Table of Contents

IRS Form 9661 – Cooperative Agreement – In the world of tax assistance for seniors, navigating IRS grants can feel overwhelming. If you’re involved in providing free tax help to individuals aged 60 and older, IRS Form 9661—officially known as the Cooperative Agreement—plays a pivotal role. This form formalizes partnerships between the Internal Revenue Service (IRS) and non-profit organizations under the Tax Counseling for the Elderly (TCE) Program. Whether you’re a grant recipient or exploring eligibility, this SEO-optimized guide breaks down everything you need to know about IRS Form 9661, including its purpose, filing requirements, and compliance tips. Updated for the June 2025 revision, we’ll draw from official IRS resources to ensure accuracy.

What Is IRS Form 9661?

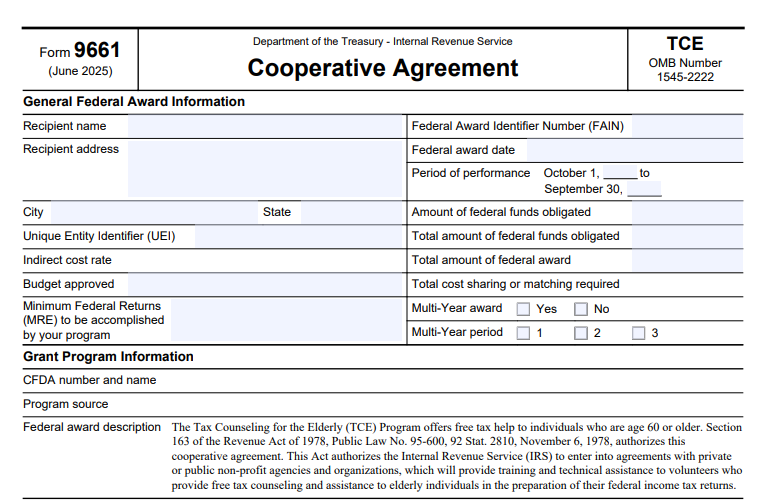

IRS Form 9661 is a binding cooperative agreement that establishes the terms for federal funding in the TCE Program. Authorized under Section 163 of the Revenue Act of 1978 (Public Law 95-600), it enables private or public non-profit agencies to receive grants for training volunteers who offer free tax counseling and return preparation to low-income seniors. The form outlines the grant’s scope, funding obligations, and performance expectations, ensuring alignment with federal award standards.

Key details from the latest revision include:

- OMB Number: 1545-2222

- Estimated Completion Time: 30 minutes

- Privacy Act Notice: Information collected supports IRS volunteer programs and may be shared for coordination purposes; responses are voluntary but required for grant participation.

This form isn’t a standalone application—it’s signed after grant approval to activate funding. Expenses outside the specified period (typically October 1 to September 30) aren’t reimbursable, and funding is contingent on congressional appropriations.

The Role of IRS Form 9661 in the Tax Counseling for the Elderly (TCE) Program

The TCE Program, administered by the IRS, targets tax assistance for elderly taxpayers, helping them claim credits like the Earned Income Tax Credit (EITC) and reduce compliance burdens. Form 9661 serves as the contractual backbone, defining:

- Federal Award Identifier (FAIN): A unique grant number.

- Amount Obligated: Total federal funds committed, plus any cost-sharing requirements.

- Multi-Year Options: For eligible recipients, it supports up to three-year awards, renewable based on performance.

By signing Form 9661, organizations commit to IRS guidelines, including non-discrimination policies and data protection for personally identifiable information (PII). This agreement empowers over 7,000 volunteer sites nationwide to process millions of returns annually, fostering community-based tax equity.

Who Needs to File IRS Form 9661?

Not every tax professional or non-profit deals with Form 9661—it’s specifically for TCE grant recipients. Eligible filers include:

- Non-Profit Organizations: 501(c)(3) entities with a track record in senior services.

- Multi-Year Grant Holders: Approved for ongoing funding cycles.

- Single-Year Recipients: New or one-off participants in the program.

If your organization applied via Form 8653 (TCE Program Application Plan) and received a grant notification (Publication 5457), you’ll need to complete and sign Form 9661 within 20 calendar days of award notice. Tax-exempt status and compliance with SAM.gov registration (including a Unique Entity Identifier or UEI) are prerequisites.

How to Complete and File IRS Form 9661: Step-by-Step Instructions

Completing IRS Form 9661 is straightforward but requires precision to avoid delays in funding. Always review Publication 5245 (TCE Terms and Conditions, Rev. 8-2025) beforehand—it’s the companion document detailing full obligations. Here’s a breakdown:

Step 1: Gather Required Information

- Recipient details: Name, address, city, state, UEI, and indirect cost rate.

