Table of Contents

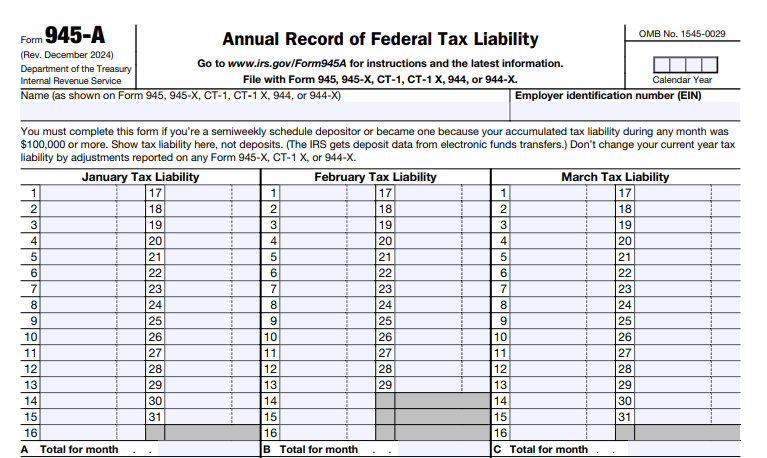

IRS Form 945-A – Annual Record of Federal Tax Liability – Employers and payers dealing with nonpayroll withholdings—like pensions, gambling winnings, or backup withholding—face a compliance tightrope. Miss the mark on reporting your federal tax liability, and the IRS could hit you with “averaged” failure-to-deposit penalties that inflate your bill. That’s where IRS Form 945-A, the “Annual Record of Federal Tax Liability,” comes in: a simple worksheet that tracks your monthly liabilities to verify timely deposits and match your total on Form 945.

For tax year 2025 (filed in 2026), Form 945-A remains essential for semiweekly depositors or those hitting the $100,000 monthly threshold, with no major structural changes from 2024. This SEO-optimized guide covers Form 945-A filing requirements for 2026, who must file, deadlines, step-by-step instructions, and penalty avoidance. Whether you’re a business owner or HR pro, use this to stay compliant. Download the latest at IRS.gov/Form945A.

What Is IRS Form 945-A?

Form 945-A is a reconciliation tool attached to Forms 945 (nonpayroll income tax withholding), 945-X (adjustments), CT-1/CT-1 X (railroad retirement taxes), or 944/944-X (small employer annual returns). It records your federal tax liability by month, based on payment dates, to prove deposits align with withholding events.

Key uses:

- Deposit Verification: IRS matches line M total to Form 945 line 3 (or equivalents) to calculate penalties.

- Semiweekly Tracking: Required for frequent depositors; prevents averaging errors.

- Amendments: File revised versions with 945-X if errors affect liability (not just math—true corrections only).

For 2025, it supports the $100,000 Next-Day Deposit Rule: Accumulate that much in a day? Switch to semiweekly for the rest of the year and 2026. No changes to the form’s core—still a two-page monthly grid.

Who Must File Form 945-A in 2026?

File Form 945-A if you’re a semiweekly schedule depositor for any part of 2025, or a monthly depositor who hit $100,000+ liability on any day in a month (triggering semiweekly status). It’s mandatory with your annual return if applicable.

Who Files Form 945-A? Quick Table (Tax Year 2025)

| Depositor Type | Trigger | File With | Notes |

|---|---|---|---|

| Semiweekly (All Year) | Total 2023 Form 945/944/CT-1 > $50,000 | Form 945/944/CT-1 | Monthly breakdown required; line M = total tax. |

| Monthly → Semiweekly | $100,000+ in one day/month | Form 945/944/CT-1 | Semiweekly from next day; full-year Form 945-A. |

| Monthly (No Switch) | Total < $50,000; no $100K day | Optional (use line 7 on return) | Skip if under thresholds. |

| Amendments (945-X) | Liability errors discovered | Form 945-X/CT-1 X/944-X | Amended 945-A only if changes total; write “Amended.” |

Exceptions: No Form 945-A for proxy tax-only filers or if you’re purely monthly without triggers. Railroad employers use it for Tier I/II taxes.

When Is Form 945-A Due in 2026?

Attach to your 2025 return: January 31, 2026 (shifts to February 2, 2026, as Jan. 31 is a Saturday). If all deposits timely, get 10 extra days (Feb. 12). Extensions? Use Form 7004 (6 months), but pay 90% by original due to avoid penalties.

