Table of Contents

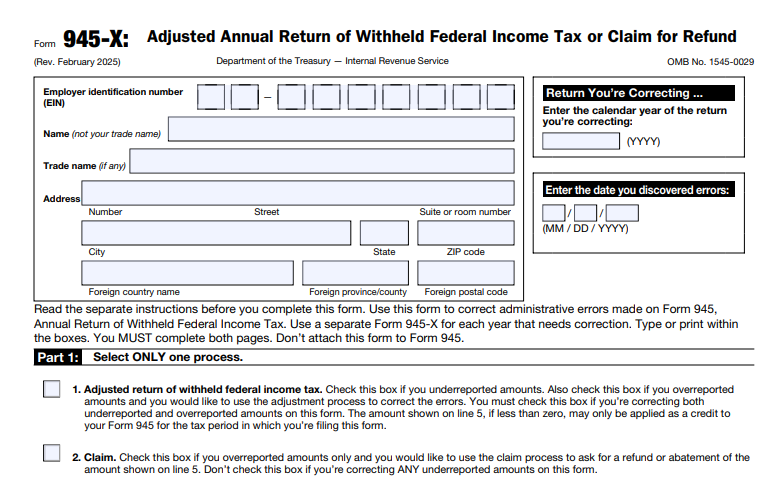

IRS Form 945-X – Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund – Tax season doesn’t end with your original filing—errors in withholding or calculations can surface later, requiring corrections to avoid audits or lost refunds. For employers reporting withheld federal income tax on nonpayroll payments (like pensions, annuities, or backup withholding) via Form 945, IRS Form 945-X is the essential tool for adjustments. In 2025, with electronic filing now supported for Form 945-X and the deadline for 2024 corrections tied to the February 2, 2026, Form 945 due date, timely amendments prevent penalties up to 25% of unpaid taxes. This SEO-optimized guide, based on the February 2025 revision of Form 945-X and its instructions, covers eligibility, step-by-step filing, and strategies to reclaim overpayments or fix underreporting efficiently.

What Is IRS Form 945-X?

IRS Form 945-X is used to correct administrative errors on a previously filed Form 945, Annual Return of Withheld Federal Income Tax, or to claim refunds for overreported amounts. It addresses issues like mathematical mistakes, misclassified payments, or incorrect backup withholding, allowing employers to adjust withheld income taxes without refiling the entire Form 945. Unlike Form 941-X for payroll taxes, Form 945-X focuses solely on nonpayroll withholding, such as from IRAs, gambling winnings, or pensions.

Key features:

- Adjustment vs. Refund: Choose to credit overpayments against future Form 945 or request a check; pay underpayments immediately.

- Administrative Errors Only: Covers reporting mistakes—not law changes or voluntary disclosures (use Form 1040-X for individuals).

- Electronic Filing: Now available in 2025 via IRS Modernized e-File (MeF), speeding processing to 2-4 weeks.

The February 2025 revision (Rev. February 2025) incorporates updates for direct deposit refunds under Executive Order 14247 and clarifies overpayment applications from prior Form 945-X filings. Download the form and instructions from IRS.gov/Form945X.

Who Needs to File IRS Form 945-X in 2025?

Employers who filed Form 945 for 2024 (due February 2, 2025) and discover errors must use Form 945-X. File separately for each year; no filing if errors don’t affect liability.

| Scenario | Filing Required? | Details |

|---|---|---|

| Underreported Withholding | Yes | E.g., $10,000 math error on 2024 Form 945—pay additional by discovery date’s due date (e.g., February 2, 2026, for 2025 discoveries). |

| Overreported Backup Withholding | Yes | Claim refund if within 3 years of Form 945 due date; notify payees via corrected 1099 if issued. |

| No Tax Change | No | E.g., offsetting errors; document internally. |

| Third-Party Payments | Yes | Coordinate with Forms 1099; attach explanations. |

Use EIN; file for each tax period. Low-volume filers (under $2,500 liability) may qualify for annual Form 945 but still correct via 945-X.

Filing Deadlines and Extensions for Form 945-X

No fixed deadline—file within the statute of limitations: 3 years from Form 945 due date (February 2) or 2 years from payment, whichever is later. For 2024 errors discovered June 20, 2025, file by February 2, 2028.