- Program metrics: Approved minimum federal returns (MRE) your sites must process.

- Award specifics: FAIN, award date, period of performance, obligated funds, and total award amount.

Step 2: Fill Out Key Sections

Use the fillable PDF from IRS.gov. Critical fields include:

- Federal Award Description: References the TCE Program’s focus on free assistance for age 60+ taxpayers.

- Multi-Year Award: Indicate “Yes” if applicable, specifying periods (e.g., Years 1-3).

- CFDA Number: 21.006 (Aging – Tax Counseling for the Elderly).

- Contact for IRS Grant Officer: Pre-filled by IRS; note name, phone, address, and email for queries.

Step 3: Sign and Submit

- Recipient Signature: Printed name, title, signature, and date from an authorized representative.

- IRS Approval: Signed by the grant officer post-review.

- Submission: Electronically via the IRS SPEC (Stakeholder Partnerships, Education & Communication) portal or as directed in your award notification. No separate filing fee applies.

Pro Tip: Budget changes over 10% require prior IRS approval. For multi-year grants, performance metrics like electronic filing rates (at least 65% for seniors) influence renewals.

IRS Form 9661 Download and Printable

Download and Print: IRS Form 9661

Key Terms and Conditions Under Publication 5245

Publication 5245 expands on Form 9661, enforcing uniform federal standards (2 CFR Part 200). Highlights for 2025 include:

- Financial Management: Use the Payment Management System (PMS) for draws; maintain records for 3 years.

- Compliance Mandates: Adhere to whistleblower protections, Buy American Act, and prohibitions on certain telecom equipment.

- Sub-Award Rules: Report cash sub-awards ≥$1,000 within 30 days; track executive compensation if thresholds met (e.g., ≥$30,000 federal funds).

- Termination Risks: Noncompliance, such as tax delinquency or PII breaches, can void the agreement.

These terms ensure fiscal accountability while prioritizing volunteer training and site quality (per Publication 5166).

Reporting Requirements for TCE Grant Recipients

Post-agreement, timely reporting sustains your grant. Core obligations:

- Quarterly Financials: Form 425 via PMS (due January 30, April 30, July 30, October 30).

- Volunteer and Site Data: Forms 13715, 13615, 13206, and 15272, submitted to your IRS Territory Office.

- Semi-Annual/Annual Reports: Form 8654 due June 30 (preliminary) and 120 days post-program.

- Sub-Award and Integrity Reporting: Via SAM.gov for awards ≥$30,000; FAPIIS for >$10 million cumulative.

Extensions are rare—request in writing 5 business days early. Unused funds must be reported by June 30 annually.

| Report Type | Form/Publication | Due Date | Submission Method |

|---|---|---|---|

| Financial Report | SF-425 | Quarterly (e.g., Jan 30) | PMS Portal |

| Volunteer Standards | Form 13615 | Before Assistance | IRS Territory Office |

| Site Security Plan | Form 15272 | Dec 31 | IRS Territory Office |

| Annual Performance | Form 8654 | 120 Days Post-Program | TCE Grant Office |

Frequently Asked Questions (FAQs) About IRS Form 9661

What Happens If I Miss the 20-Day Signing Deadline for Form 9661?

Your grant may be forfeited; contact your IRS grant officer immediately for extensions.

Can For-Profit Organizations Use IRS Form 9661?

No—only non-profits qualify for TCE grants.

How Does Form 9661 Differ from VITA Program Agreements?

VITA (Volunteer Income Tax Assistance) uses similar forms but targets broader low-income groups; TCE focuses exclusively on seniors 60+.

Are There Updates to Form 9661 for 2025?

Yes, the June 2025 revision incorporates Executive Order 14173 on merit-based opportunities and enhanced sub-award tracking.

Conclusion: Empowering Tax Assistance with IRS Form 9661

IRS Form 9661 is more than paperwork—it’s a gateway to impactful community service, ensuring seniors receive expert, no-cost tax guidance. By understanding its requirements and leveraging resources like Publication 1101 (TCE Management Guidelines), grant recipients can maximize their program’s reach. Ready to apply? Visit IRS.gov’s TCE page for the latest application packages. For personalized advice, consult your local IRS SPEC office. Stay compliant, and keep the tax relief flowing for those who need it most.

This article is for informational purposes only and not tax advice. Always refer to official IRS publications for your situation.