Key 2026 Filing Deadlines Table (Tax Year 2025)

| Return Type | Original Due Date | Extended Due Date (Form 7004) | Notes |

|---|---|---|---|

| Form 945 (Nonpayroll Withholding) | February 2, 2026 | August 3, 2026 | +10 days if deposits timely. |

| Form 944 (Small Employers) | February 2, 2026 | August 3, 2026 | IRS notifies if eligible. |

| Form CT-1 (Railroad) | February 2, 2026 | August 3, 2026 | Tier I/II taxes. |

| Amendments (945-X) | Varies (discovery year) | N/A | File within 3 years; attach amended 945-A. |

Fiscal-year filers: 15th day of 2nd month after year-end. E-file encouraged—mandatory for 10+ returns.

IRS Form 945-A Download and Prntable

Download and Print: IRS Form 945-A

How to Complete IRS Form 945-A: Step-by-Step (2025 Form)

The 2025 Form 945-A (Rev. December 2024) is a grid: Columns for daily liabilities (1–31), monthly subtotals (A–L), and year total (M). Base entries on payment/wage dates, not calendar months. Use accrual if consistent.

Essential Sections and Line Highlights

- Heading: EIN, name (match your return), calendar year (2025).

- January–December Grids (Lines 1–31 per Month): Enter daily liabilities (e.g., Line 1: Jan 1 withholding). Subtotals: A (Jan), B (Feb), etc.

- Lines 1–15: Days 1–15.

- Lines 16–31: Days 16–31 (or 28/30/31).

- Monthly Total: Add daily lines (e.g., Line A = Jan total).

- Line M: Sum A–L (must = Form 945 line 3 or equivalent).

- Special Rules:

- $100K Switch: Record pre-switch on monthly lines; post-switch daily.

- Adjustments: Ignore prior-year fixes (use 945-X); no credits here.

- Example: Withheld $52K on Jan 6, $35K Jan 20 → Jan 6: $52K (Line 6); Jan 20: $35K (Line 20); Total Jan: $87K (Line A).

Pro Tip: Sequence: Daily first, then subtotals. Software like QuickBooks auto-populates from ledgers. For amendments, copy prior form and adjust—IRS refigures penalties.

E-Filing Requirements for Form 945-A

E-file with your return via IRS-approved software (e.g., TaxBandits, TaxZerone)—voluntary but recommended for accuracy. Paper OK, but e-file processes in 2–4 weeks vs. 8–12. Attach PDF if needed.

Recent Changes to Form 945-A for 2026 Filings

The December 2024 revision (used for 2025) is stable—no big shifts:

- Deposit Thresholds: Monthly if 2023 total ≤ $50K; semiweekly > $50K.

- Penalty Inflation: FTD minimum $510 (up from $485) if >60 days late.

- EO 14247: Direct deposit refunds now available (March 2025 update).

- No Form Changes: Core grid intact; monitor for 2025 drafts.

Penalties for Late or Incomplete Form 945-A Filing

IRS uses Form 945-A to enforce deposits—errors trigger:

- Failure-to-Deposit (FTD): 2–15% of underpayment (averaged if no 945-A).

- Failure-to-File: 5% monthly (max 25%); minimum $510.

- Late Payment: 0.5% monthly (max 25%) + 7% interest.

- Trust Fund Recovery: 100% personal liability for withheld taxes.

Abate for reasonable cause (e.g., first-time abatement via Form 843). Respond to CP15/CP215 notices promptly.

Best Practices for Form 945-A Compliance in 2026

- Track Daily: Use payroll software for withholding logs; reconcile monthly.

- Switch Alerts: Monitor for $100K days—notify IRS if semiweekly.

- Amend Smartly: Only for true errors; file with 945-X to reduce FTD.

- E-File Tools: TaxBandits or OnPay for auto-calc; retain 4+ years.

- Pro Help: CPA for multi-entity; review Pub. 15 for rules.

Conclusion: Nail Your Deposits with Form 945-A in 2026

IRS Form 945-A is your shield against deposit penalties, ensuring withholdings on nonpayroll payments—like pensions or backups—align with Form 945’s total. With February 2, 2026, deadlines, semiweekly filers: Attach now to avoid averaged FTD hits up to 15%.

Download the 2025 form/instructions at IRS.gov/Form945A. Questions? Call Business Hotline at 800-829-4933. Compliant withholding: Peace of mind for payers.

Last updated: December 2025. Verify IRS sources for advice.