

- Where to File: Mail to Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999-0005 (no e-file for paper; MeF for electronic).

For 2025 Form 943 (filed 2026), corrections due by January 31, 2029.

Step-by-Step Guide to Completing IRS Form 943-X

Use the April 2025 form; gather original Form 943, payroll records, and W-2s. Explain changes in Part III.

- Line 1: Adjustment Election – Check for overpayment adjustment (apply to future Form 943) or refund claim.

- Header: EIN, name, address; tax year (e.g., 2024).

- Part I: Corrections to Employee Taxes – Adjust Social Security wages (lines 2-5), Medicare (6-9); show original (col. 2), corrected (col. 3), difference (col. 4).

- Part II: Employer Taxes – Mirror employee adjustments for matching shares (e.g., Additional Medicare 0.9% over $200K).

- Line 20: Total Correction – Net over/underpayment.

- Line 25: Balance Due/Refund – Pay if positive; claim if negative (attach Form 943-A if semiweekly).

- Part III: Explanation – Detail errors (e.g., “Underreported $2,000 H-2A wages”); certify lines for withholding protection.

- Sign & Attach: Officer signs; include W-2c if filed with SSA.

Example: Underreported $1,000 wages in 2024—add $153 (7.65% FICA) on lines 2/3; pay by January 31, 2026.

2025 Agricultural Tax Rates and Adjustments on Form 943-X

Rates unchanged: Social Security 6.2% each (12.4% total, base $176,100); Medicare 1.45% each (2.9% total, unlimited base). Adjustments use original rates.

| Tax Type | Employee Rate | Employer Rate | 2025 Wage Base |

|---|---|---|---|

| Social Security | 6.2% | 6.2% | $176,100 |

| Medicare | 1.45% | 1.45% | Unlimited |

| Additional Medicare | 0.9% (over $200K) | N/A | Unlimited |

Qualified wages for ERC: Up to 70% of first $10,000 (max $7,000/employee). Use Pub. 15 for cash wage thresholds.

IRS Form 943-X Download and Printable

Download and Print: IRS Form 943-X

Claiming Refunds or Adjustments on Form 943-X

- Adjustment Process: Line 1—recoup overpayments against 2025 Form 943; notify employees via W-2c.

- Refund Claims: For closed years; IRS issues check (6-8 weeks); elect direct deposit on line 25.

- Certifications: Protect withheld taxes; attach SSA proof if no W-2c.

Offsets apply to other debts; file separate forms for under/over mixtures.

Common Mistakes When Filing Form 943-X and How to Avoid Them

Avoid audits with these tips:

- Wrong Year Rates: Using 2025 base for 2024—apply original ($168,600).

- Vague Explanations: Part III lacks details—include payroll excerpts.

- W-2c Gaps: For employee refunds—file with SSA concurrently.

- Late Payments: Missing discovery deadlines—calendar January 31 equivalents.

- Form 943-A Omissions: Semiweekly depositors must reconcile.

Use payroll software; review Pub. 15.

Penalties for Late or Incorrect Form 943-X Filings

Corrections mitigate but incur:

- Late Filing/Payment: 5%/month (max 25%) + 0.5%/month interest.

- Deposit Failure: 10% if 15+ days late.

- Negligence: 20%; fraud 75%.

- Relief: Reasonable cause; first-time abatement via Form 843.

Document discoveries; e-file speeds resolution.

Frequently Asked Questions About IRS Form 943-X

When to file Form 943-X for 2024 errors in 2025?

By January 31, 2028; pay additional by January 31, 2026.

Can I adjust ERC on Form 943-X?

Yes, for open years; 2021 limitations expired April 15, 2025.

What’s the 2025 Social Security wage base?

$176,100, up from $168,600.

Is e-filing available for 943-X?

Yes, via MeF; no paper-only mandate.

How to claim a refund over $10,000?

Direct claim; 6-8 weeks processing.

Visit IRS.gov/Form943X for more.

Final Thoughts: Correct Ag Payroll Taxes Seamlessly with Form 943-X in 2025

IRS Form 943-X is a lifeline for agricultural employers, enabling quick fixes to Form 943 errors and safeguarding against penalties amid the $176,100 wage base. With the April 2025 revision streamlining ERC adjustments, file within limitations to recover funds or pay dues without excess interest. Download from IRS.gov today and integrate with farm management software for accuracy.

Payroll powers the harvest—precise corrections sustain it.

This article is informational only—not tax advice. Consult IRS or a professional.