- Payment Due: Additional taxes by original due date or discovery equivalent (e.g., February 2, 2026, for 2025 errors) to halt interest (0.5%/month).

- Refunds: Claim before limitations expire; process 6-8 weeks with direct deposit.

- Extensions: No automatic; request via letter (up to 6 months) but pay timely.

- Where to File: E-file via MeF providers; paper to Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999-0005.

For 2025 Form 945 (filed 2026), corrections due by February 2, 2029.

Step-by-Step Guide to Completing IRS Form 945-X

Gather original Form 945, payment records. Use February 2025 PDF; explain in Part III.

- Line 1: Adjustment Election – Check for overpayment adjustment (credit to next Form 945) or refund claim.

- Header: EIN, name, address; tax year (e.g., 2024).

- Part I: Corrections – Show original (col. 2), corrected (col. 3), difference (col. 4) for withheld tax (line 2) and backup withholding (line 3).

- Line 5: Total Correction – Net over/under.

- Line 6: Balance Due/Refund – Pay if positive; claim if negative (attach Form 945-A if applicable).

- Part III: Explanation – Detail errors (e.g., “Underreported $9,000 backup withholding due to transposition”); certify payee notifications if overreported.

- Sign & Attach: Officer signs; include prior transcripts if needed.

Example: Overreported $9,000 backup on 2024 Form 945—file June 2, 2025, for $9,000 refund (6-8 weeks).

2025 Withholding Tax Rules on Form 945-X

Rates unchanged: Backup withholding at 24% for invalid TINs; no wage base. Adjustments use original year rates.

| Tax Type | Rate | 2025 Notes |

|---|---|---|

| Federal Income Tax Withheld | Varies (per W-4) | Nonpayroll only (pensions, gambling). |

| Backup Withholding | 24% | On reportable payments ≥$600; claim refunds timely. |

Use Pub. 15 for details; coordinate with 1099 corrections.

IRS Form 945-X Download and Printable

Download and Print: IRS Form 945-X

Claiming Refunds or Adjustments on Form 945-X

- Adjustment Process: Line 1—apply overpayments to 2025 Form 945; notify payees if 1099s issued.

- Refund Claims: For closed years; IRS check or direct deposit (new under EO 14247).

- Certifications: Protect withheld taxes; attach SSA proof if no 1099 corrections.

Offsets to other debts; file separate for under/over.

Common Mistakes When Filing Form 945-X and How to Avoid Them

Avoid audits:

- Wrong Year Rates: Using 2025 for 2024—apply original.

- Vague Explanations: Part III lacks specifics—attach records.

- 1099 Oversights: Not notifying payees—issue corrected forms.

- Late Payments: Missing discovery deadlines—calendar February 2.

- Form 945-A Gaps: If semiweekly, reconcile deposits.

Review Pub. 15; e-file reduces errors.

Penalties for Late or Incorrect Form 945-X Filings

Corrections mitigate but incur:

- Late Filing/Payment: 5%/month (max 25%) + 0.5%/month interest.

- Negligence: 20%; fraud 75%.

- Relief: Reasonable cause; first-time abatement via Form 843.

Document errors; e-file speeds resolution.

Frequently Asked Questions About IRS Form 945-X

When to file Form 945-X for 2024 errors in 2025?

By February 2, 2028; pay additional by February 2, 2026.

Can I e-file Form 945-X in 2025?

Yes—via MeF; faster than paper.

What’s backup withholding on Form 945-X?

24% on invalid TIN payments; correct overreports for refunds.

Does Form 945-X affect 1099s?

Yes—notify payees with corrected forms if overreported.

How to claim a refund?

Check line 1 for refund; 6-8 weeks processing.

Visit IRS.gov/Form945X for more.

Final Thoughts: Correct Withholding Taxes Efficiently with Form 945-X in 2025

IRS Form 945-X is your safeguard for Form 945 errors, enabling refunds or payments without full refiling—crucial for nonpayroll withholding amid 24% backup rates. The February 2025 revision’s e-filing and direct deposit options streamline it; file within limitations to avoid 25% penalties. Download from IRS.gov today and pair with Pub. 15 for accuracy—corrections aren’t setbacks; they’re compliance wins.

Informational only—not tax advice. Consult IRS or a professional.